The following is the letter returned to the holders of the bill protested by Hottinguer, in answer to their inquiries:

Bank U. States, October 1839.

The bills to which you allude in your letter of yesterday, have received due protection for the honour of this bank, arrangements having been made for this purpose by Messrs. Rothschild of Paris.

(signed)

A. Lardner,

2nd Assistant Cashier.

Paris, September 23rd, 1839.

To the President [Nicholas Biddle] of the Bank of the United States [of Pennsylvania], Philadelphia.

Mr. President:-- We have the honour to inform you that we have arranged with Mr. Jaudon to accept for your account the amount of 5,500,000 francs, your draft on the Messrs. Hottinguer, which remained in suspense. We take it for granted that Mr. Jaudon will have informed you of the arrangements entered into by us with him for this purpose, and consequently consider it unnecessary to recapitulate them here, limiting ourselves to furnishing you, on the other side, a memorandum of such of your drafts as have been left in our hands to-day to be clothed with our acceptance.

We are happy, Mr. President, to have found an opportunity to give you a proof of our high consideration for the establishment over which you preside, and to have been able, at the same time, to arrest the disastrous effects which this refusal of acceptance on the part of Messrs. Hottinguer was beginning to produce in our place, as well as in Lyons, by many holders of your bills, who, pressed by the necessities to an immediate realization of their funds, were offering to part with these securities at a loss over the discount.

We shall correspond with Mr. Jaudon in every thing concerning our acceptances on your account, in conformity to his request made to us, so that we shall not be obliged to trouble you with details relative to this operation, except in case of new instructions on your part.

We present to you, Mr. President, assurances of our most distinguished consideration.

(Signed)

De Rothschild, freres,

A. de Rothschild.

Correspondence of the Courier and Enquirer.

London, September 20th, 1839.

The Liverpool steam ship being about to depart from Liverpool at an early hour to-morrow morning, and as no other steam ship will be in train for New York for an unusual time after the sailing of the Liverpool, I purpose to send you the fullest, latest, and the best ascertained account of the present state of affairs in this quarter of the world.

Preceding all other matters at the present moment is the unexpected and extraordinary occurrence respecting the French agency of the Bank of the United States.

On the night of Friday last arrived in London an express to Mr. Jaudon, informing him that on that day the house of Hottingeur, the Paris agents of the bank, had refused to accept the usual bills which had been drawn from Philadelphia against consignments, of cotton to Havre de Grace and various other ports of France. This intelligence was entirely unexpected by Mr. Jaudon, who, though the most prominent European agent of the Bank of the United States, has not professed any direct connexion with the Parisian agents of the bank, and consequently then learned for the first time that the house of Hottingeur had come to so extraordinary a determination as to refuse the bills of an establishment from which they have derived so very beneficial an interest during an agency of twenty years.

Setting off instantly for Paris, Mr. Jaudon arrived in that capital on Monday, and at once removed all the difficulties of the Messrs. Hottingeur, by negotiating with the house of Rothschild, the Jewish capitalists of so much celebrity, and who now accept the bills of the Bank of the United States.

This event has been the subject of extraordinary excitement, both in England and in France. But the numerous enemies of the Bank of the United States, who, both in London and Lancashire and Yorkshire, were exulting in the supposed downfall of the institution have now found, that, on the contrary, the result of the affair has eminently strengthened the credit of the institution; all parties now agreeing, that if Mr. Jaudon, when suddenly called upon, could provide security for 7,000,000 of francs, extraneous entirely to his own arrangements of every description, and could substitute the greatest capitalists in the whole world for the comparatively unknown house of Hottingeur -- that all this must redound most signally to the credit and solid power of the Bank of the United States.

So far indeed from the Bank of the United States having received assistance from the Bank of England, the Bank of England, on the contrary, may be said to have received assistance from the Bank of the United States, so far as to have imported 250,000 sovereigns, and to have sold them to the Bank of England, at a time when the bullion was reduced almost to nothing, is certainly "assistance" in the true meaning of the word, and this is the only transaction which has passed between Mr. Jaudon and the Bank.

Mr. Sevier (of Arkansas)

In the Senate, February 20th, 1840.

"During the existence of the first Bank of the United States, the States owed nothing; and we find that, up to 1830, which was fourteen years after the charter of the last Bank of the United States, the debts were trifling, and were confined to a few of the most wealthy and populous States. The charter of the second Bank of the United States expired in 1836.

"We find that the increase of the State debts, from 1830 to 1835, down to the period of the very close and termination of the Bank charter, that the State debts were increased from a very trifling debt, by the still trifling additional debt of forty millions.

"Soon as the Bank of the United States was destroyed, and its days were known to be numbered, and its branches in the several States were being withdrawn, the States went to work to supply their places. They had no money to start their banks, and, from necessity, went into the market with their bonds to raise it. The ball, once put in motion, could not be stopped. If one city had a bank, another city must have one also; and if the cities had banks, the country villages must have them also. And in this way, the work was overdone, and too many banks were established; and as they were all banking upon borrowed capital, for which they were paying a high interest, it was necessary for them to make at least that interest, over and above their expenses. Each bank was driving at the same object; and to accomplish it, they were led into excessive issues of their paper, and we all but too painfully know the result. This is one of the causes of the State debts."

