45th Congress, 2nd Session

Birchard Hayes, President by vote-fraud

Almon Wheeler, vice-president

John Sherman, Secretary of the Treasury

Remonetization and Free Coinage of Silver.

Mr. Bright [John Morgan Bright (January 20, 1817 -- October 2, 1911) Fayetteville Tennessee, D (1871-1881); studied law, admitted to the bar]. Mr. Speaker, I propose to offer some remarks upon the subject of the remonetization and free coinage of the silver dollar and the legal tender thereof. I do not propose to indulge in the platitudes and the clap-trap of financial theorists, because the question is too intensely practical to justify any one in attempting to allay or mislead the minds of the country with such philosophical disquisitions. The question is so vitally practical that it pushes its fibers into every man's pocket and sends its roots into all the channels of industry.

I feel deeply interested in this measure. I believe I can say without vanity that I was the first person to call the attention of this body and of the country, in January, 1875, to the remonetization of the silver dollar. I followed it up in the Forty-fourth Congress and pressed it with zeal upon the attention of the democratic party and of this House. I am here to-day to follow it up with equal zeal, and to press it still further upon the consideration of this body and of the country.

---[ You didn't actually say anything during the debates of the resumption bill, you merely had your remarks inserted into the Appendix to the Congressional Record two weeks after the act was already approved by President Grant. No one heard it then, has anyone read it since ?]Mr. Speaker, it is very proper to know what is the gist of the question before the country. The question is not whether we shall have a bimetallic currency; that question has been settled by the Constitution of our country. It is no longer an open question, being imbedded in the Constitution, the organic law of the country. Why, sir, it is idle for us to consume the time of this body and that of the country in such a discussion. Beyond question the right was reserved to the States to make gold and silver a legal tender. In consideration of that reserved power to the States, the power was conferred by the States on the General Government to coin money and to regulate the value of foreign coins, clearly showing that the General Government had assumed the obligation of domestic coinage, and also guaranteed the inflow of foreign coins. By these provisions the people supposed that they would be secure in all their money facilities.

In addition to that, Mr. Speaker, the important question arises out of these constitutional provisions, that the people as well as the States should have the power to make gold or silver a legal tender in the solution of the debts of the States and in solution of the debts of private individuals. What was to be the extent of this tender ? It was to be commensurate with the wants either of the States or of the individuals; and if such right existed I should like to know why it is that the question is agitated now and the right arrogated under the Constitution of the United States to demonetize silver at the expense of the Constitution and the rights of the people ?

Sir, it is not an open question; it is a question settled; and whenever the Congress of the United States attempts to disturb that well-settled principle it overleaps the barriers of the Constitution and runs riot over the rights of the people and the States. I am supported in this. Here is the argument of Mr. Thomas H. Benton, who was considered the father of the hard-money doctrine and called "Old Bullion." If gentlemen are interested enough in the question here is his argument, and I shall only read a paragraph from it. I read from volume 1, page 444 of his Thirty Years' View:

Mr. Benton believed that it was the intention and declared meaning of the constitution, that foreign coins should pass currently as money, and at their full value, within the United States; that it was the duty of Congress to promote the circulation of these coins by giving them their full value; that this was the design of the States in conferring upon Congress the exclusive power of regulating the value of these coins; that all the laws of Congress for preventing the circulation of foreign coins, and underrating their value, were so many breaches of the constitution, and so many mischiefs inflicted upon the States; and that it was the bounden duty of Congress to repeal all such laws; and to restore foreign coins to the same free and favored circulation which they possessed when the federal constitution was adopted.

If the fact be so, Mr. Speaker, I come to the important question and announce that the demonetization of the silver dollar was a breach of the Constitution, that it was destructive of the rights of the States, that it was an invasion of the rights of the people, that it was striking down one of the elements of legal tender for the solution of contracts in the United States. I, sir, stand here and propose to meet the question precisely as it is. I say, sir, that the demonetization of the silver dollar was a fraud upon the people of the United States by depriving them of one of their constitutional coins; that it was a fraud on the General and State Governments by lopping off one of their financial arms; that it was a fraud on the legislation of the country by an undue advantage in cutting off legislative consideration; that it was a fraud on the President of the United States, from whom the fraud was concealed by the artful phraseology of the law, as shown by his Cowdry letter; that it was a fraud on the mining resources of the country by depreciating the value of our vast silver mines; that it was a fraud on posterity by an attempt to double the value of the public debt which goes to them by inheritance.

I happened to be a member of Congress at the time of the passage of that bill. Its passage is not susceptible of vindication, notwithstanding the puerile apologies in its behalf. It was passed by fraud in the House, never having been printed in advance, being a substitute for the printed bill; never having been read at the Clerks desk, the reading having been dispensed with by an impression that the bill made no material alteration in the coinage laws; it was passed without discussion, debate being cut off by operation of the previous question. It was passed to my certain information under such circumstances that the fraud escaped the attention of some of the most watchful as well as the ablest statesmen in Congress at the time. It was passed near the closing days of the session, when in the bustle and precipitate rush of business it was most favorable for the concealment of fraud. It was passed without previous discussion or agitation before the people and without having been voted upon by the people. Ay, sir, it was a fraud that "smells to heaven." It was a fraud that will stink in the nose of posterity and for which some persons must give account in the day of retribution, and God grant "that no guilty man may escape !"

I state furthermore, Mr. Speaker, that the attempt to hold the fraudulent advantage which has been secured by that legislation is indefensible, in my opinion, upon any principle of either law or morality.

But, sir, we will notice now an apology or two for the passage of this act. We are told, sir, that under the law of 1834 gold was overvalued and forced silver out of the country. Then, sir, if gold had been overvalued it ought to have been reduced in value by appropriate legislation which would bring it to the equation of silver so that both metals should harmonize as a currency in the country without resorting to the unphilosophic, unconstitutional mode of banishing the unoffending metal from the country. The error of the former legislating ought to have been corrected. To show the evils of that legislation I call the attention of the House to an extract from Mr. Seyd's valuable work on Metallic Currency in America:

The American silver coinage was always liable to exportation, for the simple reason that it contained an undue proportion of silver. In all countries where the double valuation prevails, the relative proportion of value between gold and silver stands at 1 to 15½, and the market value of silver in countries where it is not a standard give on the average the same result. In the United States alone the rate taken was 1 part of gold to 16 of silver, (15,988.37,) the proportion resulting from the Eagle at 258 and the silver dollar at 412½ grains. The dollar, therefore, contained 3.29 per cent. more silver than it ought to have contained according to its nominal value. No wonder, then, that the dollar was rapidly exported and that no one found inducement to bring silver to the mints for coinage. And let it be understood that the supply of gold had little or nothing to do with this. Long before the discovery of gold in California, ever since 1837, has the effect of this premium on the United States silver dollar made itself manifest. In exchange for it the foreigner need not have supplied gold; other commodities served the purpose of realizing elsewhere the large profit which the United States gave to the exporter of her silver coin. Much that has been doubtful, peculiar, and unsatisfactory in the history of the United States currency between 1837 and 1850 owes its origin to this astounding mistake on the part of the Government, which must, as every one can see, have given rise to general disorganization of the currency and to disappointment in the capacity of the country to retain metallic currency. I go farther and say that it was the cause why America was obliged to make so large a use of paper money, with all its evils of unequal interests, extravagant habits and expenditure. ---Seyd on Metallic Currency, pages 52, 53.

In addition to that, Mr. Speaker, they tell us that the old dollar was dead. Dead ! Why, Mr. Speaker, if dead, it needed no enactment. But if it was not for the time needed, the dormant right to it remained in the Constitution, as many dormant powers remain there to be called up and exercised as occasion may demand; therefore the argument is without reason, and I shall proceed to notice another. If it was dead then I suppose they enacted that it should be buried, and the funeral ceremonies were performed here under the act of 1873, which was the winding-sheet of the old silver dollar --the old dollar of the fathers, with all its historic memories. Sir, they bore it away as in the case of a burial of old under circumstances which are familiar to every one:

Not a drum was heard, not a funeral note, As his corpse to the rampart we hurried.

