45th Congress, 2nd Session

Birchard Hayes, President by vote-fraud

Almon Wheeler, vice-president

John Sherman, Secretary of the Treasury

Coinage of Silver Dollars.

Mr. Boyd [Thomas Alexander Boyd, (1830-1897), Lewiston Illinois, R.; studied law, admitted to the bar]. Mr. Speaker, in view of the fact that so much has been said and written upon the question of the restoration of the silver dollar to its former place among the current coins of the country I shall be content to take up a small portion only of the time of the House in what I may have to say upon the subject. When the matter was first before us for consideration I would have been pleased to have had an opportunity to dwell more at length upon what was then, and still is, the most prominent question before the country. Its importance cannot be overestimated, and its solution will affect the material interests of this people profoundly for good or for evil.

While I am ever willing to pay due regard and proper respect to the opinions of others upon this as well as upon every question that may come before us for discussion, still there is one voice to which I am disposed to give greater heed than to any other ---the voice of the free, intelligent, and thinking people of this land. That man is blind to the real situation who fails to perceive that these people have calmly, deliberately, and intelligently considered this question so vital to their interests and with a unanimity rarely if ever witnessed in this Republic of free thought, demand the restoration of the silver dollar, and that it be clothed again with its unlimited legal-tender quality. All the material interests throughout our broad domain, Mr. Speaker, cry out with one accord and in marked harmony for the relief which it is felt and believed can be found in legislative enactments securing that end.

The great and vital question, then, to be answered is, will the Government gratify this most just and reasonable demand of our people and yield prompt obedience to their will, so plainly and emphatically and at the same time so respectfully declared. This demand is no wild and crazed hue and cry, but the earnest, zealous, eloquent expression of what they know and feel to be for their best interests, and it therefore becomes the duty of their representatives in all the departments of the Government to render prompt and willing obedience to that demand. They know, sir, where the remedy, to a great extent, for their present troubles can be found, and have been prompt to point it out; and there is no saying truer than this, that when the great heart of the people utters its oracle the decision is invariably for the right.

I am not one of those, Mr. Speaker, who are disposed to censure the Congress which enacted this important legislation of 1873-'74, which eventuated in the displacement of the silver dollar from the list of our legal-tender currency, as guilty of the perpetration of a willful and deliberate fraud upon the rights and interests of the people of this land. I am unwilling to believe that our representatives in Congress, then assembled, legislated purposely, knowingly, and deliberately, in the interest of the public creditor or bondholder to the detriment and serious hurt of the business and laboring masses of the country. I am too charitable to indulge in any such suspicions or make such charges in the face of the known truth that many honest, well-meaning, and patriotic men, now as well as then, insist and claim that such legislation was wise and proper, and should be allowed to remain undisturbed.

With these, Mr. Speaker, I cannot agree, and I have no hesitation in saying that, in my bumble judgment, it was unwise and inconsiderate legislation, and allowed to become the law of the land without a full and adequate appreciation at that time of its fearful importance, and with but little, if any, conception of its effects upon the interests of the people and the country generally. But now that its bad results have been made sadly manifest, now that time has supplied the touchstone by which it has been demonstrated that its effects are evil, and evil only, our duty is plain, Mr. Speaker, and it behooves Congress at the earliest possible moment to apply the remedy and give relief by the repeal of this noxious legislation, and a speedy return to that condition of our legal currency as it existed before the enactment of 1873-'74. The American Congress perhaps never made a greater mistake than when it ordained that legislation, and there comes to us today from all quarters of this broad land a voice, like the "sound of many waters," praying for relief from the heavy burdens and oppressive weight it has entailed upon an already over-ladened people. It was an innovation upon the established order of things which took us by surprise and for which we were not prepared.

For long years, ay, ever since the foundations of the Republic were laid, gold and silver alike, and not gold or silver, had been the recognized and universally accepted money of our people. In fact it might be said that they were written down in that instrument as the money of the Constitution. Concurrent construction and judicial decision have held that the provision of that instrument which prohibits the States from making anything but gold and silver coin a tender in payment of debts means that these metals in coin are equally and alike the constitutional money of this land with which to pay debts. True it must be admitted that during the terrible ordeal of civil war through which we have been recently compelled to pass, the like of which we sincerely trust may never occur again in our history, we were forced to yield to the irresistible demands of a cruel necessity which recognized no law, and to issue as a dernier ressort a large amount of irredeemable paper currency. This was the last desperate step of our threatened country, and taken for the purpose of relief for the time being from the terrible dangers which so menaced the existence of the Republic and startled the great heart of the nation from center to circumference with alarm at the impending ruin. But that terrible ordeal has been passed; the curtain of peace has shut out from view forever in this land, we trust, the bloody drama of war, and our country is fairly started again in her course of peace and prosperity. Still it will take time to survive the effects of war in all respects, and the consequences of this necessitous departure from our wonted system of finance are being felt and seen to-day and will continue to be felt and seen for years to come. Wild and reckless speculation followed as the logical and inevitable consequence of this large issue of an irredeemable and a depreciated currency to which we were compelled to resort, and its bad results are with us to-day and will be present to bother us for a long time to come.

Even if I did not feel and believe, Mr. Speaker, that every consideration of right, every consideration for the best interests of the people of all sections and the material prosperity of the country generally demanded the restoration of silver to its constitutional and historical equality with gold as of the legal money of the country, I should nevertheless earnestly favor the enactment of such a measure for the reason that the deposition of that coin from its proper and legitimate place was effected by legislation of doubtful fairness and propriety. The question of fact, so positively asserted on the one side and so emphatically denied upon the other, as to whether the silver dollar was demonetized in a surreptitious manner by the legislation of 1873-'74, is a sufficient reason of itself, in my humble judgment, to justify us in revising if not in totally annulling its provisions. As a matter of fact it is a matter of impossibility, from inspection of the records, to discover where in the coinage act of 1873 (if in that act at all) the silver dollar was dropped out and made to disappear.

I have taken occasion to examine with some degree of care the record of the proceedings of Congress with relation to this matter for the purpose if possible of getting at the true history. In the course of that examination I must say that I have not been able to find, either in the debates upon the measure or in any of the amendments proposed to the original bill, a single reference or allusion to the question of omitting the silver dollar from the then established legal coins of the country. The question then recurs, how was it dropped ? In my judgment that result was accomplished by and through the passage of the Revised Statutes in 1874, as I shall endeavor to maintain and establish hereafter.

As a step in that direction it will be proper, Mr. Speaker, to examine somewhat carefully the history of the coinage act of 1873, its provisions and its purpose. That act was manifestly intended simply to codify the laws relating to coinage, the Mint, and assay offices, and it did not, either in terms or by implication, as I insist, demonetize the silver dollar of 412½ grains. The original bill, which was intended for the purposes above stated only, and which, if I have a correct comprehension of its provisions, made no material or radical changes in the law then in force relating to coinage, the Mint, and assay offices, passed the Senate after some discussion in the Forty-first Congress. At the last session of the Forty-second Congress Mr. Kelley, a republican from the State of Pennsylvania, introduced a bill in the lower House of Congress on the same subject, and Mr. Hooper, of Massachusetts, reported still another, which took the place of Mr. Kelley's bill, differing somewhat in its provisions. It further appears from the record that on the 9th day of April, 1872, Mr. Hooper took occasion to explain the provisions of his bill, among which was one that changed the weight of the silver dollar, reducing it from 412.5 grains to 384 grains. The reason assigned for this reduction in its weight was (what was the fact) that the silver dollar was worth three cents or thereabouts more than the gold dollar. Upon this proposition some discussion ensued favorable to the reduction and also to the propriety of making silver altogether a subsidiary coin in the currency.