The following interesting document appears in the Albany Argus of the 27th ult[imo mense, last month], which has been sent to us with the article marked for insertion. The writer has bestowed great labour upon it; and has introduced much statistical matter in support of the views he has taken. At the present moment such an inquiry becomes extremely interesting, and the subject merits investigation.

Our Foreign Debt--Its Cause and Consequences.

No one can have forgotten the sensation created by the publication, under the authority of Mr. Flagg, the late Comptroller of this state, of a statement of the debts contracted and authorized to be contracted by those States of the Union which have resorted to the expedient of raising money by issuing bonds and stocks, on a pledge of the faith and credit of the state for the payment of the principal at a future day, generally some twenty years from the time of issuing the stocks or bonds.

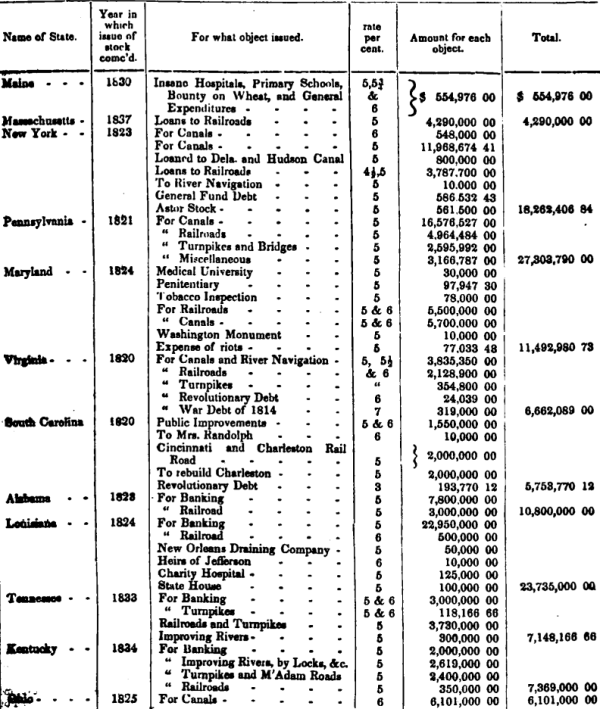

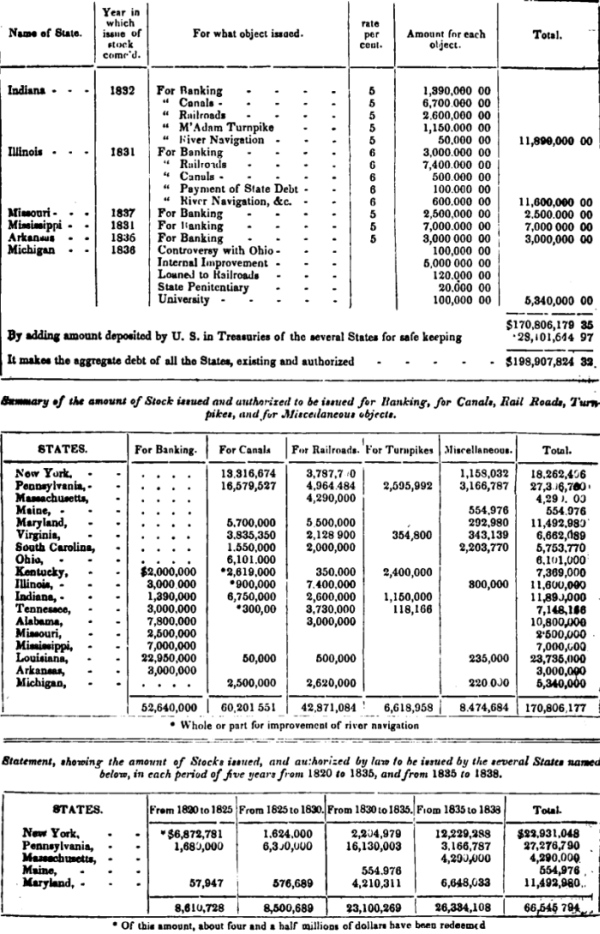

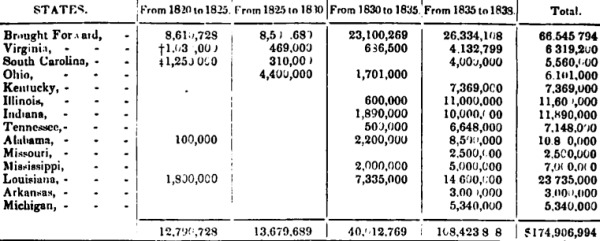

The amount of stock authorized to be created by eighteen states, in each period of five years, from 1820 to 1838, was as follows, viz:

From 1820 to 1825 ...... $12,790,728

From 1825 to 1830 ....... 13,679,689

from 1830 to 1835 ....... 40,002,769

From 1835 to 1838 ...... 108,223,808

$174,696,994

It appears from the statement that the debt were authorized to be created for the following objects, viz-

For banking, ..... $52,640,000

For canals, ....... 60,201,551

For railroads, .... 42,871,084

For turnpikes and McAdam roads, ..... 6,618,958

For miscellaneous objects, ...... 8,474,684

$170,806,277

This statement embraces the stocks authorized to be issued up to and including the legislation by the States in 1837-'38. As the legislatures of the States meet annually, it is supposed to be the practice of each, as it is of the State of New York, to make annual appropriations, or in other words, to authorize annual issues of stock, corresponding to annual wants for expenditure; and that, as state stocks did not become unsaleable in foreign markets until the summer of 1839, after the appropriations for that year had been made by the States, it is consequently fair to assume that the stocks authorized to be issued by the legislation of 1839, had been negotiated at home or abroad before the summer of 1839, when the glut in the foreign market took place.