We carved not a line, and we raised not a stone, But left him alone with his glory.

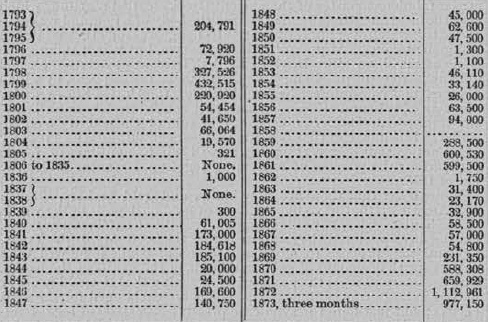

But, Mr. Speaker, it ought to have been sufficient for those who were apologizing for the demonetization of the old silver dollar to have told the truth about the old veteran that had stood and battled with all the financial storms of the Government from 1792 down to 1873. Investigation shows it was not dead, but that it was alive. From the report of the Director of the Mint in 1876, pages 33 and 34, it appears --and I have the table here-- that for the last two years before its demonetization there was more of the old silver dollar coined at the American Mint than in any five years before that time. Here is the evidence:

The following statement shows the silver dollars coined in the United States from 1792 till 1873; and that in 1872 and 1873 more silver dollars were coined at the United States Mint than in any five years from the commencement of the Government. It will be seen, then, that these reasons assigned for the demonetization of the silver dollar are pure fabrications.

The true reason, Mr. Speaker, was to be found in another fact. Germany was attempting the demonetization of her silver. She thought she was becoming affluent in gold by reason of the Franco-German indemnity, and commenced the project; and it was supposed that the apprehended engorgement of America with silver might result in the depreciation of the American bonds. Hence we find the movement commences abroad and reaches to this country, and we have the foreign bondholder uniting with the American bondholder and beseeching the Congress of the United States in a clandestine manner; and the project for the solution of the difficulty was in the demonetization of the silver dollar, because the bonds were payable in that coin. That would make gold higher and would make silver cheaper; it would make our bonds, if they succeeded in the demonetization of the silver dollar, 1.20 to 1 of the face value of the bond. The American statesman sees the bondholder sitting "like a pale Mammon" amid his boxes of gold and bonds; he listens to his siren song of national honor and his heart melts and the boon is granted, and the old silver dollar is buried out of sight for the time, and the people, the hard-handed people, upon whose broad backs all the industries of this country rest for their prosperity, get only the copper and the nickel and the subsidiary silver coins 7 per cent. light ! Unparalleled American smartness !

Now, Mr. Speaker, I propose to offer some reasons why the silver dollar should be recoined. In the first place, the obligations of the Constitution require that it should be remonetized.

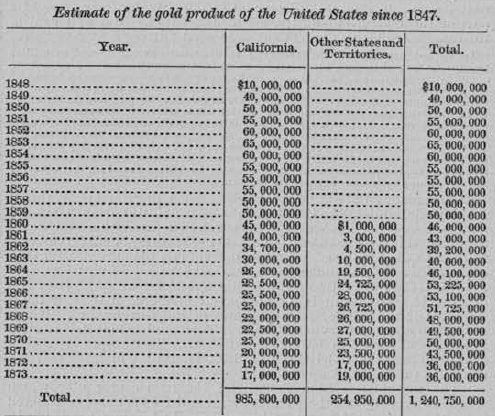

Second. It is needed for general circulation to pay the debts, the taxes, and the judgments which may be rendered against private individuals. California, we are told, can consume and utilize $100,000,000 herself.

Third. It is needed by the States for revenues to pay their bonds and other debts. The General Government has taxed State banks out of existence, expelled foreign coins, and deprived the States of facilities which they had from the foundation of the Government in the discharge of their obligations. Hence it is right that we see that this currency is restored to them.

Fourth. It is needed by the banks for reserves, for deposits, and for a ballast against inflation, and for specie resumption if they ever reach that point.

Fifth. It is needed for foreign trade with Mexico, South America, Canada, China, and all the other specie-using nations of the globe, forming two-thirds of the population of the globe.

Sixth. It is needed to utilize our vast silver mines, to employ our mining labor, and to turn the silver streams into the channels of trade. It is needed for the encouragement of our languishing industries and the employment of our starving laborers.

Seventh. It is needed for national revenues, and to pay the national debt according to contract.

The act of 1869 provides "for the payment in coin or its equivalent" of the notes, "and of all the interest-bearing obligations of the United States, except in cases where the law authorizing the issue of any such obligations has expressly provided that the same may be paid in lawful money or other currency than gold and silver."

Here the law defines that the word "coin" as used means "gold and silver."

The act of 1870 provides that the bonds issued under it shall be payable in coin, at its (then) standard value. Both gold and silver had their legal standard value at the time, and the coin mentioned could have referred only to the legal standard coins of the United States, gold and silver.

Then if it be lawful to pay in silver, there is no reason why it should not be done, though it were as plenty "as the stones in the street." And it would be unjust to a distressed people to throw away the poor advantage of paying the public debt in silver as well as gold. Mr. Seyd, in his excellent treatise on Metallic Currency in the United States, page 55, says:

I am convinced that if America again introduced the free coinage of silver she would be enabled to retain many millions per annum, would be able to resume specie payments, and pay off her national debt much sooner.

It is needed, in the eighth place, for the resumption of specie payments, as General Grant said, to aid in paving the way to it, and he was right for once. He was in favor of hoarding three or four hundred millions of dollars by the people, and the people must always have coin to sustain the solid specie payments of the country as I will demonstrate in another connection.

Ninth. I propose to show that resumption, in its proper sense, is impossible in gold in the United States. Mr. Speaker, what are the requisites of specie resumption for a nation ? I apprehend there is much disagreement upon this point; I apprehend that there is much misunderstanding upon this subject. Now, sir, what is the rule ? but before I enter upon the rule, I will make a statement with reference to the amount of outstanding currency and obligations that have to be met in order to put the country on what might be called a solid specie basis.

The attention of the House is respectfully invited to a few figures:

National-bank notes in circulation November 1, 1877, as per report Comptroller Currency ..... $315,881,990

United States notes, same date ...................... 354,490,892

Deposits in national banks, same date .............. 691,900,000

Deposits in State and saving-banks .......... 1,377,520,000

Total .............. 2,719,792,882.

These large figures confront us in our road to resumption. Now, Mr. Speaker, the point to which I wish to call the attention of this body particularly is this, that the rule of resumption, as has been supposed by many and as has been adopted by the United States, should be considered as 3 to 1; but, according to Amasa Walker, the rule in fact has been an average of about 4 to 1 and even greater in the United States. But this rule of 3 to 1 has been supposed only to apply to the circulation of the banks of the United States. It is borrowed or pretended to be borrowed from the English rule upon the subject. I propose to call the attention of the House to the English rule so that America as she has been indulging her imitative faculty will be disposed to give due consideration to the English rule which has been made imperative by statute as to specie payments. I call the attention of the House to the work of Mr. Benton, volume 2, pages 128, 129, who explains and quotes the English rule. Here is the rule:

[From Benton's Thirty Years' View]This is a point of great moment --one on which the public mind has not been sufficiently awakened in this country, though well understood and duly valued in England. The charters of banks in the United States are usually drawn on this principle, that a certain proportion of the capital, and sometimes the whole of if, shall be paid up in gold or Silver before the charter shall take effect. This is the usual provision, without any obligation on the bank to retain any part of this specie after it gets into operation; and this provision has too often proved to be illusory and deceptive. In many cases the banks have borrowed the requisite amount for a day and then returned it; in many other cases the proportion of specie, though paid up in good faith, is immediately lent out or parted with. The result to the public is about the same in both cases; the bank has little or no specie and its place is supplied by the notes of other banks. The great vice of the banking system of tbe United States is in banking upon paper, upon the paper of each other, and treating this paper as cash. This may be safe among the banks themselves; it may enable them to settle with one another and to liquidate reciprocal balances; but to the public it is nothing. In the event of a run upon a bank or a general run upon all banks, it is specie and not paper that is wanted. It is specie and not paper which the public want and must have.

