---[In 1888 George Eastman released for sale the first consumer camera which he named "Kodak"]

53rd Congress, 3rd Session

(December 3, 1894--March 3, 1895)

Grower Cleveland President

Speech of Hon. Henry A. Coffeen,

in the House of Representatives

The Currency

Volume Controls Price

Prices Control Profits, Prosperity, and the Equity of Time Payments

Who should Control Volume ?

The most elemental and firmly established truth in monetary science is that volume controls price.

"Let principles be once firmly established and particulars will adjust themselves." ---Margarette Fuller

Tuesday, January 8, 1895.

The House being in Committee of the Whole on the state of the Union, and having under consideration the bill (H.R. 8149) to amend the laws relating to national banking associations, exempt the notes of State banks from taxation upon certain conditions, and for other purposes---

Mr. Coffeen of Wyoming [Henry Asa Coffeen (February 14, 1841 -- December 9, 1912)] said:

Mr. Chairman: The great financial controversy between the money power and the people hinges upon the simple question: Who shall control the issuance and the volume of money in circulation ?

The advocates of bank issues, coming forward with the claim that the currency must be "reformed," ask Congress to deprive the Government of the right to issue paper currency for general circulation and empower the banks to both issue currency and expand or contract the volume in circulation at their own option and as their interests might suggest.

On the other hand, representing, as we believe, the interests of the people, we demand the suppression of all bank issues and the future issuance of all forms of money, whether coin or paper, by the Federal Government, making all issues full legal tender, and controlling and regulating the volume in strict accord with the interests of industry and the maintenance of equity.

What is the Use or Function of Money ?

The functions of money are three in number--- to furnish, first, the common medium of exchange; second, a common measure or unit of account by which the comparative values of other things are estimated; third, a standard by which future payments and obligations are determined and enforced.

If the standard, the value of money in exchange, is changed by contraction or expansion of volume, then equity in payment is defeated and one of the parties in the contract suffers injustice.

If a farmer has a certain number of dollars to pay in taxes, on a note, or in any other obligation, the amount being fixed when the general range of prices showed the dollar worth one bushel of wheat, it will double the burden of debt and rob him of his wheat to change the dollar, the unit of account, so that it is worth two bushels of wheat, and does the farmer the same injustice as it would to double the size of the bushel measure or any other standard of measure and settlement.

So with the products of the factory, field, shop, mine, or store. So with all, rich or poor, who have to obtain dollars in exchange for property, products, or labor. The dollar is not a unit of value when its purchasing power is changed, but a unit of account.

Mr. St. John, president of the New York Mercantile National Bank, and, in my judgment, the most competent and patriotic bank president that appeared before the Banking and Currency Committee at its recent hearings, pointed out (page 328) that money is domestic ---that it is a matter of national legislation and national concern. About 95 per cent of our trading is done within our own jurisdiction, and besides the international trade of any one country always requires translating both the money and the measures of other countries into its own.

Money is the creature of law. Money is all domestic. Our ten-dollar gold piece is accounted 258 grains of nine-tenths fine gold when beyond the jurisdiction of the United States.

Money and the yardstick have nothing in common. The yardstick is an exact unvarying measure of length. Money is an uncertain, variable measure of varying values. The yardstick is not bartered for commodities. Money is the means of acquisition and momentarily the measure of value of the things required. The yardstick is a unit of length. The dollar as a "unit of value" is preposterous. Our Hamilton-Jefferson statute, founding the mint, provided a dollar as our "unit of account." That dollar of 1792 and the dollar of 1894 contain identically 371.25 grains of silver.

Aggregate of Money Determines Prices.

The aggregate of all money afloat and in bank in the United States is our true measure of normal value of commodities here. The aggregate of money of all nations trading internationally is the measure of normal value of commodities consumed by all. Therefore, to enlarge the aggregate of money in the trading world is to raise normal prices of commodities everywhere. To enlarge the aggregate of money in the United States is to raise normal prices for home and internationally-consumed commodities here. Per contra, to diminish the aggregate of money in the United States is to lower all normal prices here, and to diminish the world's aggregate money is to lower all normal prices of internationally-moving commodities in all the trading world.