If to the above amount be added the bonds and post-notes, issued by the Bank of the United States, and by trust, canal and loan companies, and cities, but which can only be estimated, it would probably make a grand total of two hundred millions of dollars, and this is the conclusion to which Mr. Flagg arrives.

Reflecting upon this enormous amount of state and corporate indebtedness, incurred mainly within the last eight years, it suggested itself that during the memorable era of speculation embraced by that period, when the artificial "credit system" was inflated to its utmost tension throughout the Union, when individual and corporate credit stood so high at home, and state and corporate credit stood so high abroad, when the "unregulated spirit of speculation" required so much aliment and promised such extravagant returns from investments, that most of the stocks and bonds alluded to had gone abroad, and that if they had, their proceeds would appear upon the custom-house books, which in that event should show a somewhat corresponding excess of imports from, over exports to, foreign countries.

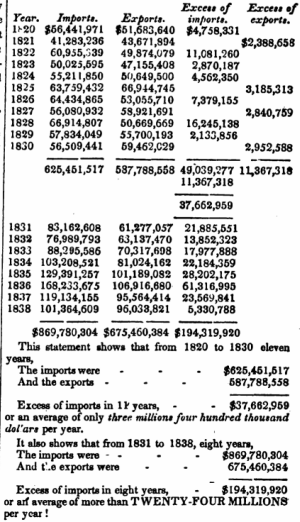

An examination of the imports and exports as shown by the reports of the Secretary of the Treasury, in the year 1820 to 1838 inclusive, and, for the purpose of the forming two periods, the first ending with 1830, second with 1838, furnishing the following results:

Assuming that the excess of $37,662,959 for the eleven years was a healthy balance, and that it covered a fair profit on the exports for the same period invested in return cargoes, then a corresponding balance for the succeeding eight years, covering a profit on the exports for that period would be about $43,210,000. This sum deducted from the actual excess for the eight years leaves the sum of $151,100,000, as the excess of imports over and above the fair returns from the exports of the same period.

If it be unfair, as in consequence of the issues of State stock before 1830 it may be, to allow more than $20,000,000 as the fair balance for the eleven years and say, $25,000,000 for the eight years, then the excess of imports for the eighteen years, beyond the fair returns for the exports would be increased to the sum of $196,000,000, or, say to $200,000,000. This then, and mainly during the last eight years, may be considered the difference between the money and foreign goods imported, and the money and domestic products exported --a difference against this country, and in favor of foreign nations.

And how, it may be asked, has this country in comparatively so short a period of time, been able to run up such an enormous foreign debt ? --That the naked credit of our merchants, high as it has hitherto stood, is not sufficient, is obvious; and even if it were, it would be contrary to the established laws which regulate commercial intercourse between nations to suffer so large a balance, the aggregation of so many years, to go unliquidated upon a mere mercantile security.

Who then has gone security for the people of the Union, and enabled them to run on so long without coming to a settlement ? The States themselves, the independent sovereignties of the confederacy, by means of bonds and certificates of stock signed by the governors or other proper officers, and under the seals of the several States, promising in the name of the people to pay the holder thereof at some future period --ten, fifteen or twenty years from this--, the principal, with interest quarterly at the rate of 5 and 6 per cent. per annum --these obligations, mortgages in effect upon the property of every citizen of the States which have issued them, of from 150 to $200,000,000, centred mainly upon the little Island of Great Britain, scarcely larger than the State of New York, and which, in effect bring the continent of North America in bondage to her, are the means by which we have been brought into our present condition.

Here then, was corroboration of the conjecture that the stocks ascertained by Mr. Flagg to have been authorized by the several States had been issued and had, to a great extent, gone abroad, where they now represent a debt, instalments of which in a few years are to be annually becoming due, and the payment of which and the annual interest of some TEN or TWELVE MILLIONS, are at once, and for a long time to come, to task the energies, and weigh heavily on the industry of our country.

The foregoing tabular statement shows that from 1820 to 1830, years of heavy excesses of importations were followed, sooner or later, by excesses of exports, thus equalizing the exchanges between us and foreign nations. The history of the times shows that the large excesses of imports in 1822 and 1828 were caused by precedent unusual expansions of the credit system, throughout the Union. The same statement shows that from 1831 to 1838, at an average rate of $24,000,000 per year, the balance is constantly against us --it is for the whole period on one side of the account-- a continual "excess of imports." A new element had entered into our commerce. State stocks began to be profusely issued --they were remitted abroad by our bankers and anxiously sought for as investments by foreign capitalists, and their proceeds, in the form of merchandise from foreign workshops, or gold and silver coin from foreign capitalists, continued up to September of the present year to swell our "excess of imports."