The true proportion is one-third, and this to apply to all the circulation and deposits, except those which are special. This proportion has been fixed for a hundred years at the Bank of England; and just so often as that bank has fallen below this proportion, mischief has occurred. This is the sworn opinion of the present governor of the Bank of England and of the directors of that institution. Before Lord Althorpe's committee in 1812, Mr. Horsley Palmer, the governor of the bank, testified in these words:

"The average proportion, as already observed, of coin and bullion, which the bank thinks it prudent to keep on hand, is at the rate of a third of the total amount of all her liabilities, including deposits as well as issues."

Mr. George Ward Norman, a director of the bank, states the same thing in a different form of words. He says:

"For a full state of the circulation and the deposits, say twenty-one millions of notes and six millions of deposits, making in the whole twenty-seven millions of liabilities, the proper sum in coin and bullion for the bank to retain is nine millions. Thus, the average proportion of one-third between the specie on hand and the circulation and deposits must be considered as an established principle at that bank, which is quite the largest and among the oldest --probably the very oldest bank of circulation in the world."

The Bank of England is not merely required to keep on hand, in bullion, the one-third of its immediate liabilities; it is bound also to let the country see that it has or has not that proportion on hand. By an act of the third year of William IV, it is required to make quarterly publications of the average of the weekly liabilities of the bank, that the public may see whenever it descends below the point of safety. Here is the last of these publications, which is a full exemplification of the rule and the policy which now govern that bank:

"Quarterly average of the weekly liabilities and assets of the Bank of England from the 12th December, 1837, to the 6th of March, 1838, both inclusive, published pursuant to the act 3 William IV, cap. 98."

Liabilities:

Circulation .............. £18,600,000

Deposits .................. 11,535,000

30,135,000

Assets:

Securities .................... 22,792,900

Bullion ................ 10,015,000

32,807,900The proportion in England is one-third. The bank relies upon its debts and other resources for the other two-thirds in the event of a run upon it.

So you find, Mr. Speaker, that the role adopted by the Bank of England, or rather under the act of Parliament, was that one-third of the liability in coin and bullion should always be in the bank, and that when a run was made on the bank by the time it had exhausted that one-third it could, from its loans, collect the two-thirds remainder in coin from the country, so that it might be prepared to pay off all its liabilities to every individual who had a claim against the bank. That is the rule, and I propose now to apply that rule to the currency of the United States and the currency and deposits of the banks, to see whether we can compass the much-coveted object of specie resumption, as it is called.

Now, sir, what are the facts as to the amount necessary to start the resumption machinery ? Let us see. Here are the outstanding United States Treasury notes in full, amounting to $354,490,892; one-third of the circulation of the national banks, $101,960,663; one-third of the deposits of the national banks, $230,633,000; one-third of the State and savings-banks deposits, $455,560,666; to pay the annual interest and sinking fund, $130,000,000; making $1,272,645,554, that is, to pay the outstanding Treasury notes of the United States in full and to pay one-third of the liabilities of banks, national and State. But it does not stop there, Mr. Speaker; but suppose by the English rule that the people hold two-thirds of the bank circulation and deposits in gold which may be collected from loans while paying out one-third while a run is made on these institutions. Then the people in the United States, to support the Government and banks, ought to have in circulation two-thirds of the bank circulation, deposits, and annual interest on the bonds and sinking fund in gold, which would make in the hands of the people $1,656,877,992. Add to that $1,272,645,554, which is supposed to be held by the banks, and you have the grand total of $2,929,523,546 required to put the United States upon the specie basis of the English government.

France has $1,200,000,000 of metal in her banks and in the country, and $520,000,000 of currency besides her deposits. Yet she cannot venture to become specie-paying without detriment to herself. Instead of resumption on the 1st of January,1878, as contemplated, she has instead recently issued $50,000,000 more paper currency. Germany has $300,000,000 of gold, and she is making an effort to get to a gold specie basis. But the coveted goal is far before her.

Let us apply the facts and see how far the United States is from this specie resumption, as it is called. According to the report of the Director of the Mint, we have in coin and bullion in this country $185,000,000 of gold. Understand that the proposition is to resume. Of this amount of gold the Government holds $32,595,000 and the banks hold $5,000,000; so that the Government and the banks are far behind.

Now let us take this $185,000,000 and subtract it from $2,929,000,000, and we still have $2,744,000,000 to be provided in gold to enable us to reach the English specie basis. Whence is this to come ? The Director of the Mint, in his report for 1874, page 20, uses the following language. Will gentlemen now give me their attention ? I am using the argument and testimony of an adversary. Let us see what he says upon the subject of gold supply in the world and in the United States. Here is his language:

[From Report of the Director of the Mint, June 30, 1874, page 20.]

The opinion has often been advanced that the large amount of gold yielded by the mines of the United States and Australia has produced an engorgement in the markets of the world. That such was the effect during the first five years after these mines were opened and during which time the maximum production was reached, and that a general advance in prices followed, may be safely admitted; but the undeniable fact that leading countries, like the United States, Russia, Austria, France and Italy, are compelled to use inconvertible paper-money, not from choice, but because they have not sufficient coin for a specie basis, would appear to show conclusively that there is not too much gold, and especially as no one country appears to possess a redundancy. This fact, and particularly when it is considered that the annual production of gold is gradually decreasing, should dispel any fears which may be entertained of its future decline in value relatively to land, labor, and commodities.

That is the testimony of a witness who is a gold bullionist, a man who is in favor of the demonetization of the silver dollar. We find, therefore, that there is no engorgement of gold, no redundancy of gold in Europe or America, and gold is on the decrease. The United States, Russia, Austria, France, and Italy are compelled to use inconvertible money for the want of gold. Then, what is the conclusion of the argument ?

Where will you go in quest of your gold ? Will you go to Europe ? The countries there are in a scramble for it; it is not there. Will you go to your own mines ? From them the flow of gold, like the fabled stream of Pactolus, flows only to bear the golden treasure to other shores, leaving but a little sediment in your own country as it flows through.

An effort was made to introduce the gold standard into India; but Mr. Bagehot, an English writer and a gold bullionist, argued that it was impolitic and impossible.

Our Government has found it impossible to introduce foreign gold into our country through the powerful medium of our national bonds with their large rate of interest. If anything can attract the gold from Europe it is the American bond. It is not to be introduced through the skill and management of the syndicate. But what is this syndicate ? It is part English and part American --might be styled a compound of the British lion and the American eagle. Its prototype was a fabulous monster of the ancient Greeks, called a griffin, which had the head and wings of an eagle and the body of a lion, and was supposed to "watch over mines of gold." Its image was sometimes stamped on ancient coins. At present it is not active, but it is watching the issue of the silver bill. In plain English it is an association formed for the purpose of practicing a feat in financial hocus-pocus, by which they extract coin-interest-bearing bonds of the United States, under the acts of 1870 and 1875, in exchange for non-interest-bearing Treasury notes, without increasing the gold coin of the country a single dollar. But how can that be done ? The Secretary of the Treasury gives notice that on a certain day he will sell five millions of bonds for gold for the purpose of redeeming legal-tender notes under the act of 1875.