But nowhere in that discussion does it appear, Mr. Speaker, that there was an intimation even of a desire or intention upon the part of any one to eliminate the silver dollar from the legal coins of the country or rob it of its legal-tender quality. This bill was recommitted, and then again, on the 27th of May, 1872, Mr. Hooper reported to the House a substitute and moved to suspend the rules and put it upon its passage, which was done. Debate was cut off under a call for the previous question. It was passed without discussion and without being printed or read, under the honest impression by the House that this substitute made no material change or alteration in the then existing coinage laws. We find here an instance of inconsiderate and hasty legislation that cannot be excused, much less justified. I mean this in no censorious or offensive sense. And I would say further that it admonishes us that in all legislation it is the part of wisdom to "make haste slowly," having reference always to the quality rather than to the amount. A little care and deliberation then, sir, would have saved us all the doubt and uncertainty that hang around the passage of that act.

Mr. Hooper was casually interrogated as to the provisions of his substitute before the bill was put upon its passage, and his answer went to the extent only that no change was made in the then existing law so far as it affected the recoining of the small coins, but the silver dollar seemed to have been overlooked entirely. No questions were asked concerning it, and as a consequence no information was had concerning its coinage.

But, Mr. Speaker, the circumstances attending this legislation seem to indicate pretty clearly that this bill, which, as I have stated, passed the House without debate and under a suspension of the rules, provided for a silver dollar, for the fact is, that in the debates upon it in the Senate subsequently it was alluded to, but nothing was said or proposed regarding its discontinuance as one of the legal-tender coins. This bill remained in the Senate undisposed of until the next session, after having been considered in the Committee on Finance. It was reported back to the Senate by the then chairman of that committee, Mr. Sherman, in December, 1872, with some amendments, coupled with the statement that it had passed the House, and that it was in substance the same bill which had passed the Senate in the Forty-first Congress. It was printed with the amendments, and then again later, on the 7th day of January, 1873, it was reprinted with further amendments, and on the 17th of January was taken up for discussion in the Senate. Then, too, we find that there was provision made in the bill for a silver dollar, which, it was alleged, was an exact equivalent of the five-franc piece of France. In the discussion which was then had, as to the design and inscription to be placed upon that coin, not a word was said about doing away with the coin itself or dropping it from its place as a legal tender.

I have looked in vain, Mr. Speaker, in the reports, debates, and amendments for anything which indicates a disposition or design or intent to do away with the silver dollar itself. After passing the Senate with the amendments of the committee it was sent to the House, and upon the refusal of the House to concur in such amendments a committee of conference was asked, which was finally agreed to by the Senate. That committee of conference, consisting of Messrs. Sherman, Scott, and Bayard, of the Senate, and Hooper, Stoughton, and McNeely, of the House, made report on the 6th day of February, 1873, which report was concurred in by both Houses, and became a law without question or debate. That law, as enrolled and signed, provides, in section 15, as follows:

That the silver coins of the United States shall be a trade-dollar, a half-dollar, or fifty-cent piece, a quarter-dollar, or twenty-five-cent piece, a dime, or ten-cent piece; and the weight of the trade-dollar shall be four hundred and twenty grains troy; the weight of the half-dollar shall be twelve grams and one-half of a gram; the quarter-dollar and the dime shall be, respectively, one-half and one-fifth of the weight of said half-dollar; and said coins shall be a legal tender at their nominal value for any amount not exceeding five dollars in any one payment.

And by section 17 it is declared---

That no coin, either of gold, silver, or minor coinage, shall hereafter be issued from the Mint other than those of the denominations, standards, and weights herein set forth.

Section 18 proceeds to fix and prescribe the inscriptions and devices to be placed upon the coins, and the only words having special reference to the silver dollar are these: "And on the reverse of the silver trade-dollar the weight and fineness of the coin shall be inscribed."

Now, Mr. Speaker, an examination of the report of the committee of conference shows us that the only sign or trace of changes in these sections is found in the following portion of such report:

That the House recede from its disagreement to the sixth amendment of the Senate and agree to the same, with the following amendment:

In line 5, strike out the word "grains " at the end of the line and insert in lieu thereof "grams;" and in line 6, strike out "grain" and insert "gram."

And the Senate agree to the same.

That the House recede from its disagreement to the eighth amendment of the Senate and agree to the same, with the following amendment:

After "silver" insert "trade."

What follows of this report is not material to the question under consideration.

Now, Mr. Speaker, if I read the history of this legislation correctly, it does not appear where or at what stage the silver dollar, which was in section 15 when the bill went to the committee, was dropped out; but we do find that in section 18 there is an indication that it was changed to the "trade" dollar. Neither in the debates upon the measure nor in any of the proposed amendments do we find any allusion to the question of its omission from the list of legal-tender silver coins; and it will appear upon a careful examination of said section 15, which is the only section of the act that contains any provisions affecting the question under consideration, that by its terms the silver dollar of 412½ grains was not demonetized.

The coins therein named were specifically declared to be a legal tender at their nominal value for any amount not exceeding $5 in any one payment. These coins were first the trade-dollar, which is universally conceded was never intended for circulation at home, but was expressly coined for the Indian, Chinese, and Japanese trade. By carelessness, however, in that legislation a grave error was committed in declaring it a legal tender at all ---an error which in a few years thereafter was corrected by a repeal of that clause which gave to it its legal-tender quality. The other of said coins named in the act which were made a legal tender for the like sum of $5 and no more, are the half and quarter dollar and dimes, known as the subsidiary coins. These were left just as they had been since 1853, changed neither in their legal-tender quality nor in their fineness or weight. The last change made in them was in 1853, and then only as to their weight, for the reason that it was then deemed necessary to reduce their weight in order to keep them at home; and they were, by reason of that legislation, so made less in weight that two half dollars or four quarters or ten dimes were no longer equal to the silver dollar of 412½ grains, and they were also then limited in their legal-tender quality to the amount of $5 and no more.

Now, Mr. Speaker, it is manifest that the coinage act of 1873 makes no change in the status of these subsidiary coins, but leaves them precisely as they were established by the act of 1853. What change then, if any, did the coinage act of 1873 make in the legal-tender coin of the country ? This, and this only, that it declared the trade-dollar a legal tender for $5 in any one payment ---an inadvertence which, as I have before stated, was afterward remedied. If, then, the demonetization of the silver dollar of 412.5 grains was not accomplished by the provisions of the coinage act of 1873, how was it done ? I shall not assume to answer this inquiry solely upon my own authority, but I will adopt the language of the distinguished Senator from Ohio, [Mr. Thurman,] who, in my humble judgment, answers it in terms too full, true, and correct to be improved upon, in the following concise and pointed statements.

I say, then, it was not by the coinage act of 1873 that the dollar of 412½ grains was demonetized. How was it done ? It was done by the passage of the Revised Statutes in 1874, and what were these Revised Statutes ? The Revised Statutes were a compilation authorized by Congress to be made by certain commissioners appointed by the President. What were they authorized to do ? To change the law ? No, sir; they had no more authority to change the law than any man who walks the streets of Washington; they had no right to change it in any single particular that altered its meaning; they had no right to enact any new law, and they did not pretend to do so. What did they do ? They made their report. It came in the form of a bill. What was that bill; what was its title ? What is the title of the Revised Statutes as given in their bill ? "Revised Statutes of the United States, passed at the first session of the Forty-third Congress, 1873-'74; embracing the statutes of the United States, general and permanent in their nature, in force on the 1st day of December, 1873, as revised and consolidated by commissioners appointed under an act of Congress."