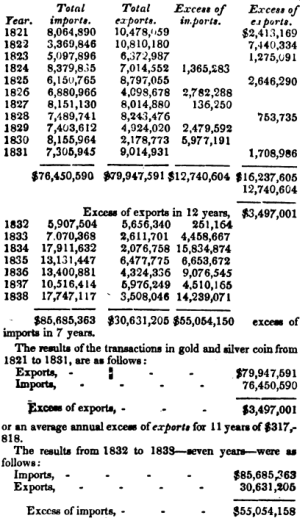

An interesting and important element of the operations from 1821 to 1838, is furnished by the following tabular statement of the exports and imports of Gold and Silver coin, separate from other articles:

Here then we have the following results:-- From 1820 to 1831, the average annual excess of imports, of all kinds, was $3,400,000, while the average annual excess of exports of gold and silver coin, for the same period, was $317,000.

During the period from 1832 to 1838 --seven years-- while the total average annual excess of imports of all kinds, was about $24,000,000; the average annual excess of imports of gold and silver coin was nearly $8,000,000; or in other words, the annual average excess of imports of merchandise for the seven years, was $16,000,000; and the annual average excess of imports of gold and silver coin for the same period, was $8,000,000; making together the aggregate annual excess of $24,000,000. Here we have, in comparison with the period from 1820 to 1830, an unnatural and unprecedented excess in the imports of merchandise alone of, say $10,000,000 per year more than, in an ordinary and wholesome state of things, the country, could well bear, and as the same time, we have an additional unnatural and unprecedented excess in the imports of gold and silver coin, of $8,000,000 per year, more.

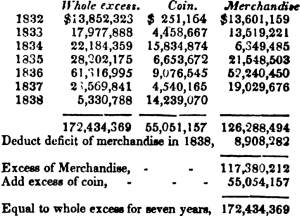

This view of the case is best presented in the following tabular statement. The first column gives the whole excess of imports for 7 years; the second column, that portion of it which is coin, and the third column, that portion, being the residue, which is merchandise.

Thus it will be seen that in 1838, though, exclusive of coin, there was an excess of exports over imports of $8,908,282, still as there was an excess of the imports of coin over the exports of coin of $14,239,070 there was a nett excess of imports of $5,330,788. According to the natural and unembarrassed laws of trade the country was in debt at the close of 1837, from 160 to $170,000,000, and still we witness in the following year, not a stimulated production sent abroad to relieve the country from a portion of its indebtedness, or at least to pay the interest on it, not a drain of a portion of the specie of which we had already accumulated so much, to do the same office, but a still further accumulation of specie and of consequent indebtedness.

We have thus seen from unquestionable facts and figures, the actual unnatural condition of the country in reference to foreign nations: And now for a glance at the causes of this condition, and of its effects, past, present, and prospective, upon the currency and industry of the country.

We have seen in the tabular statement of imports and exports first above given, that, for the eleven years preceding 1831, occasional large excesses of imports were, either mediately or immediately, followed by excesses of exports to regulate the exchanges, so that at the close of that period there appears to be an "excess of imports" of $37,662,959.

This, or a large portion of this excess it is admitted is not inconsistent with square accounts between this country and foreign nations.

We have also seen that for the succeeding period of eight years, the balances, to the average amount of $24,000,000 annually are, without any change, constantly against this country, and showing at the close of that period, and independent of the balance of the former period, an aggregate excess of imports of $194,319,920. This excess, or a large portion of this excess, is utterly inconsistent with square accounts between this and foreign nations, as is the existence of a debt of that amount utterly at variance with the laws which regulate commercial intercourse between nations, all the world over. A mere commercial debt of one quarter that amount due to foreign nations could not exist without utterly prostrating our merchants and banks, and with them the whole artificial credit system. Nothing short of the fair and untainted credit of the sovereign states of the Union is of potency sufficient to produce and sustain such an unnatural and portentous state of things. And it is in that quarter that we are to look for the explanation of the difficulty.

From 1820 to 1830 the amount of stocks issued by the states was about $26,000,000, and it is fair to assume that a portion of the "excess of imports" at the close of that period was represented by state stocks which had gone abroad. But it was not until after 1830 that the flood-gates of state legislation were opened and stocks poured out in their greatest profusion. From 1830 to 1838 the sum of $148,000,000 in stocks was issued or authorized to be issued by the states, and it was in this period that our imports exceeded our exports in the sum of $194,000,000. Here then is the wonder-working agent, the new and powerful element in the exchanges which has eluded the public scrutiny until it has brought us to a most humiliating bondage to foreign nations.

Our patriot fathers escaped the trifling tax upon tea by the extreme measure of rebellion against the government which imposed it, and staked their all upon the issue. The last remnant of the debt incurred in our contests with that power is but just paid off, when their sons find themselves in as grievous a state of bondage as their fathers were threatened with, paying an annual tribute of from 10 to $12,000,000 to the very power whose dominion and exactions their fathers so boldly repudiated and so successfully freed themselves from.

Do we not find in this new feature of the credit system a mighty engine, capable of controlling and setting at naught all the wholesome laws which ought to regulate our commercial intercourse with the rest of the world, and, as it were by stealth, against our best interests, leading us blindly into an enormous foreign debt ? And if it has had power to do this, may we not trace to the operation of its silent but fearful energies the hitherto inexplicable throes and convulsions of the great credit system in this country during the last ten years, to account for which so much has been written, and spoken, and forgotten, and about which there are at this moment such conflicting opinions ?