We will say that there are fifty banks and gold brokers, English and American, that have five millions of gold on deposit in the vaults of the banks. They have also hoarded five millions of Treasury notes. On the day appointed they appear before the Secretary of the Treasury and they propose to buy five millions of bonds if he will take checks for that amount of gold on deposit in the vaults of the banks. The Secretary accepts the proposition, knowing that the gold is never moved in large transactions. The bonds are exchanged for the gold checks; but just here the syndicate presents $5,000,000 of legal-tenders for redemption, and the Secretary exchanges the gold checks for the legal tenders. The result of the transaction is the syndicate has the interest-bearing bonds and the gold unmoved in the vaults of the banks; the Secretary has the legal-tenders, which are carried to the destruction account and burned up; the people have lost their money from circulation and have gained a new burden in the interest on the bonds.

The syndicate only repeats the process at as many calls as the Secretary may choose to make. The gold remains in the banks, the syndicate holds the interest-bearing bonds, and the legal-tenders are absorbed, and so the process is continued until the whole legal-tenders of the United States are "wiped out," and $5,000,000 have done the whole work.

Well, Mr. Speaker, will the House permit me to tell a little anecdote in illustration of this matter, which is said to have occurred to a western forester, a man of celebrity in his day, the well-known Colonel Davy Crockett. Silence gives consent, and I will tell it. He went on one occasion, with a number of his jolly friends, to a grocery. He had a single coon-skin, which was currency in that day, with which he wished to buy a quart of whisky. He laid his coon-skin on the counter and got his whisky. He asked what he should do with it, and was told to throw it into the loft, which he did. After they drank their whisky, the colonel went around and twisted the coonskin out of the loft with his ramrod, and, bringing it back to the counter, bought another quart of whisky. The coon-skin was again thrown into the loft and again the colonel twisted it out and again he brought it back and bought another quart of whisky. So he repeated the process and they drank whisky the whole day upon a single coon-skin, just as the syndicate are consuming the legal-tenders of the United States with the sum of $5,000,000 of gold which remains in the vaults of the banks. [Laughter.] But, Mr. Speaker, I have not time to dwell longer on that subject to-day.

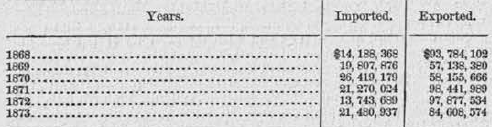

Again, the gold cannot be introduced through our commerce. There is a reported gold balance against us of $15,000,000, and to this should be added the carrying trade of the United States, which paid to foreign vessels, according to Mr. Grosvenor, $60,000,000, and, according to the same authority, for smuggling, $50,000,000, making the true balance of currency against the United States $125,000,000.

Now, Mr. Speaker, while all Europe is in a scramble for gold, I inquire, whence is it to come, to put this country upon a specie basis ? All the orifices are open for outflow from the United States, through interest upon our bonds held abroad, through interest upon State bonds, and through the private indebtedness of our people. And, sir, Mr. McCulloch, in 1866, thought be could reach it in 1869. He pursued the golden phantom. So with Mr. Richardson, so with Mr. Boutwell, and so with Mr. Bristow. All pursued the phantom, and failed in the effort.

Now, to change the figure, the present Secretary of the Treasury takes it up, and is going to force the camel through the eye of the needle, though he may crush every bone in the body-politic. No, Mr. Speaker, we will need all our mountains, both of gold and silver, to pay the interest upon our bonded debt, to pay the debt itself, and to furnish a coin-currency for the people. Therefore resumption is impossible in gold. It will take ages to recover us from the Serbonian bog into which we have marched and to reach the solid-road through a specie basis for our country. The little we collect of gold as it percolates from our foreign commerce, the little sediment left from the outflow of our mines, will never furnish us with that metal while the continent stands, unless there is some other resource.

Mr. Speaker, our country is in distress and staggering under the burden of its public debt. If we look for relief by payment in gold, the debt will cling to us like the curse to the wandering Jew. While Germany and the Scandinavian states are demonetizing silver and our silver mines are unmeasured in their resources, now is our opportunity. Now is the time to take the tide at the flood which "leads on to fortune." If the occasion is lost, I here leave it on record for the eye of posterity that our public debt will not be paid in gold in the next half century.

We are told, Mr. Speaker, that we ought not to remonetize the silver dollar, because it is too fluctuating in value. That argument has often been made before; but is it truthful ? I maintain that it is not, and I am supported in my judgment by the facts of history. I have an extract from Mr. Benton's speech, who gave the history of currency in 1837 when it was under discussion. They arrayed all the facts from the time of the Roman emperors down to the present time, and it resolved itself into the practical question, as he states in the extract --which I will not read but will furnish-- that the silver dollar maintained its relation to gold for over three hundred years in silver countries, in Mexico, Spain, and South America. [From Benton's Thirty Years' View]

Revival of the Gold Currency

A measure of relief was now at hand before which the machinery of distress was to balk and cease its long and cruel labors; it was the passage of the bill for equalizing the value of gold and silver and legalizing the tender of foreign coins of both metals. The bills were brought foreward in the House by Mr. Campbell P. White of New-York, and passed after an animated contest, in which the chief question was as to the true relative value of the two metals, varied by some into a preference for national bank paper. Fifteen and five-eighths to one was the ratio of nearly all who seemed best calculated, from their pursuits, to understand the subject. The thick array of speakers was on that side; and the eighteen banks of the city of New-York, with Mr. Gallatin at their head, favored that proportion. The difficulty of adjusting this value so that neither metal should expel the other had been the stumbling block for a great many years; and now this difficulty seemed to be as formidable as ever. Refined calculations were gone into, scientific light was sought, history was rummaged back to the times of the Roman empire, and there seemed to be no way of getting to a concord of opinion either from the lights of science, the voice of history, or the result of calculations. The author of this View had (in his speeches on the subject) taken up the question in a practical point of view, regardless of history, and calculations, and the opinions of bank officers, and, looking to the actual and equal circulation of the two metals in different countries, he saw that this equality and actuality of circulation had existed for above three hundred years in the Spanish dominions of Mexico and South America, where the proportion was 16 to 1. Taking his stand upon this single fact as the practical test which solved the question, all the real friends of the gold currency soon rallied to it. .....

The good effects of the bill were immediately seen. Gold began to flow into the country through all the channels of commerce; old chests gave up their hoards; the mint was busy, and in a few months, and as if by magic, a currency banished from the country for thirty years overspread the land and gave joy and confidence to all the pursuits of industry. But this joy was not universal. A large interest connected with the Bank of the United States, and its subsidiary and subaltern institutions, and the whole paper system, vehemently opposed it; and spared neither pains nor expense to check its circulation, and to bring odium upon its supporters. People were alarmed with counterfeits. Gilt counters were exhibited in the markets, to alarm the ignorant. The coin itself was burlesqued, in mock imitations of brass or copper, with grotesque figures, and ludicrous inscriptions --the "whole hog" and the "better currency," being the favorite devices. Many newspapers expended their daily wit in its stale depreciation. The most exalted of the paper-money party, would recoil a step when it was offered to them, and beg for paper. The name of "Gold humbug" was fastened upon the person supposed to have been chiefly instrumental in bringing the derided coin into existence; and he, not to be abashed, made its eulogy a standing theme --vaunting its excellence, boasting its coming abundance, to spread over the land, flow up the Mississippi, shine through the interstices of the long silken purse, and to be locked up safely in the farmer's trusty oaken chest. For a year there was a real war of the paper against gold. But there was something that was an overmatch for the arts, or power, of the paper system in this particular, and which needed no persuasions to guide it when it had its choice: it was the instinctive feeling of the masses ! which told them that money which would jingle in the pocket was the right money for them --that hard money was the right money for hard hands-- that gold was the true currency for every man that had any thing true to give for it, either in labor or property; and upon these instinctive feelings gold became the avidious demand of the vast operative and producing classes.