The volume purports simply to be a compilation of the statutes of the United States in force December 1, 1873, not any new enactment, not any change of the laws from what they were on the 1st of December, 1873, but simply a compilation in a convenient form of the laws as they existed on the 1st day of December, 1873. What was the law on the 1st day of December, 1873, on the subject of legal tender ? The silver dollar of 412½ grains was then by the law of the land a full legal tender for all debts, public and private. No man can deny it. It is useless to say that it was not in existence. There was the law; there was the power of the Government to put these silver dollars in existence to any extent which it saw fit. There was a legal right to coin them, and to coin them to any extent that the Government saw fit to coin them. Why, sir, this argument that they were not then in existence might just as well be made against gold. Were there gold eagles or half eagles or quarter eagles or gold dollars enough to pay the debt of the United States, much less the debts of the whole public and all private individuals ? Nobody pretends it; yet gold coin was a legal tender, and the Government had the potentiality to coin it to meet any demand or the people or of the Government for its existence; and just in the same way the silver dollar was full legal tender, and the Government possessed the potentiality to coin it to any extent to which public policy or justice required it to be coined.

Here, then, were these Revised Statutes declaring themselves on their face to be the laws that were in force on the 1st day of December, 1873. As I have said, at that time the silver dollar of 412.5 grains was full legal tender for all debts, public and private. But what was found in this book after it passed, after it passed without reading, after it passed as I saw it without ever the package containing the bill being untied on your Clerk's desk, but the bill simply read by its title; what was found in it ? There was found in it what I will read. Remember that the fifteenth section of the coinage act was only one section in an act containing sixty-seven sections and there it belonged. It said that "the said coins," that is the trade-dollar, the half dollar, the quarter dollar, the dime, shall be a "legal tender for $5 in any one payment," not touching the dollar of 412½ grains; but now these revisers of the statutes, taking that section out of the "coinage" and clapping it under the head of "legal tender" and striking out the word "said," produced this thing which passed the Senate and passed the House, without I venture to say ten men in either body ever knowing that there was any such thing in the bill or would be in the law:

"Sec. 3586. The silver coins of the United States shall be a legal tender at their nominal value for any amount not exceeding $5 in any one payment."

Now, Mr. Speaker, I have endeavored to give in as brief and concise and true form as I can the history of that most unfortunate legislation which, after violating the spirit if not the letter of the Constitution, stopped not there, but in its deleterious results has disturbed most seriously the commercial interests as well as the dearest rights of the people throughout the length and breadth of the land. Gold and silver alike have since "time whereof the memory of man runneth not to the contrary" constituted the basis and firm foundation of the monetary system of all nations and peoples. With us it may truthfully be said, Mr. Speaker, that ever since the establishment of the Government silver coin has constituted the chief and oftentimes the only metallic legal-tender currency in general use. If age entitles it to any consideration at our hands, then I answer, sir, that away back in 1792 the Congress of the United States made provision for the coinage of a silver dollar, equal in value to the Spanish milled dollar then current, containing 371¼ grains of pure silver, to be the monetary unit of value in this country. The standard weight of that dollar was 416 grains, and so remained until 1837, when it was reduced to 412.5 grains. Yet the quality of pure silver which it contained and its intrinsic value remained unchanged for a period extending over eighty years, during all which time the silver dollar so coined continued to be the monetary unit and standard of values for this country. And it was left for us, in this enlightened day and generation, to lay sacrilegious hands upon this venerable coin and cast it out from the Eden of our favorable consideration and banish it, as some would have us do, forever from its place in the list of our legal coins.

I stand here, Mr. Speaker, to enter my protest against this act of vandalism and to demand in the name of right and justice, and in behalf of the millions of our people who desire this consummation, the restoration of that banished coin to that position to which it is constitutionally and of right entitled. Although I am unwilling to pay blind tribute to whatever is past, yet every candid man must admit that in this step we have taken a wide and unwise departure from the practical wisdom which characterized the conduct of the statesmen of those former times in their treatment of this subject, and he who "runs may read" in our depressed condition to-day the sad and startling truth that we are paying dearly for this rash and inconsiderate bit of legislation. Little wonder is it that we should feel these crushing results when we consider that by a single blow we have swept away that standard measure of values to which during a very large portion of the term of our national life our business as well as credits had adjusted themselves.

This innovation upon the existing state of things was of too grave and serious a nature to have been ventured upon without the most careful consideration and the fullest possible discussion of its merits, before the country, whose people were so deeply and materially interested in the event. Now that time and opportunity have been afforded for that consideration and discussion, and now that its baneful effects have been seen and felt throughout this broad land, the people are announcing in thunder tones their condemnation of the rash act, and demanding in terms that it behooves their Representatives to hear and heed, the restoration of the silver dollar to its full legal-tender quality in payment of all debts, public as well as private. I am in full accord with their demand in this regard, and I feel and believe, and therefore charge, that there will be signal and criminal omissions of the performance of an act of well-merited justice to that people if this Congress fails to do its might in the effort to repeal the legislation of 1873-'74, and to restore the dollar to its legitimate and rightful place in our currency.

I aver further, Mr. Speaker, that, whether done designedly or not, the whole tenor of our legislation since 1869 has had the effect of enhancing the value of the bonds of this Government and thereby augmenting the weight of the public burden, and that it is now high time to do something in the interest of the debtor, and if possible relieve the people from the crushing load that now bears so hardly upon them. I would not do this, sir, to the detriment of any of the rights of the public creditor, but I urge it without feeling liable to any such charge, in the light of the glaring truth that all these bonds which our golden-mouthed advocates of demonetization insist are and should be payable in gold, are by the terms, so plainly written upon their face that no reasonable man can doubt, payable and redeemable in coin of the standard value of the United States on the 14th day of July, 1870. At that date coin of the standard value of the United States embraced both the silver and the gold dollar, and both were equally a lawful tender in payment of public and private debts alike. If this be so, then what semblance of justice is there in the charge so flippantly and glibly made and repeated by our opponents that in the remonetization of silver we are guilty of a breach of the public faith and of a willful attempt to force the holders of our bonds to receive the principal and interest of a debt in silver when they had been led to believe that "payment in coin" meant gold coin and not silver. I deny that any such interpretation can be placed upon our conduct, and these charges, coupled with the zeal with which they are made, evidence the desperation of desperate advocates of a desperate cause. In viewing the personnel of these champions of demonetization, I cannot but believe that they are actuated as much by self-interest as by a regard for the public credit or the people's weal.

There is nothing in the circumstances surrounding the contracting of the debt, and certainly nothing in the terms of the contract, to warrant the belief on the part of the purchasers of our bonds that they were payable, or meant to be payable, in gold. And whether viewed in the light of a legal or moral question, there is no feasible ground upon which to base such a claim. We simply ask a bare compliance with the terms of a law so plain as to leave no room for doubt as to its proper construction. And I venture now and in this presence the assertion that if by some strange and unlooked-for concurrence of causes the relative supply of the two metals was reversed in this country, that if our western mines instead of silver should yield their tons of gold, that those who are now foremost and loudest and fiercest in their advocacy of payment in gold would suddenly become the ardent and zealous advocates of the propriety of the payment of the debt in silver, ready and willing to see perfect harmony between the letter and the spirit of the contract. They would then cease to play the part of theorists and doctrinaires and grow eloquent over the advantages of a single over a double monetary standard, and be content to make the most out of their securities by receiving in payment the silver they now so bitterly denounce. I say it in no offensive sense, but it is apparent to the most casual observer that the opponents of silver, who are the advocates of a single standard, are those who constitute the creditor class in our midst, the money power as it is ordinarily termed. And it is marvelous how they insist upon a faithful and strict observance of the rights of the laboring and business classes, and attempt to dignify their position by professions of kindest regards and solicitude for their interests. They would not have two kinds of money; the one for the poor, the other for the rich.