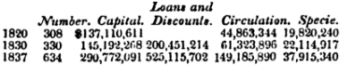

The condition of all the banks of the Union at three several periods as ascertained and reported to Congress by the Secretary of the Treasury, was as follows:

Here we see that, with an increase of only twenty-two banks from 1820 to 1830, ten years, and a corresponding increase of capital and circulation, we have an increase in the next seven years of three hundred! with a corresponding increase in discounts and circulation --all have doubled in seven years. We have seen that at the close of 1830, our accounts were about square with foreign nations, and that beginning with 1831 commenced a career of importations, the excesses of which over the exports, were, upon an average for eight years, more than $24,000,000 per annum, of which annual excess $16,000,000 was merchandise and $8,000,000 was specie.

Independent of the gold and silver coin, which of course was borrowed, we were incurring during eight years an average annual debt of at least $10,000,000, for merchandise alone. This in a wholesome state of things would have thrown the exchanges against us, and would have regulated itself by a drain of specie: but what do we witness ? Instead of a drain of specie, a diminution of discounts and a contraction of circulation on the part of the banks of the Union, we have a spectacle such as probably never was witnessed in any other country, and which certainly has no parallel in our own --an annual average accession from abroad, in specie, of $8,000,000, an average increase in the banks of the Union off fifty per annum, a corresponding increase of discounts and circulation, and the letting loose of that "unregulated spirit," which, up to the discrediting of our stocks abroad, seems for several years to have possessed every citizen of the republic.

Does it require any extraordinary sagacity to see that these results have been produced, and alone produced, by the powerful agency of the credits, the stocks of the Sovereign States of the Union ? General Jackson, Nicholas Biddle, specie circulars, or government banks, are, of themselves, alike powerless to "regulate" or control events brought about by such potent agents. State Legislatures at home by refusing to issue, or foreign capitalists by refusing to buy, can alone put a stop to a career which has been fruitful of so much mischief, and which threatens the infliction of so much more.

It may not be amiss in this connexion, to allude to the fact that the U.S. Bank, and subsequently the Pennsylvania U.S. Bank, in consequence of their great credit abroad, and the latter institution more directly and efficiently through its agent Mr. Jaudon planted in London for the express purpose, have been the chief channels through which the state stocks have been poured into the London market.

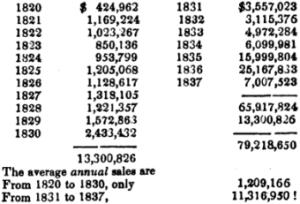

The sales of public lands since 1820 have been as follows:

Under the stimulus given to the whole banking and credit systems by the unnatural and forced importations of specie from abroad in exchange for state stocks, and the communication of that stimulus to the prices of all kinds of property, look at the fearful and accelerated velocity with which the "public domain was exchanged for credits on the books of banks" --in as many years running up to 3, 6, 8, 15, and $25,000,000. So abundant was the specie, that in 1837 after the issue of the famous "circular," and all the banks in the Union had suspended specie payments, the receipts for lands were, in coin, over $7,000,000.

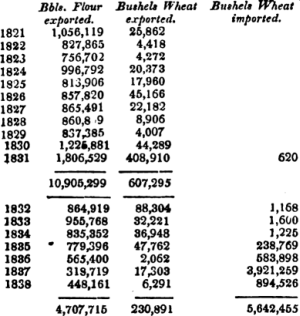

The exports and imports of wheat and flour from 1821 to 1838 were as follows:

The average annual exports of flour and wheat are as follows:

From 1821 to 1831 equal to 1,002,432 bbls.

From 1832 to 1838 equal to 517,911 bbls !

In getting the average for the latter period the imports have been deducted from the exports. Commencing with 1831 not content with running in debt abroad for luxuries; at the rate of some $16,000,000 per annum, we began, for the first time in our history, to import our bread-stuffs --the necessaries of life; until in 1837 our imports of grain were double our exports, and this at the very moment too, when with arable lands enough to supply Europe with breadstuffs, our citizens were eagerly taking up the government lands at an average rate for seven years of $11,000,000 per annum.

Upon a review of the whole matter, it cannot fail to strike an impartial observer that the radical cause of most if not of all the phenomena of the last eight years, connected with the currency, and which upon any other hypothesis are utterly inexplicable, is to be found in the issue of stocks on the credit of the states. Whether the policy of the states in entering upon such a career is founded in folly or wisdom, is not now the question. That is a matter to be settled by those who are to be directly affected by such a course. It is only in view of its general and disturbing influence upon the foreign and internal monetary concerns of the Union, breaking in upon the hitherto immutable laws of trade, setting at naught the calculations of our most prudent and sagacious financiers and merchants, and throwing out of gears the whole machinery of commerce and finance, that the matter has been looked at.

It may be objected that the figures furnished by the custom-house books are not reliable premises for such important deductions. The writer can only say that they furnish the only data on the subject, and that though they only approximate to accuracy, it is fair to assume that during a period of eighteen years, they are as correct for the last eight as for the first eleven, and that a comparison of the latter with the former cannot do injustice.

One view presented by the discredit of our stocks abroad, is a very important one for the country. The actual natural balance of trade having been for several years against us, and a drain of specie having only been prevented by the avidity with which foreign capitalists have taken up our state stocks, what is to be the effect of such discredit ? The interest upon our foreign debt, as it has gradually increased to 150 or $200,000,000 has been paid by new issues of state stocks, --now that the foreign market is glutted, the foreign holder wants specie. What is to be the effect of this drain each quarter or half year, and equal to from 8 to $10,000,000 per annum ? We must submit to it, or there must be a great diminution of our imports and increase of our exports.