In reference to the coinage question, so ably discussed by my friend who has just taken his seat [Mr. Bland], I desire to say that I indorse in the main what he has said. And yet I wish to call attention to another phase of the currency bill before us that is of paramount importance to a realization of the fact that this question is not so much as to what shall be the material of money or the money of ultimate redemption, whether it shall be silver coin or gold coin or uncovered legal tender paper. No man who is competent to grasp the entire currency question will fail to realize that it is the volume of money that regulates prices, and therefore regulates profits and prosperity. I have upheld the free coinage of silver, as you all know, from first to last. I believe today it is a practical step to take, not so much that it is the only means that would relieve the depression, but because it is prominently before the country, and in due deference to the deep-seated desire on the part of the people in many parts of the country, and for the purpose of keeping the Democratic pledges to the people it should be carried forward until silver coinage is restored.

Mr. Chairman, the American Banking Association and its allied interests, including the European moneyed interests as well as the American, as far as they work in general concert of purposes, I wish to designate under the general terms money power or money dealers or bank syndicate, for general convenience, and not for the purposes of offense or abuse of persons engaged in the business of banking.

I have no blame to cast upon those engaged in the business of banking under the laws as they exist or as they may exist. Every man has a right to engage in banking under such laws as are made. I have had some little experience in banking, and my banking investments have been profitable.

It is the system of banking and the character of financial legislation and the unsound arguments and vicious methods that I would attack and expose.

In my judgment the money power and their advocates have in times past and even now on this floor are seeking to avoid the main issue and conceal from the general public their main purpose in all proposed legislation before us.

The main question and the most important issue is who shall control quantity or volume of currency in general circulation.

Their main purpose is to secure to themselves as a general class of money dealers the power to expand or contract the volume of currency, suddenly an entirely at their own option, so to control the value of money and credits in their relation to property and prices.

Banks Seek the Control of the Volume in Circulation.

Whoever controls the general volume of currency in circulation, controls the general range of prices, and prices control property values, wages, profits, and the opportunities for general prosperity; and these things involve the welfare of mankind.

Believing these things, Mr. Chairman, and even knowing them as certainly as anything can be known in any of the ordinary sciences, how can I sit silent and unconcerned in this Hall, and in the midst of these debates, and see any proposition carried to turn this all-important control over the money volume and a new lease and extension of power into the hands of banking corporations ? This places control out of the reach of the people and the Government, which is in duty bound to protect the people.

Sir Robert Peel said, when he brought forward in Parliament his bill for the reform of the currency, in 1844, in describing the importance of the question to all interests and people:

There is no contract, public or private --no engagement, national or individual, which is uneffected by it. The enterprises of commerce, the profits of trade, the arrangements made in all domestic relations of society, the wages of labor, pecuniary transactions of the highest accounts and of the lowest, the payment of the national debt, the provisions for the national expenditure, the command which the coin of the smallest denomination has over the necessaries of life, are all affected by the decision to which we may come on that great question which I am about to submit to the consideration of the committee.

Every man, woman, and child in this country is vitally interested in this question, and so long as I represent them even the poorest and humblest citizens in the State of Wyoming shall have the satisfaction of knowing that their interests are neither forgotten nor bartered away and surrendered to the money power.

The Quantity of Currency in Circulation Regulates Prices.

The philosophy of this question is in this fact, that it is the total volume of money in circulation, whatever its form and without regard to its material, that controls the value of every dollar as far as its monetary use is concerned. I see there are a few in my presence who are inclined to question this proposition, especially some of my colleagues on the Coinage Committee, but I say to you that all competent authorities almost without exception are agreed upon that fact. There are no leading authorities in the universities of any land or continent, or any noted authorities, I believe, except one or two, but what have finally acknowledged the point that it is the aggregate, the entire quantity of money or number of units in circulation, that regulates the value of every unit or dollar for the time being. Therefore, the free coinage of silver, great question as it is, bringing up the great injustice that has been done the people by its demonetization, all of which I admit and claim, still is an incidental question to the currency question.

Then, what is the issue before us to-day ? The issue in which the people are most vitally interested is practically who shall control the volume in circulation ? I will submit authorities to you in extended remarks to show you that it is the aggregate volume, without particular reference to the material of which the units are composed, that regulates

the value.

Mr. Money. Will the gentleman allow me to ask him a question ?

Mr. Coffeen of Wyoming. Yes.

Mr. Money. I want to understand the matter. Do you contend that it is the volume of currency circulating in this country that regulates prices here ?

Mr. Coffeen of Wyoming. Yes.

Mr. Money. Or that it is the volume of currency in the world that regulates the prices of articles of universal consumption ?