Neither would I, Mr. Speaker. But restore to silver its legal-tender quality and it will resume its equal place beside the other metal. I have intimated before that the people of this country know their interests, and I assert now that with astounding unanimity they have declared for the restoration of silver and against the pretended friends who have professed so much in their behalf but are careful to take no single step in that direction. The solicitude they manifest in lipservice for the workingmen and laborers is a charming piece of acting, and their persistent efforts to persuade those classes that the remonetization of silver will reduce their wages 10 per cent. is a specimen of concern rarely witnessed on Earth. Why, I ask, have these defenders of the act which took away from us so large a portion of the circulating medium of our country, and who still use their utmost endeavor to prevent its restoration ---why, I ask, have these bright particular stars in the zodiac of financial wisdom and patriotic worth become so suddenly and earnestly solicitous of the laborer's welfare, in face of the fact that these laborers have not asked for this special favor of their championship, but, on the contrary, are flooding this Congress with petitions and memorials beseeching and advising legislation in the directly opposite direction ? I deny the claim of magnanimity to those who grant a favor that is neither asked for nor desired. The masses of our people know and understand their interests as involved in this issue as fully and intelligently as those who profess to have their welfare so much at heart, but who either willfully or ignorantly fail to take any steps in the material advancement of that welfare.

These masses are willing and content to receive their pay in the restored silver dollar, whether it be in payment of wages or in liquidation of any bonds they may be fortunate enough to hold. Judging of the future by the past they feel and believe that the simple act of remonetization itself will have the effect to wipe out the difference that now exists between the value of silver and gold and place them side by side at par. If this be so, then I ask who can be wronged by the proposed legislation ! Certainly not the public creditors, whether their debts were contracted before or since the legislation of 1873-'74. No respectable authority pretends to urge that the depreciation of silver was brought about by any other cause than its demonetization. And if this be true, the removal of this cause will re-establish it in its former position and again bring it upon a par with gold. This being so, then who can say with any degree of plausibility that the Government will do wrong by paying her debts in that which is on a par with gold ? Those who oppose this popular demand endeavor to clothe it in sectional garb, and with faulty statesmanship attempt to array North against South and the East against the West. If ever a question was free from such characteristics it is this one. It affects no locality particularly, but the entire people, and they to-day, if we understand their voice correctly, have decided the question by an overwhelming majority, which will grow larger day by day.

And that decision is strictly on the side of right and fair and honorable dealing, and no public creditor can have just cause for complaint. That decision involves the violation of no provision or contract, perpetrates no wrong upon any one, but means only the consummation of an act of fair dealing and perfect justice. Everybody admits that when the "act to strengthen the public credit" became a law in 1869, silver constituted a part of the coin in which the bonds were specifically declared to be payable. So, also, when the refunding act of 1870 was passed, it still remained and was a constituent part of the standard coin, in which the new bonds were to be redeemed and their interest paid. The additional truth stares us in the face that this coin disappeared in a quiet, if not a mysterious manner, and that Congress has the undisputed power and full authority to provide for its issue again, and that it will then become as it was before a part of the coin of the country of the same standard value as on July 14, 1870, and that as a consequence the Government can use it in payment of the public debt. Now, I ask, Mr. Speaker, in view of these facts, why should the Government, grieviously burdened as she is by her mountain-high obligations, be expected or required to pay her debts in a currency whose value has thus been artificially enhanced at the cost of the interests of her people ? And how unkind and cruel it is that those of us who are willing and offer and insist upon the strict fulfillment of all the legal and moral obligations involved in the payment of these debts should be denounced as knaves and the advocates of repudiation.

But, sir, these gentlemen will learn in due time that bitter, blatant denunciation is a harmless weapon and that the narrow, uncharitable advocacy of a selfish zealot is of but little benefit to any cause. These questions deserve a higher order of antagonism, and until this is used the people have no fears for the issue. Incased in the triple armor of a just quarrel the advocates of concession to the all but unanimous wish and demand of the people have no question as to the result of the contest, satisfied that right will prevail and justice at last be done to those who have been so fearfully wronged. In the past no single act has been done that has prejudiced the rights of the creditors of this nation, and we promise to be equally consistent in our conduct for the future. No one entertains the most remote thought of repudiation, either directly or indirectly. We simply ask for a fair compliance with the terms of the contract and will be content with nothing less, nor concede anything more. Indisputable figures demonstrate the truth that the bondholders have hitherto been magnanimously dealt with and that with them there should be no cause for complaint against the proposed legislation. Since 1862 the profits to purchasers of our bonds in payment at par in United States coin amount to the enormous sum of $678,551,460 on $2,049,975,700 sold. In Heaven's name, is not this enough ? If to oppose the importunate demands of these moneyed interests for "more" constitutes a communist, then I am one. This is not a question of class or section, but one that concerns the entire people of this great American nation, whose interests should be in harmony and whose aim should be to insure their own welfare without injuring the rights of others.

In this species of communism I keep company with a vast majority of the people in every section and quarter of the country. Plain, hill, valley, and savanna are alike full of those who recognize the truism that the object and aim of legitimate legislation and patriotic statesmanship should be to secure the greatest good to the greatest number. The benefit of this legislation will be felt North and East as well as South and West, and the former sections need the desired relief more if possible than the latter. The only ones who have escaped the wreck of business and fortunes are the holders of our bonds. This fact is admitted by Mr. Belmont in his recent letter to Mr. Hendricks, as will appear from the following extract:

While the investments of the rich have been shrinking, their mills closing, their real estate sunk under mortgages, their railroads defaulting, and our well-to-do merchants and traders breaking down by thousands under falling values on every hand, suffering far more keenly and generally in all eastern cities than any western rural populations can begin to imagine, these millions of wage-receiving, industrious poor who are holders of our national debt have been spared the affliction of seeing their investment tumbling down in the general ruin.

But, Mr. Speaker, before I conclude, I desire to refer briefly to a matter rather of personal than public interest. On Saturday, the 9th of February instant, the gentleman from New York [Mr. Chittenden] took occasion again to enlighten the House and the country with one of his exhaustive, burning, zealous, eloquent appeals in behalf of the single standard, demonstrating the grand truth which I have recognized since I first felt the spell of his God-given gift that in him we have the orator born ---not made--- now a rara avis in terris. He has been the especial champion upon this floor of dear money and the ever-ready apologist for the unreasonable demands of the money power. It is his pleasure in presenting petitions and memorials to this House to tell us how many millions of money are represented therein, that, in his opinion, being a sufficient passport to the highest possible consideration that could be awarded them.

In that remarkable effort the gentleman took occasion to step aside from the consideration of the main subject to pay his respects to the proceedings of conventions recently held in two of the principal cities in the State of Illinois. In the start I beg leave to say to the gentleman, with all due respect for his ability, that the gentlemen who took leading parts in these conventions held in the cities of Bloomington and Chicago are his peers in all that goes to make up a good, devoted, and patriotic citizen. They have at heart the welfare of the country and her people as much as the gentleman can possibly have, and I think are possessed of as intelligent an appreciation of the demands of the situation as he. And judging from the number of petitions that have reached Congress from New York and other eastern States, I believe these men of the West are in closer sympathy with the masses of the East upon this question of currency than many of their Representatives upon this floor. The most determined opposition to this fair and equitable legislation comes from those, Mr. Speaker, whose interest it is to have continued in existence a single legal-tender currency, which has been artificially enhanced in value by unwise legislation. The friends of this legislation are the people of the country. It is in truth the people's measure; but the perverted vision of the gentleman from New York allows him to see as bondholders only the hard-handed working men and women of New York and other States, whose deposits in the savings-banks are to a large extent invested in bonds, the widows, orphans, and unmarried women, whose all is invested in national banks. "These," he says, "are the real bondholders." A simple glance at these statements is sufficient to demonstrate their falsity.