Whether owing to monetary difficulties in England and on the continent, or to a distrust on the part of the foreign capitalist of the honesty of the states, or of their ability to pay the interest and principal of the debts they are so extensively and eagerly incurring, state stocks are at this moment a drug in the foreign market. At this crisis the question arises, is it for the permanent interest of the states to resuscitate their prostrate credit abroad, and thereby be enabled to plunge again into a new issue of stocks, and re-enact the scenes of the last eight years ? And if so, how is it to be done ? Shall it be done by the lapse of time, by a long course of patient enduring industry and economy, winning back the confidence we have lost by our extravagance and folly; or by calling upon a government, that of the Union, out of debt, with an untarnished credit, to endorse or assume the stocks of the states, and thereby give them currency in the foreign market ? This latter project is the course prescribed by the British house of Barings, Brothers & Co., Bankers, brokers, &c., Threadneedle-street, London, and is contained in a circular letter which is extensively quoted and endorsed by the papers in this country which advocate the scheme. The first is the course dictated by honesty and a regard to the permanent interests of the country; the latter is the temporary expedient of foreign state stock brokers, the only effect of which would be to postpone for a time, but greatly to increase and aggravate the burden which must eventually come upon the country.

If the writer has been able to communicate the convictions of his own mind and the ground thereof, he thinks he has established the following positions.

1st. That at the close of 1830, so far as can be learned from the official statement of our exports and imports, we are about square with foreign nations:--

2d. That at the close of 1838 we were in debt from 150 to $200,O00,000 to foreign nations:--

3d. That of such indebtedness, more than $50,000,000 was for gold and silver coin imported in the last eight years:--

4th. That as a mere commercial credit is inadequate to the support of a foreign debt of more than from 20 to $30,000,000, such indebtedness for all the specie, and for most of the merchandise, is represented abroad by stocks of the several states issued to raise money to establish banks and to make internal improvement, and of which $170,000,000 was issued and authorized to be issued in the last eight years.

5th. That as our bank capital, bank discounts, and bank circulation, more than doubled from 1830 to 1837 when, according to the laws of trade, specie should have flowed from the country to pay for importations for which our own surplus productions were not an equivalent, and when consequently our bank discounts and circulation should rather have contracted, --that this effect is to be referred to the same cause as that which brought $55,000,000 of coin into the country when the balance of trade was against it, --to wit, state stocks.

6th. That owing to the above enumerated causes, having their origin in state stocks, when we believed ourselves at the height of prosperity as a people, but when in fact we were more in debt than ever before, when the whole Union, as it were, were "trading on borrowed capital," and when men, women and children were clothed with goods obtained from foreign workshops, on the credit of the states! agriculture itself seems to have participated in the inebriation of the times, and we relapsed from a bread selling to a bread buying people.

7th. That as the interest upon our foreign debt of from 8 to $10,000,000 annually, which has been heretofore paid, by new issues of state stocks, must, now that stocks are not taken, be paid in another medium, there must be a permanent quarterly drain of specie from the country, or there must be a very considerable diminution of our imports, and increase of our exports.

A.

Debts of the Several States

Mr. Flagg's Tables

In May, 1838, after the passage of the General Banking Law, authorizing the Comptroller to issue circulating bank notes on a pledge of the evidences of public debt of the several states, Mr. Flagg sent a circular to the financial officer of each state, soliciting information in regard to the amount of stock created, the rate of interest, and when payable, the mode of transferring the stock, whether specific funds were pledged for the payment of interest, and whether the interest in all cases was paid by the state. Full answers were received to these inquiries, except in two or three cases: And the amount of stock, actually issued previous to the time of giving the information, (say in June, 1838,) was stated in the Comptroller's annual report of 1839, page 89, at $123,703,750.11.

The following tables show the total amount of stock issued and authorized to be issued by each of the eighteen states which have resorted to this mode of raising money. Where the returns of the financial officer did not afford all the information which was desired, the state laws have been examined to ascertain the extent of authorized loans. The operations of many of the states have been so extensive and varied, that it is not an easy matter to get at the precise amount of stock issued and authorized to be issued. It is probable, however, that the aggregate amount of stock authorized by all the states is even greater than the amount stated in the tables. ---Albany Argus.

Maine.-- The stock issued by this state is to be redeemed under the direction of the legislature, by the sale of public lands, from the debts due the state, by taxes, or new loans, as may be deemed expedient from time to time. The amount of notes due from individuals to the state, (August, 1838) is $326,721. The whole amount of located lands belonging to the state, is 1,400,000 acres, valued at $1,500,000. The undivided lands belonging to Maine, are estimated at 3,011,000 acres, making the total number of acres 4,411,000. This total includes half of the land north of the St. John's river, in the King of Holland's award. The stock of this state is negotiable and transferable by the holder, and the interest in all cases is payable by the state. The interest on $235,000 is payable at Boston, annually and the interest on the residue at the state Treasury, annually and semi-annually, the stock bears interest at 5, 5½, and 6 per cent. The value of the taxable property of the state in 1830, was $28,807,687.24.

New Hampshire has issued no stock. The expenses of government are defrayed by a direct tax.