Mr. Coffeen of Wyoming. I intended to treat of that later, but I will take that up now. The prices in every nation are regulated on the basis of the money of that nation, and we should not forget that monetary systems are of national and local concern, and not international, as some suppose. There is no "money of the world."

Exports and imports are regulated purely and entirely in the exchange of merchandise for merchandise, and they are always translated into the local monetary system of the country dealt with. Therefore, in answer to the gentleman, who has put a very pertinent and proper question, I will say, without fear of successful contradiction, that the prices in this country, named in the circulating money of this country, will depend on the aggregate number of units in circulation in this country, as they will depend and be named in every other country upon their respective monetary systems.

Mr. Money. Now, I do not want to interrupt you---

Mr. Coffeen of Wyoming. This is no interruption. I think this is profitable.

Mr. Money. Then, if that is true, would the increase of the volume of circulation in this country raise the price of cotton and wheat in this country, without regard to the universal volume of currency in the world and the demand for those two articles ?

Mr. Coffeen of Wyoming. That is a proper question, and we ought to be able to answer such questions as that. Those products that are produced in this country beyond the capacities of this country to consume, and which depend, therefore, on export for their market, will, without regard to prices named in our money, be at least partially influenced in price named in the foreign money by the foreign market.

But, going on now from where we left the question, who shall control the volume of money in circulation ?

From the very nature of the case, as I shall undertake to show a little further on, the volume or quantity of money in general circulation controls and regulates the general range of prices on commodities.

As money appreciates property and price depreciate. As the volume of money increases prices of all commodities increase generally in the same ratio; but increasing the volume of money cheapens the value of the dollars or units of account, which is the cause of the increase of general prices. So again, to contract or diminish the volume of money increases the value or purchasing power of the dollars or units, which lowers the price of commodities.

Hence we state the general proposition, that to increase or decrease the value or purchasing power of money has directly opposite effect on the value or price of all commodities and properties exchanged for money. It is folly, then, for the money power to claim that they want good, high-priced money and plenty of it. To make money plenty cheapens it, and while cheaper money is both good and honest money, if kept in due proportion to the needs of the country, honest and helpful to all who have aught to sell or pay, yet the money dealers want high purchasing power money, and they know, or ought to know, that scarcity produces it. There is no such thing possible as high-priced money and "plenty of it."

To prove this elemental truth of monetary science, that volume of currency in circulation controls the general range of prices, I submit the following authorities; but in general let me say that all competent authorities in both Europe and America are nearly unanimous in their recognition of this principle.

John Stuart Mill says:

That an increase of the quantity of money raises prices, and a diminution lowers them, is the most elementary proposition in the theory of currency.

The authorities on this quantitative theory of money have been so thoroughly collated by Senator John P. Jones, and given in his great speech on the question of repeal of the silver-purchase law in October, 1893, that I shall quote a number of them as given by him, and in connection shall quote a part of what the Senator himself had to say on this topic. I regard the great Senator himself as even a greater authority on almost every phase of the money question than many of the noted writers from whom he makes quotations:

I shall now proceed to speak of the quantitative theory of money. I wish to say, preliminarily, that I have heard no Senator deny the scientific correctness of that theory; yet if it be correct the so-called standard of gold is a standard of gross injustice.

The Quantitative Theory of Money.

Political economy, Mr. President, has been called "The dismal science." The most dismal branch of it, if men are to endeavor to force conclusions to fit some preconceived theory without reference to principles, is that which relates to money. The persistent determination to make the whole science subordinate to the absurdities of the gold standard has operated like a Westinghouse brake on the progress of the civilized world. But there is one principle of monetary science that, if held steadfastly in view, will constitute an unerring guide through what would otherwise be a path of inextricable difficulty. That principle is that the value of the unit of money in any country is determined by the number of units in circulation. In other words the value of every dollar depends on the number of dollars out.

The greater the number of dollars out, other things being equal, the less will be the value of each dollar; the fewer the number out, other things remaining the same, the greater the value of each --and this without any regard whatever to the material of which the dollars are composed. This is the key to the financial situation in the United States. Much more; it is the key to the financial situation in every land. Without this key it is in vain that the student attempts to unlock the door leading to the Arcanum of monetary knowledge. Unlike many of the locks made by man, the lock on that door is unpickable. The household of science is one that thieves can not break through and steal. He who would enter must first find the key. With this key in hand, the most secret recesses may be explored with confidence. Without it, the student travels in a circle --returning, after much labor, to the point from which he started upon his journey. Like one in a maze, when most confidently expecting to find his way out, he but sees himself coming up against impassable barriers.