As to the national banks, it is true they are the holders of our bonds and as a consequence we regret to admit are the consistent and persistent opponents of this bill. As to these others to whom the gentleman refers, I have only to say that they are of the people of this land, and, being willing to receive their pay in what was the legal coin of the country at the time of the contract, they are to-day in full sympathy with the people generally in their demands for that relief which they feel can be found in the proposed legislation.

Then, again, the gentleman from New York, [Mr. Chittenden] in a manner characteristic of the illiberal advocates of the money power, took occasion to "stop, ay pause in his magnificent flight," to comment for a moment upon an occurrence which took place in this House on the day preceding. This remarkable occurrence, Mr. Speaker, which arrested the gentleman's attention consisted in my objection to printing in the Record a memorial from the Chamber of Commerce of New York upon the question of the remonetization of silver. He charged that a great wrong had been done by denying this society a privilege to which in his opinion it was especially entitled. In that step I acted solely in the interest of economy, and simply did what had been repeatedly done before and has been done time and anon since, and not through any want of respect or consideration for that society.

But the inordinate zeal of the gentleman, to which his discretion has more than once been made to succumb, most unkindly and falsely attributed my conduct to ignorance of the history of that society and expressed sorrow for the "inexperience and 'un wisdom' of any member who in view of the age and history of that institution could stand up and object to the printing of its petition in the Recordd." In reply I would say to the gentleman that I had some knowledge of that society and of its age and great respectability, but that I considered it entitled to no less nor any more consideration in that respect than the many other associations and individuals whose petitions were refused a similar request, not from any want of respect, but, as was stated, to avoid incumbering the Record as well as to avoid the incurring of an entirely unnecessary expense. While I am willing to accord to this society all that is due it on account of its age and worth in other respects, I cannot award to it that soundness and correctness in its views upon the great question at issue which the gentleman claims in its behalf.

In view of the fact, too, Mr. Speaker, that it has existed so long, and will likely survive for years to come, and in view also of the other fact, that the gentleman himself is one of its most prominent members, it might have been as well to have committed the task of delivering its eulogy to other times and other hands. I further assure the gentleman that I shall honor that society for what it has done in the past, and shall respect it in view of the great expectations we may justly form of it in the future, and while I do this I trust the gentleman may never again so far forget himself as to "stop" in his direct course and turn aside for the purpose of doing injustice to one who did not deserve it in any aspect of the case. If, when I have had the benefit of his age and experience, I am able to practice no more wisdom that he has shown in this instance, I shall feel, Mr. Speaker, that it will be my misfortune to be compelled to look back upon a misimproved past. We are grateful, indeed, to the Chamber of Commerce of New York for all that it did for Chicago in the time of her misfortune. That city has arisen from her ashes and like the golden phœnix will soar to a height which will excite worthy emulation in all the great cities of the land. In her pride and prosperity her good citizens will never cease to hold in grateful recollection those kind friends who came to her relief in the time of her direst need.

The gentleman has attempted to rob the charity of the chamber of commerce of its merit by attempting to lay its recipient under obligations that would involve a sacrifice of conscience as well as principle. He may tauntingly charge "that the scores of millions which his denounced Shylock friends loaned to Chicago have been hopelessly lost and squandered in Quixotic adventures;" but I assure him that a better day is coming, that the pall which now hangs so heavily over city and country alike will be dispelled by the legislation we propose, but which will grow darker and altogether fatal, we fear, if the financial views he advocates become the policy of this nation. His efforts would be fatal to the conversion of Quixotic ventures into grand and glorious realities. But, Mr. Speaker, the people at large and their Representatives here comprehend the problem presented for solution and to-day we know that remonetization is all but an accomplished fact. It is the result, too, of cool and calm deliberation, and not a sentiment peculiar to the West, nor the result entirely of the general distress that now prevails everywhere. The people of all sections and a large majority of their Representatives here favor it as legitimate, right, and proper legislation, which always aims at doing the greatest good to the greatest number. And in this position I believe that each of its supporters upon this floor is acting in strict accordance with his own honest and intelligent convictions and not, as alleged by the gentleman from New York, giving support to this bill through fear of being burned in effigy at home. As for myself, I am with the gentleman on one branch of the financial question, and I know of no power this side of omnipotence that could induce me to vote against my honest, well-founded convictions, and so I believe of every other member of this House. Convinced, then, that the bill under consideration is in the right direction, I give it my most hearty support.

Coinage of Silver Dollars.

The bill (HR 1093) to authorize the free coinage of the standard silver dollar and to restore its legal-tender character.Mr. Hatcher [Robert Anthony Hatcher (1819-1886), New Madrid Missouri, D.; studied law, admitted to the bar]. Mr. Speaker, so much has been said and written about the measure now pending before Congress, "providing for the coinage of standard silver dollars, and restoring the monetary function thereof," that it is almost beyond human ingenuity to advance new ideas and arguments in support thereof, which have not been already stated in some shape or form. But the question in all its bearings is of such vital importance, involving the welfare of the people and the prosperity of this country, that I would be derelict of my duties to my constituents were I to remain silent.

I shall endeavor to treat this subject from a practical point of view, and my remarks shall have the merit of brevity. Not the least of the sad calamities our last civil war entailed upon us was the issue of an irredeemable paper currency. It was a war measure, a necessity which knows no law, a measure which could not be re-enacted in time of peace without amending the Constitution. The paper thus issued was made legal tender, that is, lawful money.

In forming the Constitution the States conferred upon the United States the right "to coin money and regulate the value thereof and of foreign coins." The States reserved to themselves the right to make gold and silver a legal tender for all debts. Gold and silver, then, are our only constitutional money. Silver was the coin of the colonies long before the Constitution itself was adopted. It follows, then, that we cannot demonetize either gold or silver without an amendment to the Constitution. Silver was the time-honored coin of our fathers, and, according to official information, the total amount of silver coined up to 1873 was $169,723,000. Besides, there was in circulation many millions of the Spanish and Mexican dollars, which by law were made a legal tender and which formed no small portion of our currency. Silver was then the standard of value in this and most other countries of both hemispheres.

On the strength and credit of the silver dollar which had gladdened the eyes of past generations prosperity reigned throughout the land. Commerce and industries, with slight intervals, flourished; the farmers secured fair prices for their products. We added twenty-three States to the Union; enlarged our public domain by the acquisition of Louisiana and Florida; we fought the war of 1812 and the Mexican war, and acquired Texas and California and adjacent Territories, in whose bowels are hidden immeasurable treasures of the precious metals. It was, indeed, the era of good feeling and plenty while silver and gold coin were freely circulating with us. We were then a prosperous nation. After the late war between the North and South began, the Government, unable to borrow money at home or abroad, was driven to the necessity to issue its own notes. It declared them a legal tender for all debts, public and private, except duties on imports and interest on the public debt in the shape of United States bonds. These notes, commonly called greenbacks, whether issued illegally or not, must be brought up to their full face value and should be made as good and valuable for every use and purpose of the Government as gold and silver coin.