But I do not stop there, Mr. Speaker. We have the testimony furnished by the Director of the Mint from his own tables and in a statement here compiled in decades, showing that the general average for the one hundred and fourteen years from 1760 to 1873 is 15.18; being 15 and nearly one-fifth instead of the present standard which we have adopted, the ratio of 1 to 16. During the above period the ratio of the highest monthly average in the United States was 1 to 15, in July, 1859, at which rate a silver dollar of 412½ grains was worth 1.05 in gold

During this period there were but three years in which the ratio fell below 1 to 16; in 1809, when it was 16.25; in 1810, 16.15 and in 1815, at the close of the British war, when it was 16.30. The ratio for the lowest monthly average in July, 1876, after it was demonetized, was 1 to 19.19, at which rate the dollar was worth 83 cents.

Thus, Mr. Speaker, you find from Mr. Benton and the testimony of the Director of the Mint that we have shown by unquestioned authority that silver has maintained its uniform relation to gold for four hundred years; and having maintained this relation, the charge is untrue that it is too variable in its value. Then, sir, if that argument be answered, why the main argument is taken away from them. Besides all that, Mr. Speaker, its value did not fall until it was demonetized. It did not cease to be coin until it was demonetized and until the prohibition was made by the Government itself. It was a direct assassination by national legislation, instigated by the conspiracy of European bondholders. So, then, this was only an apparent depreciation of it, superinduced by the means I have indicated.

Another objection is that if remonetized it should be made of equal value to gold. Why, Mr. Speaker, I answer that the parties who aided in the demonetization are estopped from interposing an argument of that description. They will not be permitted to take advantage of their own wrong. But the true answer is: Whenever it is remonetized, when the work which they undid is restored, it will be restored to the equation with gold itself. Ay, sir, the value was fixed in 1792 at 371¼ grains of fine silver, and it was made only 3.5 grains light in the alloy in 1837. It has not only held its own, but was worth 5 per cent. in 1860. Even the ¼ per cent. of fine silver that was added to it in 1792 withstood all the financial vicissitudes and storms down to 1873.

It was too fine to stay in the country. Our average was about 16 to 1. In other countries the average was 15.5 to 1, ours being 3.5 per cent. more according to Mr. Seyd, to whose statement of this point I call the attention of the House as giving the true reason why American silver in part had left the country.

[Here the hammer fell.]

The Speaker pro tempore. The gentleman's hour has expired.

Mr. Ewing. I ask unanimous consent that the time of the gentleman be extended.

Mr. Deering. For how long ?

Mr. Bright. I would rather not be limited, because I would thereby be forced out of the channel in which I am following out my line of thought.

Mr. Deering. I object.

Mr. Ewing. I ask unanimous consent that the time of the gentleman from Tennessee be extended for half an hour.

There was no objection.

Mr. Bright. I will not trouble the House with reading the opinion of Mr. Seyd in relation to the high value of silver and the occasion for its leaving the country in part, but will embody it in my remarks:

The plea that no silver bullion was brought to the United States, and that an actual stoppage in the coining of silver dollars took place, advanced as a reason to prove the indisposition of the Americans to use silver money, is quite false, for who indeed, I repeat, would bring silver to the United States mints when he could obtain 3 per cent. more for it elsewhere ? I maintain that these incongruities in the American silver currency have done much harm to the country. Besides the silver produced in the States, or which came from abroad and could not maintain itself, the vast treasures of Mexico have passed by instead of flowing in part into the United States for the development of her interior commerce, and for the formation of a solid basis to her international trade. And now the United States are in this remarkable position, that the richest silver deposits are opened in their own territories, producing vast sums of solid precious metal, which instead of serving herself as money all go abroad to swell the currencies of other nations, while the great Republic herself labors painfully under the weight of a depreciated paper currency.

But, Mr. Speaker, our contract was for standard value of 1870. Hence we were not bound to keep it at an equation with gold so that we kept it within the limits of the contract.

"But," it will be said, "it does not matter much, for if we send away all this silver we get something else in return for it, either gold or goods; we pay with it, and it thus turns the exchange in our favor." I deny the truth of the mathematical meaning of this saying. Supposing the silver was not produced, would not the United States import less, or rather be compelled to import less luxuries ? And so, if by the operation of the present laws silver were not driven away from the country but were to some extent permitted or encouraged to remain in it, this result would follow: the benefit of its present production would take two directions; one portion of it would go abroad, another portion would remain in the country for the encouragement and development of the home industry. The direct unfavorable law of tenders, amounting practically to a forbidding of the proper use of silver, creates an inequality whose influence is irresistibly strong, destructive of neutrality, and therefore most injurious.

The third objection is, we ought not to fix a value to operate twenty years hence. Why, Mr. Speaker, our obligation runs with the contract. As we maintain, these bonds were payable in silver and some of them were running forty years hence, and the holders have a right to claim the standard value under the act of 1870. And they may run for centuries yet to come. Hence to restore the silver dollar is only providing one of the means for the deferred payment of the bonds.

The fourth objection is, that we ought not to add to our depreciated currency. This was depreciated by law. It was not the depreciation of commercial considerations alone. We propose to appreciate it by law and restore it to its original position. By making it a full legal tender it will spring at once to a par with gold.

The fifth objection is, that England, Germany, and the Scandinavian states have adopted gold as a sole legal tender, and we ought to follow their example. I answer they have no right to impose an obligation upon us to change our Constitution or to change our contracts, for we change our contracts when we contract our currency and destroy our silver. And whenever we adopt the example which has been inaugurated we cripple all our industries that they may reap the profit. I suppose they will want us to have a king next, in imitation of their example.

The legal-tender coins of the United States are fixed by the Constitution. In Europe they are fixed by statutory law or the will of the sovereign. It is impossible, sir, to abolish silver. Three-fourths of the nations of the Earth use it --two-thirds of the population of the globe. If it could be done, it would increase the value of gold more than two-fold and the taxes and debts in proportion; and after it had done its perfect work of contraction, desolation, and destruction of industries, and inaugurated an unparalleled reign of poverty and distress, it would be succeeded by a deluge of paper currency throughout the world to supply the deficiency occasioned by the destruction of one of the great coins of the Earth. So says Mr. Bagehot, the English writer on the subject, and who shows conclusively that there is not gold enough in the world for a currency.

Again, we need the money at home. We do not need money to circulate in foreign countries. We deal in exchange with foreign countries. Our coins when they go abroad go to the mints of the European nations. When we regulate the operations of our mint, let it be done to the advantage and interest of our own people. It is not only wise but profitable to take care of ourselves. Every nation ought to have and maintain a home currency with its stability secured by constitutional law.

The sixth objection is that it should be only made a partial legal tender limited in the collection of debts. I answer this would demonetize it in part, would make it a subject of speculation, and would cripple the United States and the State governments and the people in the collection of taxes and in the payment of debts and in all the commercial uses of money.

Mr. Speaker, I will now call the attention of the House to another matter of grave consideration --the subject of the free coinage of the silver dollar. The operations of the Mint at present are with oppressive discriminations against the people. I maintain, first, that there ought to be free coinage of the silver dollar, because such was the policy of the Government from 1792 to 1853, a period of about sixty years. From 1853 to 1873 there was a charge of ½ per cent; from 1873 to 1875 the charge for gold was 0.2 per cent. The act of 1875 made the coinage of gold free of charge. In the second place I maintain, not only the policy of the Government, that it should be free, but because the expense ought to be borne by the country and not by the depositor. The Director of the Mint, in his report for 1873, gives the reasons why gold should be coined free, and his argument is equally applicable to the free coinage of silver.

[From report of the Director of the Mint, June 30, 1873, pages 13 and 14.]

Earnings and Expenditures.