To the possessor of this theory and of an impartial mind, that is to say, a mind in search of truth for truth's sake, there is no phenomenon of industry, of commerce, or of finance that is not accounted for. With it, all facts in the monetary world harmonize. All the teachings of history illustrate its force. It has therefore for support both reason and experience. It resolves all doubts; unriddles all enigmas; makes clear that which, without it, would be an insoluble problem of political economy. But in order to receive all the benefits of truth, men must not approach the investigation with a predetermination to prove some special theory. The truth is always its own justification.

No Senator will rise in his place and deny that, other things being equal, the value of each unit of money in a country depends on the total number of units forming the monetary circulation of that country. No Senator will attempt to deny that, all other things remaining the same, the prices of property and commodities in a country are regulated by the number of units constituting the monetary circulation of the country; and by the "number of units" I mean, of course, for this country the number of dollars, for France the number of francs, for Great Britain the number of pounds sterling, etc.

The quantitative theory, Mr. President, is not new. In the third century of the Christian era the Roman jurisconsul Paulus gave a description of money which indicates the acceptance at that early period of the principle of quantity as that to which the money unit owed its value. I invite special attention to this clear-cut statement:

"The origin of buying and selling," says Paulus:

"goes back to barter. Primitively, there was no money. One thing was not called "merchandise" and the other "price," but every one, according to his needs, and according to his circumstances, bartered things useless to him for those which would be useful to him; for it often happens that what one has too much of another lacks. But, as it would not always or easily happen that you had what I should have wished for, and that, conversely, I had what you wished to obtain, choice was made of a material which, being declared forever legal value, would obviate the difficulties of barter by means of a quantitative equation. And this material, stamped in the corner by the State, circulates with a power which it derives not from the substance but from the quantity. Since that time, of the things thus exchanged one is called merchandise, and the other is called price."

This description was deemed worthy to be incorporated in the Pandects of Justinian, compiled and promulgated in the sixth century, thus demonstrating that the lapse of three hundred years had not rendered it obsolete. It is as sound to-day as it was when first written.

John Locke, in his Considerations, relating to the value of money, said:

"Money, while the same quantity of it is passing up and down the kingdom in trade, is really a standing measure of the falling and rising value of other things in reference to one another, and the alteration in price is truly in them only. But if you increase or lessen the quantity of money current in traffic in any place, then the alteration of value is in the money."

Locke further said:

"The value of money in any one country is the present quantity of the current money in that country in proportion to the present trade."

David Hume, the historian, says:

"It is not difficult to perceive that it is the total quantity of the money in circulation in any country which determines what portion of that quantity shall exchange for a certain portion of the goods or commodities of that country. It is the proportion between the circulating money and the commodities in the market which determines the price."

Ficthe says:

"If the quantity of purchaseable articles increases, while the quantity of money remains the same, the value of the money increases in the same ratio; if the quantity of money increases, while the quantity of purchaseable articles remains the same, the value of the money decreases in the same ratio."

James Mill, in his treatise on Political Economy, says:

"And again, in whatever degree, therefore, the quantity of money is increased or diminished, other things remaining the same, in that same proportion the value of the whole and of every part is reciprocally diminished or increased."

John Stuart Mill (Political Economy) says:

"The value of money, other things being the same, varies inversely as its quantity; every increase of quantity lowering the value, and every diminution raising it in a ratio exactly equivalent"

And again, as I have already quoted in connection with my remarks on cost of production, Mr. Mill says:

"Alterations in the cost of the production of the precious metals do not act upon the value of money, except just in proportion as they increase or diminish its quantity."

Ricardo (Reply to Bosanquet) says:

"The value of money in any country is determined by the amount existing. That commodities would rise or fall in price in proportion to the increase or diminution of money I assume as a fact that is incontrovertible."

Ricardo further says:

"There can exist no depreciation in money but from excess; however debased a coinage may become, it will preserve its mint value; that is to say, it will pass in circulation for the [so-called] intrinsic value of the bullion which it ought to contain, provided it be not in too great abundance."

John Stuart Mill again says:

"W e have seen, however, that even in the case of metallic currency the immediate agency in determining its value is its quantity." --Principles of Political Economy, volume II, page 89.

William Huskisson (The Depreciation of the Currency, 1819) says:

"If the quantity of gold in a country whose currency consists of gold should be increased in any given proportion, the quantity of other articles and the demand for them remaining the same, the value of any given commodity measured in the coin of that country would be increased in the same proportion."