Vermont.-- This state has issued no stock.

Connecticut.-- This state has issued no stock or bills of credit, since the revolutionary war. "The amount of grand list is $97,122,697," in 1837.

Rhode Island.-- This state has issued no stock. Valuation in Jan. 1824, $32,640,000.

Massachusetts.-- Interest on two millions of stock payable in London by the rail-road corporation, in whose favour the stock is created; the interest on the rest is payable at the state Treasury, the several corporations reimbursing the Treasury for the interest so paid out. The scrip in all cases is made payable to bearer, and no form is necessary in transferring the same. The real and personal property within the state is $268,360,407.

New York.-- This state commenced issuing stock in 1817, for the construction of the Erie and Champlain canals. The sum of $600,000 was issued prior to 1820. The law of 1817 created a board of commissioners of the canal fund, consisting of the state officers, and placed under the management of the board, specific revenues which were pledged for the payment of the money borrowed. There has been derived from the auxiliary funds thus set apart, since the first organization of the canal fund, the sum of $5,824,761; which exceeds by $276,000, the whole amount paid for interest on all the money borrowed for the Erie and Champlain canals for 21 years, from 1817 to 1838. From 1821 to 1838, these two canals have yielded in tolls $15,088,375.97. The result is, that the whole of the original debt is provided for, and except about 2¼ millions, has been paid off and the stock cancelled. The laws authorizing money to be borrowed previous to 1825, contained the following provision, viz.-- "That it shall not be lawful for the commissioners of the canal fund, to make loans under this act, beyond such amounts as for the payment of the interest thereof, the canal fund, at the time, shall be deemed ample and sufficient."

In 1825, the financial policy in regard to moneys borrowed, was changed, and loans from that time to the present have been authorized without setting apart specific funds for the payment of interest. In each case, however, the payment of the interest is made a charge on the Treasury; and provision has been made to borrow from the Erie and Champlain canal fund to meet this demand on the Treasury. In 1837, after the suspension of specie payments, this state paid the interest on its whole debt in coin, and redeemed about one million of the stock due in 1837, by paying 109 dollars in New York city paper for each 100 dollars of stock redeemed. For six years, from 1833 to 1838, the revenue from the tolls of the canals after defraying all expenses of repairs, and paying interest on the whole amount of the outstanding debts, yielded an average surplus of $610,000 per annum. This surplus will sustain a debt of 12 millions of dollars.

The stocks issued by the state of New York, are transferable in the city of New York, either by the owner in person or by a power of attorney. The original certificate in all cases to be produced when the transfer is made.

The aggregate valuation of real and personal estate in 1837 was $627,554,784.

Pennsylvania.-- This state pays the interest on its stock at the bank of Pennsylvania, where the stock is transferable. The following revenues are set apart for the payment of interest on the stock loans, viz. canal and railroad tolls, dividends on turnpike and bridge stock, auction duties, collateral inheritances, county rates and levies, tax on personal property, and escheats. Whenever the revenues arising from the above sources is not sufficient for the payment of the interest on the stock loans, the deficiency is taken out of the Treasury proper. The acts of assembly directing the loans to be made, direct also that the Governor shall borrow on the credit of the commonwealth, and such fund or funds as have been or shall be created, for securing the punctual payment of the interest, and the reimbursement of the principal.

The aggregate valuation of real and personal estate in 1835 was $294,509,187.

New Jersey has not issued stock of any kind, or loaned her credit to any company.

Maryland.-- This state in all cases pays the interest on the stock, half yearly and quarterly, but the companies which the state has aided by its loans, reimburse the Treasury for the amount of interest paid from time to time. A sinking fund has been established from premiums and other sources, which now, (1838) amounts to $1070,306.03, which is applied to the purchase of the state stock.

During the suspension of specie payments, this state did not pay the interest on its stock, either in specie or its equivalent. Some of the holders of the stock refused to receive depreciated bank paper for the dividends, and the treasurer, in December 1837, reported this fact to the legislature, and in March, 1838, an act was passed which provides that the state treasurer shall cause the interest on the state stock that shall hereafter accrue, and that which has accrued since the first of April, 1837, to be paid "either in coin or its equivalent in current bank notes, to be determined by the commissioners of loans by the price of coin in Baltimore on the quarter day.

The private, real, and personal property, other than merchandise, and rights and credits of all sorts, is estimated at over $100,000,000. No uniform mode of valuing property throughout the state is observed. In most of the counties, the valuations are made under acts of 1785 and 1797, which requires all lands to be put down at $3 per acre, male slaves at the highest, $100, and females at $80 each.

Virginia.-- The interest on the stock issued by this state, is payable semi-annually at the treasury in gold or silver. The profits of the improvements for which the stock is issued, are pledged for the payment of interest and principal; and if necessary the general revenues of the commonwealth are pledged for the payment of the interest.

The aggregate valuation of the real property of the state in 1818 waa $206,893,978; and now probably three hundred millions. There is no mode of ascertaining the personal property.

South Carolina.-- The faith of the state and the capital of the Bank of the state of South Carolina, and the annual dividends thereof, pledged for the payment of $800,000 issued from 1822 to 1826. And the annual dividends have been formed into a sinking fund for that purpose, and at this time, (Oct. 1838,) amount to upwards of $800,000, so that the six per cents. redeemable in 1840 will no doubt then be paid. The interest on two millions, to be loaned to the Louisville, Cincinnati and Charleston rail road, is payable semi-annually in London. The two millions for rebuilding a part of Charleston, is to be loaned to individuals, and the stock to be re-imbursed from the mortgages of individuals. The interest on the state stock is payable semi-annually in London.