---[ a) the Lincoln Government could borrow, at 6% as anyone else with good credit; banks in the North were willing to finance Lincoln's war; but Lincoln and Chase had different plansUnder the pernicious policy pursued by three consecutive republican administrations, backed by the moneyed aristocracy of the East, and sustained by congressional republican legislation, the volume of our paper currency was steadily contracted, and the national debt was reduced with a break-neck speed to the utter disregard of an impoverished, tax-ridden people, staggering under the weight of excessive taxation, and while more or less still suffering from the losses sustained by the war. It was done like all class legislation fostered by the republican party, at the expense of the great masses of the people, the producers, for the benefit of the few, the capitalists and bondholders. Our paper currency thus enhanced in value, its purchasing power, of course, was augmented accordingly. Hence the values of land, houses, products of all kinds, wages, and nearly everything marketable shrank and diminished proportionately; and the large debtor class (unfortunately by far the most numerous of our people) find themselves unable to meet the stern demand of an inexorable creditor. And why ? By reason of the joint operation of the contraction of currency and the demonetization of silver, whereby the proceeds of their lands, their products, if offered for sale, yield to-day 50 per cent. less than at the time they became debtors, when the fatal pruning process on our finances had not yet commenced. To be sure, the purchasing power of money has doubled because the amount of our so-called paper money is gradually to be decreased and the functions of silver coin crippled, the former by the so-called resumption act of January 14, 1875, the latter by the infamous demonetization act of 1873. Both these acts proved to be the Pandora box for the American people fraught with untold evils and woes. What the one failed to accomplish the other effectually finished. Both these measures, in my humble judgment, were the portentous guide-post to our present financial prostration, and unless speedily repealed will lead this nation into inevitable ruin.

By way of practical illustration of my statement as to the relation between the debtor classes and the creditors, let us suppose for instance: Roe owes Doe a ba1ance of $3,000 on his farm, which he purchased six years ago. Silver was then as good as gold, nay, from 2 to 3 per cent. better than gold. Roe was then earning $4 a day. Since or by the passage of the resumption act gold was virtually made the standard value; silver cheapened, has been denounced and proscribed until values have fallen and shrunk fully 50 per cent., so that Roe with the same exertions can only make $2 a day. Consequently he must pay Doe just twice as many days' labor for the amount due on his farm as he thought he would have to pay when he bought the farm. Days' wages, as we all know, are measured by money or its equivalent. Gold having become scarce in this country, being almost exclusively in the hands of the speculators and money-changers, its purchasing power has been doubled. Thus $4 in gold pays you for two days labor instead of only one, when Roe bought his farm. And this is the reason why the rich men out of debt ---the creditor classes, foremost of whom are the bondholders--- are opposed to silver. They want to retain the single gold standard, because gold doubles the value of the debts due them. While they profit by the enhancement in the value of money, it lays a burden upon the masses of the people, the laboring-men and the farmers.

Mr. Speaker, silver and gold have been the metallic money from time immemorial, and, as stated before, silver was the money of the colonies and is the money of our Constitution. Silver is emphatically the money of the people, the coin of daily life. The standard value of the silver dollar up to 1873 was 412½ grains troy, and was a full legal tender for all debts, public and private. Like gold, its coinage was unlimited. The relative value of silver and gold, if the silver dollar of 412.5 grains is again coined as contemplated by the pending bill, and the gold dollar remains at 25.8 grains, will be 15.98 parts of standard silver for 1 part of standard gold.

But in France, Italy, Switzerland, and a few other states comprising the Latin union, the relative value is 15½ of silver to 1 of gold. From this it will be seen that we undervalue our own silver nearly one-half grain compared to those states; and yet the silver five-franc piece (which is the unit of value in France) is equal in value to the gold five-franc piece, and there is said to be more gold in France today than in England and Germany together. And again, there is a large excess of silver over gold coins in France. It is true that one of the reasons why silver is at par with gold in France and certain other states, is because they have discontinued to coin silver, save subsidiary coins. But, mark this, suspension of coining silver was ordered not because they have enough or too much of it, but to guard against its depreciation threatened by the sudden influx of silver from Germany. Moreover, it should be borne in mind that said states are possessed of an immense supply of silver coins that we cannot for years acquire. Granted that with our present coinage facilities at the utmost we strike $50,000,000 per year, it will take at least fifteen years for us to acquire an amount equal to theirs at the present time. And if they, with their enormous amount of silver coins in circulation can keep silver at par with gold at the ratio of 15.5 to 1, why cannot we with a very scanty inadequate supply maintain that par at the ratio of 15.98 to 1 ? Gold and silver in bullion, uncoined, are commodities, and like other commodities will fluctuate in value; their value being regulated by the law of supply and demand.

When silver was very scarce in this country and worth more in the market than gold, it was thought that we could not afford to pay in silver. Soon after it happened that Germany, in 1871, demonetized its silver, in consequence of which at least $350,000,000 were thrown out of circulation and offered for sale upon the money-markets of the world. Japan had also demonetized silver, while in some other countries silver coin has been partially expelled from circulation by paper money. Its market value depreciated at once. Now that silver has become more plentiful and we can afford to resume its coinage, we are told that it has been demonetized by Congress.

Let us inquire how this demonetization was brought about; if it was done in a fair, open, and honest way; if it was constitutional. The origin of the attempt to demonetize silver in this country dates back to the passage of the so-called mint or coinage act, approved February 12, 1873. The bill originated in the House, by which the value of the silver of the old standard silver dollar was reduced from 412.5 to 384, because of its excessive value over gold; the Senate, however, instead of reducing the weight of the silver dollar of 412½ grains did, in fact, increase the same to 420 grains.

The way it was done was recently, for the first time, exposed in the halls of the Senate Chamber by Senators Beck and Hereford; and without repeating here their statement, I may be permitted to state briefly that a silver dollar increased by 7.5 grains' weight was substituted for the one issued at that time, which was worth as bullion 3.5 cents more than the gold dollar and 7.5 cents more than two half dollars; in other words, the silver dollar of 412½ grains had a greater intrinsic than nominal value. The new silver dollar of 420 grains was made what was called a trade-dollar.

The bill as originated in the House and thus materially changed in the Senate was put on its final passage without any explanations on the part of those who had charge of the bill, and who must have been cognizant of the changes made. No opportunity for discussion was afforded, and thus it passed toward the last days of an expiring Congress, when measures of doubtful propriety or iniquity have often been pushed through. I had not then the honor of being a member of Congress. How Congress permitted itself to be duped, cable-towed in a measure of such vast importance, remains a mystery in the annals of modern legislation.

It is said, misfortunes never come singly. After the standard silver dollar was banished from our mints, the Revised Statutes took another step toward demonetizing the silver dollar by repealing all acts upon the subject of silver coins and of its legal-tender function. In revising the statutes of the United States it was agreed that no change in any way, so as to alter the sense of existing laws, was to be made. The revisers were not authorized to make any change in the laws, but to preserve the law exactly as it stood. The approval of the two Houses was given to the work upon the assumption that the laws had not been changed, the laws as in force on the 1st day of December, 1873. But behold ! Section 3586 does declare that "the silver coins of the United States shall be legal tender at their nominal value for any amount not exceeding $5 in any one payment." This means the demonetizing of all the silver coins of the United States. Previous to that time we had, strictly speaking, not demonetized the old standard silver dollar. We had discontinued its coinage, and that is all. Even after the act of February 12, 1873, every outstanding silver dollar, and there are still several millions of them in circulation, was a legal tender of all debts, public and private. Can it be that the insertion in the Revised Statutes of a provision altering the existing law was done by mistake or accident ? Or was it done by cupidity, by conspiracy, by fraud ?

I am inclined to believe, Mr. Speaker, that both the act of February 12, 1873, and the wording of section 3586 of the Revised Statutes were accomplished---

By ways that are darkIf it is true, as argued, that gold and silver coin are our only constitutional money, and that we cannot make paper representatives of this coin a legal tender without amending the organic law, is it not bound to follow that we cannot demonetize either gold or silver coin without amending the Constitution ? If the Constitution determines the character of our money, of our coin, we certainly have never demonetized silver, despite the systematic attempts practiced upon a confiding people in the way and manner aforesaid. We have ceased to coin it, that is, of the old standard, and if Congress orders it to be coined again, as we are in duty bound, it will be restored to the old standing and prestige it once enjoyed in the money family. It will then be a full legal tender, not only to the paltry sum of $5, for that would not meet the necessities of the people, but a legal tender to any amount.