With respect to the expenses of the mints, it should be stated that it never was intended that they should be self-sustaining, and that prior to 1853 no charge for the coinage of either gold or silver was imposed; the evident intention of the framers of the original mint law having been to invite foreign bullion and coin to the mint for coinage. In the year above stated, a law was enacted authorizing and requiring a coinage charge of one half per cent to be imposed, which continued in force down to the 1st of April, 1873, when the new coinage act took effect, reducing the charge to one-fifth of 1 per cent.

The reasons for a free coinage of gold are simple and direct, and are briefly stated as follows:

First. By throwing the cost of coinage on the depositor the cost of production is correspondingly increased.

Second. The coining value of gold is lowered, which tends to repel it from the mint and encourage its export. For the same reason it repels foreign gold.

Third. It is unjust to the depositor, as he pays the entire expense of coinage, in which the whole public are as much interested as himself. Coinage of the standard metal is indispensable to the public, and the expense should accordingly be contributed by all.

It should also be stated that, under the coinage act, the melting of the bullion to bring it to a condition for determining by essay the proportion of gold and silver contained, or the "fineness," as it is termed in mint language, is made a subject of charge to the depositor, and will bring to the Treasury a sum approximating somewhat to that accruing from the coinage charge. The imposition of this new charge should be considered an additional argument for abolishing the coinage charge. It is not subject to the same objection for the reason that a charge for melting is made in London.

Again, the coinage of silver ought to be free because the coinage of gold is free and silver is the most used by the people. The discrimination is unjust and oppressive upon the people. It is a tax to pay the expenses of the coinage on gold, as Mr. Sherman calls it "the money of the rich," and is throwing a burden on the people. I say it is unjust, and to show the prostitution of the mint in this particular, first, we purchased under the act of 1875 silver bullion with which to coin fractional silver to supersede the fractional paper currency. We purchased it with gold-interest-bearing bonds. The people of the United States are paying now about $2,000,000 annual interest on these bonds for a subsidiary coinage.

No only so, but according to the report of the Secretary of the Treasury the seigniorage which was collected for the coinage of silver for the last year, and covered into the Treasury, was $3,273,239, as also appears from the report of the Director of the Mint, making $5,273,239, which was thrown as a burden and tax upon the people to pay for the expense of coining "the money of the rich," as stated by the Secretary of the Treasury. Sir, it is a burning shame upon the legislation of the country ! Why will you do it ? England does it ! What does Mr. Seyd say on the subject ? I will call attention to a few paragraphs:

The expenditure of the Mint falls on the taxation; the expense for coining gold is consequently borne by all classes, although gold is used principally by the smaller number, the wealthier portions of the community. The mere assertion that the coining of gold is intended for the benefit of all classes does not, in face of the patent fact that the poor use it but rarely, meet the justice of the case. In England the extreme injustice of this matter becomes all the more glaring when it is borne in mind that the British silver coinage, that upon which more than three-quarters of the nation are dependent for their intercourse with each other, is charged with a heavy seigniorage of from 8 to 10 per cent., a profit which serves the mint as a set off against the free coinage of gold. Gold, it may be said, is coined in England gratuitously for the higher classes at the cost of the lower classes, which deal in silver. Moreover, while the coinage of gold is thus of full value, open and free to all, and the supply unrestricted within the natural boundaries of commerce, the silver coinage is debased; the mint refuses to coin it for the public; it has but a strictly limited legal-tender value, and the amount in circulation thus becomes restricted within narrow and unnatural boundaries.

Let any member who votes to tax the coinage of the silver go and tell his constituents that he did it to pay the expenses of coining gold, "the money of the rich;" let him tell them that he did it to raise revenues from the people by the clandestine means of a mint tax on their money; let him go and tell them, by way of apology, that England does it and thus grinds the faces of the poor for the benefit of the rich. That is the reason you have the silver taxed on your mints for the advantage of the rich of the country, while $5,000,000 are ground out of the poor and laboring men of the country per annum to favor the gold-mongers who get their coinage free of expense. Sir, that measure had a double object. It was not only to favor the gold, but it was to drive silver out of the country, and a tax upon it always has this tendency. But what should be the policy of our country ? Why, sir, instead of driving it out of the country, our policy ought to be that which was intended by the fathers of the country, to throw our ports open as wide as the gates of heaven and admit it from the four quarters of the globe, and give our own people the advantage of coinage and placing our currency upon the terra firma of a specie basis. Sir, the Constitution of our country has been violated by the policy that has been forced on and is ruining this country.

Oh, but they tell us there is to be an Atlantic flood of silver in consequence of its demonetization in Germany. Sir, in the language of a distinguished orator of the Revolution, "Let it come. I repeat it, Let it come," and we will roll back the silver billows upon them in payment of our national debt.

Why, sir, we have a debt redeemable now of $660,000,000, and by the 1st day of January, 1881, we shall have a debt of $1,452,000,000, according to the report of the Secretary of the Treasury. And if we adopt proper measures in this era, they will galvanize our trade, our industries will spring from the dust, and again the march of prosperity will begin. Sir, France is not so delicate as the United States. When her obligations in part were payable in silver to Germany she did not scruple upon the point of honor when she fell short to go into Germany and purchase $20,000,000 of silver there and take it to her own mints for coinage to pay her own obligation with. France did not scruple to do that. It is time we were getting down from our stilts and showing some dint of pity for the bond-ridden, bank-ridden, monopoly-ridden, mortgage-ridden, tax-ridden, and poverty-ridden people.

And yet, sir, still we are told about bad faith. When they talk about bad faith we hurl the slander back into the teeth of the slanderers. We propose to pay according to contract. The bondholder shall have his pound of flesh, but we do not intend that his victim shall be bled to death in addition to that pound which the law gives him.

Why, sir, the bondholders have no right to complain. In the first place, we funded their debt and gave a double value to them in this way, we gave a double rate of interest upon it and paid the interest in gold, making it now equal to 15 per cent. of the original value of the bonds. In addition to that, under the act of 1869, at a time when the five-twenties and other bonds were payable in legal-tenders, they prevailed upon Congress to bullionize the debt and thus we gave them $500,000,000 more in value. They prevailed upon us to pass the act of 1870 to secure coin at its then standard value and prevent its alloy or depreciation by the act of the Government. And by an amendment in 1871 they required the quarterly payment of the interest, making at this time a difference in their favor of $5,000,000 per annum, the difference between the semi-annual and quarterly interest. In addition to that we passed the act of 1873 for their accommodation, demonetizing silver and giving a contraction to the currency and an addition to the purchasing power of their capital which is now distressing the country.

Congress passed the resumption act of 1875 to contract the currency and at the same time to avoid a stipulation in the act of 1869, which provided for the payment of the bonds in "coin or its equivalent." That term "equivalent" meant that whenever the legal-tender notes should be equal with coin, gold or silver, then the 5/20 bonds should be payable in such notes. And these bonds are now payable in legal-tender notes, because they are now "equivalent" to silver coin --even admitting, for the sake of the argument only, that they were not originally payable in legal-tenders. This explains the reason of the merciless war which is waged against the legal-tender notes. With a heart as hard as the adamant of the desert, the foreign bondholder would rather see every industry of our country strangled in the tightening folds of contraction and the whole land blasted with mildew than have his bonds paid in legal-tender notes. The bondholders are moving heaven and earth to get to gold resumption. Conscious of their power, they have become insolent, intolerant, and abusive. They denounce all as financial dunderheads who dare to thwart their policy and defend the people against their boundless rapacity.

Mr. Speaker, there is no enlightened financier that will contend that a forced resumption of specie payments can be of any practical advantage to the country. It will bring desolation and ruin in its wake. It will bring every industry of this country to its crutches. It is already making our great commercial cities financial graveyards. It is emptying our shops and mills and blasting our fields. Millions of laborers are this day rolling in shoals from one side of the country to the other, praying for wages and for bread. And after vainly trying every avenue of escape from misery and wretchedness, they wail out their despair in the language of Milton's fallen angel: Which way I fly is hell !