Valuation of property, $200,000,000.

Ohio.-- The interest on the stock of this state is payable in New York where the stock is transferable. Auxiliary funds are set apart for the payment of the interest, and in case of a deficiency therein, it is made the duty of the Auditor of State to levy an adequate amount by direct taxation. The loans were invariably made on pledges of specific revenues for the payment of both principal and interest.

The state of Ohio, at the commencement of its loans, organized a system of finance on a firm foundation, providing by direct taxation for the payment of the interest and the ultimate redemption of the principal. In 1837, after the suspension of specie payments, Ohio paid the interest on its debts in New York city paper, at the rate of 109 dollars, for each $100 of interest.

Aggregate valuation of real and personal property, $110,000,000.

Kentucky.-- This state in all cases pays the interest on her own stocks. Auxiliary funds are set apart for the payment of the interest; but if these funds should prove insufficient, the state is bound to resort to direct taxes. In 1836, the Legislature established a sinking fund for the payment of the debt; to which fund is appropriated bonuses and dividends on bank stock, premiums on scrip, state dividends on turnpike stock and all internal improvements, profits of the Commonwealth's bank, proceeds of state stock in the old Bank of Kentucky and the excess in the Treasury over ten thousand dollars of each year. The Governor, by an act passed in 1838, is authorized to borrow any sum not exceeding the capacity of the sinking fund, to pay the interest, and ultimately the principal, of the state bonds, at an interest not exceeding 6 per centum per annum.

Taxation is confined to specific subjects. The aggregate value of such as are chargeable with revenue is $217,453,041, upon which a tax of ten cents on the $100 is paid.

Illinois.-- The state in all cases pays the interest on the stock. In addition to the usual pledge of the faith of the state, lands, revenues, &c. there is specifically pledged for the redemption of the canal bonds, the lands granted by the general government to aid in constructing the canal; the estimate of which is equal to the whole cost of the canal. There is also pledged for the interest and final redemption of the bank bonds, the dividends and the stock owned by the state in the banks, which amounts to nearly half a million of dollars more than the amount of these bonds.

Indiana.-- The canal lands granted to the state by the general government on the Wabash river, are pledged for the payment of the loans made on account of the Wabash canal. The interest on the bonds issued to the State Bank is paid by the bank.

In 1837, after the suspension of specie payments, this state purchased coin to pay the interest on its debt; and for the July quarter paid 111 dollars in New York paper for each $100 in coin.

Aggregate valuation in 1837, estimated at $95,000,000.

Louisiana.-- The interest on the state bonds is paid by the respective banks to which they were originally issued. The interest on other state stocks is paid out of any moneys in the treasury.

The Bank of Louisiana, two millions of stock, the profits retained for redemption of the instalment of 1839, sufficient to cover the amount $60,000,000.

Consolidation Association.-- These bonds are guaranteed by mortgages on real productive property, amounting to three millions of dollars. No stockholder can borrow more than 50 per cent. on his stock, and this amount is returned by yearly instalments to meet the payment of the bonds by the bank. The state for its guarantee is considered as stockholder for one million of dollars, and on the payment of the bonds will divide accordingly with the stockholders. Dividends are only declared as the bonds are paid, and in the same proportion. The profits, until then, are retained as a sinking fund to meet the redemption of the bonds.

The Union Bank has bonds to tile amount of seven millions of dollars, and is conducted on similar principles as the above. The original guarantee on mortgages of productive property is eight millions. The state for its guarantee is to receive one-sixth of the nett proceeds.

The Citizen's Bank has received bonds to the amount of eight millions of dollars, and can demand four millions more; is conducted on the same principle as above described. The guarantee is on $14,000,000 of mortgages on real productive property. The state holds one-sixth of the nett profits, which are only to be divided as the bonds are paid by the bank, and in the same proportion.

Mississippi.-- This state has issued bonds on the faith of the state to the amount of seven millions of dollars, and has subscribed that amount in the stock of two banks.

Missouri.-- has issued bonds to the amount of $2,500,000 to the State Bank of Missouri.

Arkansas.-- has issued three millions of bonds to two banks in that state.

Michigan.-- The proceeds of the public works as well as the faith of the state pledged for five millions --the lands set apart for the University pledged for the loan for that object. The loans to rail roads are secured by pledge of the roads, &c. The interest on $100,000 issued to defray the expenses of the controversy with Ohio, is to be paid by a direct tax.

North Carolina.-- This state has set apart a large amount of funds for internal improvements and for the establishment of public schools, which is placed under the direction of two boards, styled the Literary and Internal Improvements boards. These funds, until required to meet specific appropriations by the legislature, are loaned out to individuals and corporations at six per cent. The state of North Carolina owes no debt.

Tennessee.-- The interest on the state bonds subscribed to the Union Bank, were paid by the dividends on the stock, until the revolution of 1837, after which the state paid the interest from the ordinary resources of the treasury. The interest on the bonds issued to rail road and turnpike companies is paid by the state, and the companies are required to reimburse the Treasury for the sum from time to time paid.