The advantages sought to be gained through unjust and unconstitutional legislative enactments for the discontinuance of the coinage of the "dollar of our fathers" and destroying its legal-tender quality were in the interest and for the benefit of the bondholders. It was then known that silver was flowing into this country from the newly discovered mines of Nevada and Colorado, and that the German Empire began to demonetize her silver, whereby a serious decline in the value of silver was likely to take place. It was then apprehended by the far-seeing, keen-scenting bankers and capitalists of Europe, where most of our bonds are held, that the sudden influx of silver in this country would induce us to pay our obligations in coin that would cost us less and was more attainable than gold, and that by a free coinage of silver we might succeed in bringing silver at par with gold; and, moreover, that the value of the American bonds would depreciate.

A prominent Senator, Mr. Jones, from Nevada, whose practical knowledge of the so-called silver question is conceded by all, in a recent interview as published in the National Republican expresses his views as follows:

Silver is not produced in sufficient quantity, and nowhere exists in sufficient quantity, beyond current consumption in the arts and the supply needed for Asia, to be thrown on our markets in sums large enough to threaten injury to our finance, industry, or commerce. During the year 1877, India, Japan, and China received from San Francisco, Southampton, Marseilles, and Venice, in the course of trade, $105,000,000. This is $25,000,000 more than the production of the entire world during the same year.

Which statement, if but approximately true, goes far to prove that the hue and cry raised by these patriotic bondholders of Europe and their allies in Wall street and elsewhere about flooding the country is simply preposterous. Like the Pharisees, they hold up their hands in holy horror and denounce the advocates of constitutional silver coin as repudiators, financial quacks, victims of the silver mania. And why ? Because we propose to pay their bonds, principal and interest, no longer exclusively in gold, which is the money of the rich, the few, but to pay according to the express terms of the contract as provided by law. When the Government at the commencement of the war needed money, it found itself unable to borrow money at home or abroad. It was therefore driven to the necessity of issuing its own notes. These notes by law were made a legal tender for debt, and were not convertible into money. Everybody, poor and rich, had to take them because they were compelled to take them. These United States notes of which there were in circulation upto November 1, 1877, $354,490,000 form a part of our non-interest-bearing debt. Some people exchanged these non-interest-bearing notes for the bonds of the United States because they preferred to have the obligations of the Government, which promised interest as well as principal at a certain fixed period, an inducement the former did not offer. The capitalist who took these bonds became at once the creditor of the United States. He did not pay in gold for them, but paid in greenbacks when it took from $1.30 to $2.80 in paper to buy one gold dollar. What were the conditions of these bonds ? What did we promise to the creditor ? Did we promise to pay in gold ?

Any one before he buys a bond can see for himself what are the terms the conditions of the same, the obligation of the United States. These bonds were issued under various acts of various dates and varied according to the terms of the contract. Prior to 1869 it was held even by leading republicans of Congress that the bonds issued up to that time, with slight exceptions, were payable in lawful money. The late Thaddeus Stevens, the head and front of the republican party of his time, on July 17, l868, indulged in the following vigorous language on that question:

House of Representatives

Friday, July 17, 1868.

The Committee of the Whole resumed the consideration of the funding bill.

Mr. Thaddeus Stevens. I understood the gentleman from Illinois [Mr. Ross] who first spoke upon this subject to say that he understood that our outstanding bonds should be paid according to the principle of the New York platform. What is that platform ?

Mr. Ross. To pay the five-twenties in lawful money.

Mr. Stevens. You mean by "lawful money" ---

Mr. Ross. Greenbacks; that is your doctrine and mine.

Mr. Stevens. I hold to the Chicago platform, and, as I understand it, to the New York platform, upon these bonds; that these bonds shall be paid just according to the original contract.

Mr. Farnsworth. According to the law.

Mr. Stevens. What was that law ? That bonds of a certain amount should bear five per cent. interest in gold. Now, up to the time that they fall due, we must pay them faithfully. After they fall due they are payable in money, just as the gentleman understands "money," just as I understand it, just as we all understood it when we passed the law authorizing that loan; just as it was a dozen times explained upon this floor by the Chairman of the Committee of Ways and Means when called upon by gentlemen to explain what it meant, and just as the whole House agreed that it meant.

I want to say that if this loan was to be paid according to the intimation of the gentleman from Illinois [Mr. Ross]; —if I knew that any party in this country would go for paying in coin that which is payable in money, thus enhancing it one-half, if I knew there was such a platform and such a determination on the part of any party— I would vote on the other side, Frank Blair and all. I would vote for no such swindle upon the taxpayers of this country. I would vote for no such speculation in favor of the large bond-holders — the millionaires who took advantage of our folly in granting them coin payment of interest. And I declare ---well, it is hard to say it--- but if even Frank Blair stood upon the platform paying the bonds according to contract, and the Republican candidates stood upon the platform of paying bloated speculators twice the amount which we agreed to pay them, then I would vote for Frank Blair, even if a worse man than Seymour headed the ticket. That is all I want to say.

To remove all doubts that had existed on that question, the point, as usual, was stretched so far that for the bondholder's benefit the act of March 18, 1869, was passed by which it is declared that "the faith of the United States is solemnly pledged to the payment in coin, or its equivalent, of all obligations of the United States not bearing interest, known as United States notes, and of all the interest-bearing obligations of the United States, except in cases where the law authorizing the issue of any such obligation has expressly provided that the same may be paid in lawful money, or other currency than gold or silver."

This was simply an outrage upon the people. A letter from the present Secretary of the Treasury, addressed to a gentleman in New York [March 20, 1868, to A. Mann, jr., Brooklyn Heights] has been recently brought to light which shows what his views on the payment of Government bonds were in 1868. It cannot be published and read too often. It is as follows:

Dear Sir: I was pleased to receive your letter. My personal interests are the same as yours, but, like you, I do not intend to be influenced by them. My construction of the law is the result of careful examination, and I feel quite sure an impartial court would confirm it, if the case could be tried before a court. I send you my views as fully stated in a speech. Your idea is that we propose to repudiate or violate a promise when we offer to redeem the "principal" in legal-tenders. I think the bondholder violates his promise when he refuses to take the same kind of money he paid for the bonds. If the case is to be tested by the law, I am right; if it is to be tested by Jay Cooke's advertisements, I am wrong. I hate repudiation or anything like it, but we ought not to be deterred from doing what is right by fear of undeserved epithets. If under the law as it stands the holders of the five-twenties can only be paid in gold, then we are repudiators if we propose to pay otherwise. If the bondholder can legally demand only the kind of money he paid, then he is a repudiator and extortioner to demand money more valuable than he gave.Truly yours, John Sherman.

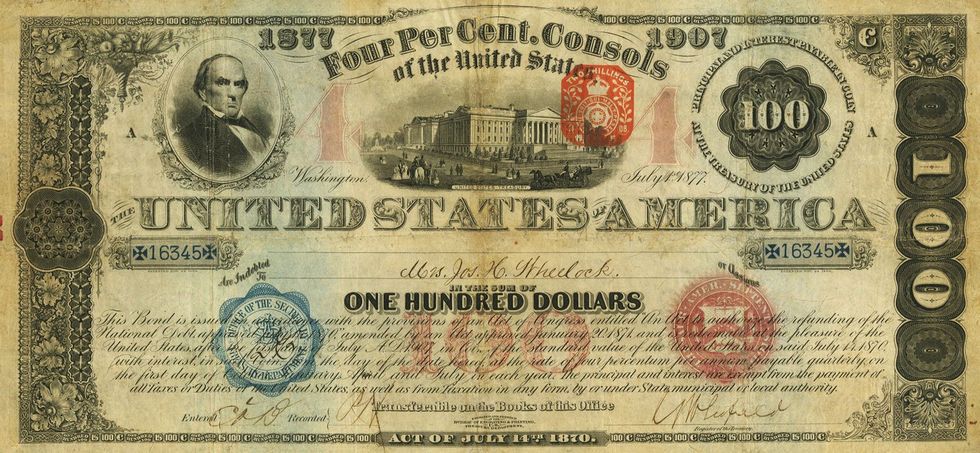

By the act of July 14, 1870, all bonds authorized under it, were payable in coin of the then standard value, not in gold but in "coin," in coin of the then standard value. And according to the last monthly statement of the public debt issued by the Treasury Department there were about $783,000,000 of our bonded debt authorized by the act last cited as amended by a subsequent act of January 20, 1871.