Sir James Graham says:

"The value of money is in the inverse ratio of its quantity; the supply of commodities remaining the same."

Torrens, in his work on Political Economy, says:

"If the value of all other commodities, in relation to gold, rises and falls as their quantities diminish or increase, the value of gold in relation to commodities must rise and fall as its quantity is diminished or increased."

Prof. DeColange, in the American Cyclopedia of Commerce, article "Money," says:

"The rate at which money exchanges for other things is determined by its quantity. * * * Supposing the amount of trade and mode of circulation to remain stationary, if the quantity of money be increased its value will fall and the price of other commodities will proportionately rise, as the latter will then exchange against a greater amount of money; if, on the other hand, the quantity of money be reduced, its value will be raised, and prices in corresponding degree diminished, as commodities will then have to be exchanged for a less amount of money. * * * In whatever degree, therefore, the quantity of money is increased or diminished, other things remaining the same, in that same proportion the value of the whole and of every part is reciprocally diminished or increased."

Says Prof. Sidgwick, of Cambridge University:

"The exchange value of any particular coin will vary in exactly inverse ratio to the variations in quantity of the aggregate." --Principles of Political Economy, page 251.

Does the Material in Money Control its Value ?

Now, having established the fact beyond any danger of successful contradiction that the value of money is controlled by the number of units in circulation, and since a few --mostly novices in the study of monetary questions, or special pleaders for special interests-- still hold and advocate that it is in whole or in part the value of the material of which money is composed that regulates its value, I wish to take up this feature of the question and we will find that it is equally clear that without regard to the material of which convenient forms of money are composed, still the volume in circulation regulates the value for monetary purposes.

This rule applies even to the circulation of uncovered paper money, whether issued by the banks or by the Government, as long as it is kept in general circulation, and so the values of gold dollars and silver dollars themselves, by adding paper money to the volume, are affected, and diminished or increased according as the quantity of paper money is increased or decreased. On a former occasion [June 5, 1894.], when the repeal of State-bank tax was before us, I tried to make this clear to all.

This fact and a true recognition of the effect of expanding or contracting the amount of paper currency in circulation is essential in any proper discussion of the question of empowering banks to issue what they call an elastic currency or of issuing any currency whatever, or withdrawing any from circulation.

Senator Jones gives valuable testimony again. He says:

So absolutely clear are the leading writers that the value of money unit is, in every case, other things being equal, determined by the number of units out, and does not depend on the material of which the money may be composed, that they have not the slightest hesitation in asserting that the rule applies even to uncovered paper money, so that the value of every dollar of gold and silver in circulation is diminished or increased, according as the quantity of paper money is increased or diminished; and reciprocally as to all of these, the increase in the number of dollars of either kind diminishing the value of each dollar of the others, while the decrease in the number of either increases the value of each of the others, without the slightest regard whatever to the material of which either of the dollars is composed.

If this be so, if the value of the unit of money depends not on the material of the dollars but on their quantity, what becomes of the gold standard ? If this be so, inasmuch as silver has been utilized as money since the dawn of creation, why abandon it now, unless Senators are prepared to abandon the automatic system altogether ? If we must, by legislation, compel a change in the value of money (for that is what this measure means), why legislate so that it can change in one direction only, and that the direction which is always favorable to the classes that lend money and live idly on their incomes --the direction most injurious to society, most fatal to industry, most narcotizing to energy ?

Prof. Stanley Jevons, in his work on Money and Mechanism of Exchange, says:

"There is plenty of evidence to prove that an inconvertible paper money, if carefully limited in quantity, can retain its full value. Such was the case with the Bank of England notes for several years after the suspension of specie payments in 1797, and such is the case with the present notes of the Bank of France."

In his proposal for an economic and secure currency, the great authority, Ricardo, himself a most acute dealer in money, says:

"A well regulated paper currency is so great an improvement in commerce that I should greatly regret if prejudice should induce us to return to a system of less utility. The introduction of the precious metals for the purposes of money may with truth be considered as one of the most important steps toward the improvement of commerce and the arts of the civilized life; but it is no less true, that with the advancement of knowledge and science, we discover that it would be another improvement to banish them again from the employment to which, during a less enlightened period, they had been so advantageously applied."