Resumption, so called, is tearing the very heart of this nation to pieces and throwing it to the vultures. When the bondholders are made to tremble on their throne of gold and bonds by the earthquake of popular discontent, they have no language of relief except "Give them the bayonet!" They would re-enact the appalling tragedy of English resumption from 1819 to 1823, when one hundred and sixty thousand landholders were reduced to thirty thousand, the description of whose horrors baffled the eloquence of the British Parliament and defied the graphic pen of England's most eloquent historians.

But there is another startling fact which lies in the path of resumption. When we reach resumption we will reach another conclusion: the national debt will never be paid; not because it will be repudiated, but because the nation cannot pay it. It will be an inheritable burden, under which posterity will grown and swelter for ages. Such is the fate of England.

A recent able English financial writer uses the following language:

To us (says the author of The Bank Charter Act and the Rate of Interest) it is indeed a melancholy reflection and one withal worthy of grave pondering, that when the United States shall return again to a convertible currency the liquidation of this national debt must cease. Our own sinking fund, devised for a similar object, we know ceased to receive any important payments after the abrogation of the bank-restriction act. No currency, doubtless, but one that was able to sustain a great war need be expected to liquidate its cost.

Then, sir, when we reach resumption this country must pass under the yoke and be perpetually enslaved to the money oligarchy. For them our commerce will climb the liquid mountains of every sea to gather gold from every coast, to bring it back and empty it into the lap of the bondholder. Then will our Government reach for the "Midas fingers" of taxation to rob the nests of the people's earnings to fill the coffers of the bondholder; then, sir, will the shops and mills ply the spindle and the loom for the benefit of the bondholder; then will the farmer, converted into the vassal tenant, pursue his rugged toil and the fields yield their golden harvests for the benefit of the bondholder; then will the miners delve like slaves to tear the golden bowels from the earth to enrich the nation's lords; then will our Mint, prostituted from the common good, coin gold, free of charge, "the money of the rich;" and lastly, for them our armies will move to overawe and quell the outbreaks of plundered and starving labor.

Let the nation's creditors beware and moderate their extortions. They have already heard one roar of maddened labor sound like a trumpet-blast of prophecy. Endurance has its extremity. Let them remember that the snowflake is the nucleus around which congeals the avalanche of the Alps, which a sunbeam may loosen and send it plunging like mad thunder on the plains. Let them remember that their accumulating wrongs may rise mountain-high and stand out like Ebal, the Jewish mount of cursing, on which some avenging prophet may stand and loosen the nation's curses on the authors of the people's wrongs.

But let us hope in the triumph of equity and justice. Let us inaugurate an era of relief and reform by remonetizing the old silver dollar of our fathers; repeal the resumption act and loosen up the coagulated currency in the money centers, and send it like vital blood into all the arteries and veins of commerce. Then will the land again smile with contentment and plenty, and the oceans blossom with our sails.

The Finances.

Mr. Bright, by unanimous consent, obtained leave to print in the Record some remarks on the financial situation. On the Senate Finance bill, (S. 1044) to provide for resumption of specie payment, (which, by this time, had been passed and approved)

Mr. John Morgan Bright, of Fayetteville, Tennessee. Mr. Speaker, I propose to give some reasons why I cannot vote for the Senate finance bill now pending before the House. It seems to be a dish cooked to suit the taste of the President [Ulysses Grant], as it is but the embodiment of the views expressed in his financial veto message of last session.

The present bill provide, first, for the coinage of fractional silver to redeem the outstanding fractional currency; second, for the repeal of the charge of 1/5 of 1 per cent. for coinage; third, for the removal of restrictions on the amount of national-bank circulation; fourth, for the repeal of that clause of the finance bill of last session which required the redistribution of 55,000,000 of national-bank currency; fifth, for the redemption of legal-tender notes in excess of $300,000,000, amounting to 80 per cent. of the new national-bank notes, to be issued in their place; sixth, for the redemption in coin of the legal-tender notes outstanding after the 1st of January, 1879; seventh, for raising the coin for the redemption of the notes by the use of any funds in the Treasury not otherwise appropriated, or by the sale of bonds payable in coin under the act of July 14, 1870, and eighth, for the repeal of all laws inconsistent with the provisions of the bill.

Senate bill 1044 as it was introduced on December 22, 1874.

Be it enacted, &c., That the Secretary of the Treasury is hereby authorized and required, as rapidly as practicable, to cause to be coined at the mints of the United States silver coins of the denominations of ten, twenty-five, and fifty cents, of standard value, and to issue them in redemption of an equal number and amount of fractional currency of similar denominations, or, at his discretion, he may issue such silver coins through the mints, the sub-treasuries, public depositaries, and post-offices of the United States; and, upon such issne, he is hereby authorized and required to redeem an equal amount of such fractional currency, until the whole amount of such fractional currency outstanding shall be redeemed.

Sec. 2. That so much of section 3524 of the Revised Statutes of the United States as provides for a charge of 1-5 of 1 per cent. for converting standard gold bullion into coin is hereby repealed, and hereafter no charge shall be made for that service.

Sec. 3. That section 5177 of the Revised Statutes of the United States, limiting the aggregate amount of circulating notes of national banking associations, be, and is hereby, repealed; and each existing banking association may increase its circulating notes in accordance with existing law without respect to said aggregate limit and new banking associations may be organized in accordance with existing law without respect to said aggregate limit; and the provisions of law for the withdrawal and redistribution of national-bank currency among the several States and Territories are hereby repealed. And whenever and so often as circulating notes shall be issued to any such banking association, so increasing its capital or circulating notes, or so newly organized as aforesaid, it shall be the duty of the Secretary of the Treasury to redeem the legal-tender United States notes in excess only of $300,000,000 to the amount of 80 per cent. of the sum of national-bank notes so issued to any such banking association as aforesaid and to continue such redemption as such circulating notes are issued until there shall be outstanding the sum of $300,000,000 of such legal-tender United States notes, and no more. And on and after the 1st day of January A.D., 1879 the Secretary of the Treasury shall redeem in coin the United States legal-tender notes then outstanding on their presentation for redemption at the office of the assistant treasurer of the United States in the city of New York, in sums of not less than fifty dollars. And to enable the Secretary of the Treasury to prepare and provide for the redemptions in this act authorized or required, he is authorized to use any surplus revenues, from time to time, in the Treasury not otherwise appropriated, and to issue, sell, and dispose of, at not less than par, in coin, either of the descriptions of bonds of the United States described in the act of Congress approved July 14, 1870, entitled "An act to authorize the refunding of the national debt," with like qualities, privileges, and exemptions, to the extent necessary to call this act into full effect, and to use the proceeds thereof for the purposes aforesaid. And all provisions of law inconsistent with the provisions of this act are hereby repealed.

As to that clause of the bill which provides for the repeal of the charge on coinage, I make no point. It would have a tendency to encourage the home coinage of the precious metals. England has authorized free coinage since 18 Charles II.

That clause of the bill which provides for the repeal of the law of last session requiring the redistribution of $55,000,000 of national currency among the States according to wealth and population is intended to take immediate effect and prevent the redistribution and to secure and perpetuate a financial advantage to certain States to the injustice and prejudice of others. The report of the Comptroller of the Currency to the present session shows that the unequal distribution still exists.

The six New England States have an excess of $69,905,101; the five Middle States have an excess of $7,861,239; the fourteen Southern and Southwestern States have a deficiency of $52,467,842; the nine Western States have a deficiency of $23,063,966; and the nine Pacific States and three Territories have a deficiency of $7,972,619. The Eastern and Middle States have an excess of 78,295,579.

The same report shows the following per capita circulation: The six New England States have $31.45, the Middle have $12.66, the fourteen Southern and Southwestern have $2.81, the nine Western have $6.86, and the eleven Pacific and Territories have $2.