Such then was the contract between the United States and its creditors. Its language is clear and not ambiguous. Both the act of 1869 and 1870 required payment in "coin." And yet they are not happy, those poor creditors. They would, if possible, like to see the word "gold" before "coin" inserted on their bonds, and have them paid in gold coin. If, then, it is lawful to pay in silver coin, why not insist upon it that it should be done ?

Thew whole national legislation for years past has been in the interest of the capitalists and monopolies. A high protective tariff was imposed upon the country in the interest of the few whereby the masses of the people, the producing classes, are indirectly taxed on the most necessary articles of life, as salt, iron, lumber, wool, &c. State banks were taxed out of existence and national banks created, counting at present over twenty-one honored in numbers, and receiving in aggregate a bounty from the United States Treasury of some $20,000,000 per year. Subsidies were granted to grasping corporations, giving them immense tracts of lands, larger in their total area than many of our States combined, and hundreds of millions of money were voted to them out of the pockets of a hard-toiling, debt-ridden people. In short, a system of legalized robbery was inaugurated by which the rich became richer and the poor made poorer.

I have shown how by a series of legislative enactments, including the demonetizing of silver and the specie-resumption act, the nation's creditors and capitalists reaped benefit after benefit, not the least of which I might add here, was the funding of the national debt. They, of all men, have the least right to complain when the public demand that the public debt shall be paid in silver as well as in gold, in accordance with the express terms of the contract.

The distinguished Senator from Kentucky, [Mr. James B. Beck] in his great speech alluded to before, throws such a flood of calcium light on the subject under discussion that I cannot resist the temptation to avail myself, among some other of his arguments, of the statement reproduced by him in that speech. That statement gives a succinct history of all the bonds that were sold each year and the prices that were paid and the interest that was given, and from which it appears that the bondholders up to 1869 had received over $100,000,000 of profit before they even got the principal. Here it is:

In 1862 the Government sold 6 per cent. 5/20 bonds to the amount of $60,982,450, and received for them greenbacks at their face, dollar for dollar. The demand now is that these bonds shall be paid in gold at their face, and yet, owing to the depreciation of greenbacks at the time of their purchase, only $44,030,649 in gold was paid for them. This makes a clear speculation of $16,951,801 in favor of the bondholder in this first transaction. On this clear speculation the bondholders have received interest for eleven years, amounting to $11,187,188, which, added to its principal, makes the sum of $28,138,989 already received in that single transaction, for which not one dollar was ever paid.

In 1863 the Government sold of the same kind of bonds $160,987,550, for which it received an equal amount in greenbacks. A standard authority placed the average price of gold during that year at $1.58 in currency. It will thus be seen that these bonds cost their purchasers but $101,890,854 in gold, leaving a profit of $59,096,696, without including the interest. For ten years, however, the Government has paid interest on this naked profit, this principal, without any consideration. The interest thus paid amounts to $35,458,017, which, added to this fictitious principal, makes $94,555,713, now in the pockets of the bondholders on that year's operation, for which they never paid anything.

In 1864 the Government sold these bonds, amounting on their face to $381,292,250. Again, the Government received only depreciated paper for these bond obligations, and at that time our currency was enormously depreciated, if tried by the gold standard. The price of gold during that year was at an average of 201 in currency. The sale of these bonds, therefore, which are now assumed to be gold bonds, only realized to the Government $189,697,636 in gold, less than one-half of their face value. There was left to the capitalists, who speculated in them as purchasers, the immense profit of $191,594,614. This was the amount of the broker's shave, and on it he has drawn interest from the people for ten years, amounting at this time to $114,956,768. Add this to its principal, which stands as pure speculation, and we find that the bondholders have made as clear gain, as something for nothing, the sum of $306,551,382 on the one year's transaction of 1864.

In 1865 the Government sold bonds to the amount of $279,746,150, on which it suffered a discount of $71,532,060, at the hands of the capitalists. The interest already paid by the people on this discount reaches $38,627,307, making this year's operation realize for the bondholders $110,159,367, for which not one cent was ever paid.

In 1866 the Government sold $124,914,400 of its bonds, for which it received depreciated paper currency amounting to $88,591,773 in gold, according to the then price of gold. The difference between the face of these bonds and the amount they realized to the Government was $36,332,627. Eight years' interest received on this shave amounts to $17,434,556. Adding this interest and its principal together, and we find that the bondholders have received $53,757,183 out of this year's sale of bonds, for which not one dollar ever left their coffers or reached the United States Treasury.

In 1867 the Government sold of its bonds the immense sum of $421,469,550. The purchasers paid for them $303,215,503, leaving a clear profit to them on the operation of $118,254,047. Taking the interest on this profit for seven years, amounting to $49,661,694, already paid, and the speculators have in their pockets, if these bonds are to be paid in gold, the sum of $167,915,741 on this year's brokerage, and for which they never gave a farthing in consideration.

In 1868 the Government sold its bonds to the still further amount of $425,443,800. Their purchasers paid $312,826,323 for them, clearing by that annual speculation the sum of $112,617,477. Add six years' interest on this bonus, amounting to $40,542,288, to the bonus itself, and we find that these traffickers in a nation's perils have received in this operation $153,159,765 of the people's money, for which not the slightest equivalent was ever paid into the United States Treasury.

In addition to the foregoing 6 per cent. bonds, the Government, at different times, during the years mentioned, issued and sold $195,139,550 of bonds bearing 5 per cent. They realized to the Government $122,957,410, thus leaving to the purchasers a net profit of $72,182,140. Interest already paid on this profit amounts to $26,115,724, which, added to the profit itself, makes the sum of $98,297,864 as the amount now in the pockets of the bondholders growing out of their operations in the 5 per cent. bonds, and for which there is not the slightest consideration.

An account of the bondholders' clear profits arising from no investments at all, may therefore be stated in the following tabular form:

1862 ........................... $28,138,989

---Wednesday, February 17, 1875, page 1403. Senator Beck was quoting from a campaign speech of Senator Wolsey Voorhees

1863 .............................. 94,555,713

1864 ............................... 306,551,582

1865 .............................. 110,159,367

1866 ................................. 53,757,183

1867 .................................... 167,915,741

1868 .................................... 153,159,765

On account of 5 percent. bonds ............................................... 98,297,864

Total .......................................... 1,012,536,004.

This statement, Mr. Beck assures us, was carefully and truthfully prepared. It needs no comment. To be sure, sir, the bondholders have no right to complain of any unfair treatment, or of derogation of their rights as public creditors, or of any violation of the public faith.

Suppose, Mr. Speaker, new gold mines, "bonanzas" yielding immense quantities of that precious metal, should be discovered in this country, or in Africa, or Australia, and in consequence thereof gold should become far more plentiful than silver is now, and the value of gold should depreciate so as to render silver more valuable, the bondholders would no longer be content with the payment of gold; they would then insist on being paid in silver coin.