The act of last session ordering the redistribution of the currency conceded the justice of the measure. Now it is proposed to go back and revive the iniquity. Free-banking will be no compensation for the injustice to the destitute States, as I will show in another connection. It is only a contrivance to direct all the trade winds and gulf streams to the favored sections. A large part of the productions of the South and West is diverted from the natural commercial channels and are thrown thousands of miles across the interior at ruinous rates of transportation. Our one-sided financial condition, sanctioned by law, has thrown our whole commercial gravitation out of course. In the one section where money is plenty, labor is rewarded and productions in the vicinity command a fair price. The reverse is true where the money is scarce. Look to New Orleans, that beautiful city of the sun, at whose feet the din of commerce used to roar day and night, with money exchanges in her favor, and with a commercial outlook equal to that of ancient Tyre, but now despoiled of her trade and wasting in decay. She is now without money to pay for the great staples sugar and cotton, but the stranger generally pays for them with checks on the great money centers of the East, and the checks are applied to the payment of merchants' accounts, or used in the purchase of goods at high prices, which are to be consumed at the South. So the revolution of the wheel of commerce empties but little money into her lap. In the mean time she is devoured with taxation. Other sections may read their commercial fate in Louisiana with a continuation of our present financial policy.

I would injure none, but have all our sections march abreast in the race of improvement. But I do protest against the consolidation of a great money power in this country, which, unchecked, sooner or later, will subjugate both the Government and the people.

But to pass on. That clause of the bill which provides for the redemption of fractional currency with fractional silver coin is unnecessary, expensive, and in the interests of the money power. The facts will prove my position. The report of the Treasurer of the United States for 1874 shows the amount of fractional currency outstanding to be $45,880,002.34. Our Government has no silver which can be used for coinage to redeem the fractional currency. The existing law pledges our duties, first, to the payment of interest on the public debt; second, to the payment of 1 per cent. of the sinking fund; third, the residue to be paid into the Treasury.

---[ In 1874, the U.S. Mint in San Francisco produced 800,000 "trade-dollar" silver coins a month and shipped them to China. There is plenty of silver and gold, but shipped out of the country, then gold-bonds are borrowed from England.]In proof that the silver cannot be raised from duties, the report of the Secretary of the Treasury in his estimates for 1875 shows a deficiency in the sinking fund of $22,093,748.43, and the deficiency for 1876, 11,920,914.

The report of the Treasurer for 1874 shows a falling off in the customs for last year $24,985,685.01, and a falling off in internal revenue $11,920,914, making a total decrease of revenue $36,349,218.25. So there is no "surplus" nor "residue" now in the Treasury, nor the promise of any, out of which the silver can be raised. Then the only alternative is to raise it by the sale of coin bonds under the act of July 14, 1870. Humiliating spectacle, to see the Government a suppliant at the feet of the money power to borrow silver to redeem her fractional currency !

But let us see something of the cost of converting the fractional currency into fractional silver. The act of July 14, 1870, amended by the act of January 20, 1871, under which the bonds are to be issued, provides that the bonds shall bear 5 per cent. interest payable quarterly, and the principal payable in ten years. The quarterly interest makes it about equal to 6 per cent. per annum. If these bonds are payable in gold, as the friends of the bill contend they are, then they are to be sold at par for silver. The gold is now worth 6 per cent. more than silver. This would make a difference in the value of silver to be raised and the gold bonds of 2,902,800. But this is not all. The annual interest on these bonds is $2,900,000, and in ten years the interest will amount to $29,000,000, making exchange and interest for ten years $31,902,800; and still the principal, 45,880,002, not paid.

This is a little financial stroke which plays handsomely into the hands of the money power; whereas the fractional currency costs but little more than the paper and printing, is more portable than silver, and being the symbol of the national credit it is used as a medium for the exchange of our property and productions and the payment of our debts and taxes, is a legal tender in sums under five dollars and exchangeable for legal-tender notes at the Treasury of the United States.

The fractional silver could have no greater use, for it would not be a legal tender for any sum over five dollars. The people are not demanding such a measure. It would be paying too much for the whistle. But this is not the worst; it is only the child out of which the giant is yet to grow.

The bill next provides for the redemption in coin of $82,000,000 of legal-tender notes, being the amount in excess of $300,000,000. If there was no surplus in the Treasury to raise silver, there would be none to raise gold. Then the gold must be raised by the sale of more gold bonds. Gold is now worth 12 per cent. more than legal-tender notes. The difference in the value of $82,000,000 legal-tender notes and gold would be $9,800,000. The annual interest on the gold bonds would be $4,920,000 and the interest for ten years would be $49,200,000, which added to the exchange would make $59,000,000; and still at the end of ten years the principal would be unpaid. On the other hand, the legal-tender notes cost but a trifle, bear no interest, and answer all the purposes for the exchange of commerce and the payment of taxes and debts, except interest on the public debt and duties on foreign goods.

Again, the bill provides that $100,000,000 new national-bank notes shall be issued in the place of the $82,000,000 legal-tender notes redeemed. This would not increase the volume of currency, as $20,000,000 of the outstanding legal-tender notes would be withdrawn from circulation to be held as a reserve for deposits in the national banks.

So far as the people are concerned, the practical result of the transaction would be the swapping off of $82,000,000 of legal-tender notes for national-bank notes at a cost of $59,000,000, exchange and interest for ten years. It is all for the bondholders and nothing for the people. A guardian would be removed from office who would change his ward's debt from a non-interest to an interest-bearing debt.

Again, the bill provides for the redemption of the $300,000,000 legal-tender notes outstanding, after the 1st of January 1879. For the reasons stated before, the Government will be compelled to resort to the sale of more bonds to raise the coin. The gold being worth 12 per cent. more than Treasury notes, it would make a difference in the value of the notes and bonds of 36,000,000. The annual interest on these bonds would be 18,000,000, and the interest for ten years would amount to $180,000,000, making a total for exchange and interest for ten years of $216,000,000; and still the principal due and unpaid.

As it is contemplated, suppose the national banks issue $300,000,000 of their notes in the place of the $300,000,000 legal-tender notes redeemed, and that they should make an estimated gross profit of 15 per cent. per annum for ten years, it would give an aggregate of $450,000,000.

Then sum up the result of converting the fractional currency and legal-tender notes into coin bonds, we have the following:

Exchange for fractional currency ............ $2,902,800

Exchange of $382,000,000 legal-tender notes ............... 45,840,000

Interest on bonds exchanged for fractional currency and legal-tender notes for ten years ........... 252,028,000

Gross profits of national banks on $382,000,000 for ten years at 15 percent. ............ 450,000,000

Total ........................ 750,770,800

To say the least of it, a large proportion of this amount would be ground out of the people in ten years by the stupendous extortions of the bill. Whatever may be said in palliation of the items of exchange and bank profits, there can be no question that the interest on the bonds to raise coin for the redemption of fractional currency and legal-tender notes would cost $252,028,000 in ten years, which would have to be raised by taxation. And at the end of the time the people would have to face the principal of the bonds, amounting to $427,880,000, due and unpaid, and no doubt with an empty Treasury, if the logic of this policy is pursued to its conclusion. And at the time these bonds fall due there perhaps will be due $1,000,000,000 of other bonds, and the holders demanding payment, or to have their bonds refunded, and the revenues of the country farmed out to them for another term of years.

I warn the country now of the "dismal swamp" which lies ahead of this wicked policy, a policy which builds up the money power on the distress of the people. I protest against yielding the country a prey to such a system of usury and plunder.

I propose now to show that the bill is hollow with delusion, and that its proposed gold basis is like the boy's phantom gold at the end of the rainbow. After a course of financial tribulation, it will end in disappointment and disaster. Our financial system has a foreign as well as domestic relation. Financial theories may be certain in their normal application, but they become as treacherous as the faithful compass when swayed by foreign influence.