The distinguished economist and editor, Mr. J.R. McCulloch, in commenting on the principles of money laid down by Ricardo, says:

"He examined the circumstances which determine the value of money, * * * and he showed that * * * its value will depend on the extent to which it may be issued compared with the demand. This is a principle of great importance, for it shows that intrinsic worth is not necessary to a currency, and that, provided the supply of paper notes declared to be a legal tender be sufficiently limited, their value may be maintained on a par with the value of gold, or raised to any higher level. If, therefore, it were practicable to devise a plan for preserving the value of paper on a level with that of gold, without making it convertible into coin at the pleasure of the holder, the heavy expense of a metallic currency would be saved."

It appears, therefore, that if there were security that the power of issuing paper money would not be abused; that is, if there were perfect security for its being issued in such quantities as to preserve its value relatively to the mass of circulating commodities nearly equal, the precious metals might be entirely dispensed with, not only as a circulating medium, but also as a standard to which to refer the value of paper.

Lord Overstone also admits that irredeemable paper money can, by a proper limitation of its issues, be kept at par with gold. In adopting a paper circulation he says--

"We must unavoidably depend for a maintenance of its due value upon the adoption of a strict and judicious rule for the regulation of its amount."

Supporting this view we find also that Alexander Baring, in his evidence before the secret committee of the House of Lords in 1819, said:

"The reduction of paper would produce all those effects which arise from the reduction in the amount of the money in any country."

An early and distinguished authority in our own country, Mr. Gallatin, said:

"If in a country which wants and possesses a metallic currency of seventy millions of dollars, a paper currency to the same amount should be substituted, the seventy millions in gold and silver, being no longer wanted for that purpose, will be exported, and the returns may be converted into a productive capital and add an equal amount to the wealth of the country."

When we know that these are views of the leading writers --all uniting in the assertion that that which determines the value of money is the quantity, not the material-- it must excite our special wonder that Senators propose to destroy silver as money of final payment, or to repeal a law which by its slight addition to the quantity of money has at least tended to maintain, in some degree, among us the equities of time contracts and deferred payments. When Senators know that all great projects in this country, on which the employment of labor depends, are based upon the prices of commodities, and that when those prices are constantly falling, workingmen must be relegated to idleness, that every debt must be paid in a dollar of increasing value, to the ruin of merchants and of the projectors of industrial enterprises in which labor should be employed, it is incomprehensible how they can advocate the establishment in this country of a gold standard, or of any standard except such as will furnish a sufficient volume of money for the business of the people.

With reference to Ricardo, it is to be borne in mind that his profession was that of stockbroker. Hence we must make allowance for his desire to maintain the gold standard --knowing, as he very well knew, that the gold standard meant a certain level of prices for commodities-- that is to say, that it did not mean the possession of gold, but the ability of money-lenders, creditors, and the idle aristocracy and income classes of Great Britain to obtain all the comforts and luxuries of life at a level of prices getting constantly lower, for, if by those means, workmen were relegated to idleness, those idlers felt themselves not individually responsible. Their inquiry was: "Am I my brother's keeper?"

In a paragraph of the twenty-seventh chapter of his work on Political Economy, Ricardo makes the broad statement that a nation may be on the gold standard without having a solitary dollar of gold within its entire territory, provided only that, whatever may be the form of its money, the number of the units of that money shall not exceed the number of gold units which, if the country used gold money, would be its distributive portion of the gold of the world. That proportion is, of course, fixed by the general range of prices. Ricardo's statement is:

"A currency is in its most perfect state when it consists wholly of paper money, but of paper money of an equal value with the gold which it professes to represent. The use of paper instead of gold --he continues-- substitutes the cheapest in place of the most expensive medium, and enables the country, without loss to any individual, to exchange all the gold, which before it used for this purpose for raw materials, utensils, and food --by the use of which both its wealth and its enjoyments are increased."

It will be remembered that on Saturday I demonstrated, by citations from the leading writers that money has no value whatever except value in exchange --purchasing power--and that when the term "value of money" is used, it means only purchasing power and not any value, which, for commodity purposes, might attach to the material of which it is composed. "By limiting its quantity" --Ricardo says-- "its value in exchange which, as I have said, is the only value that money has, is as great as an equal denomination of coin, or of bullion in that coin."

And he very properly adds:

"There is no point more important in issuing paper money than to be fully impressed with the effects which follow from the principle of limitation of quantity."

Of course there is no point more important than that. The principle of limitation of quantity is of the very essence of the value of money, of whatever material it may be composed.

If money were unlimited in quantity it would have no value whatever. Nothing has value that is unlimited in quantity. If, instead of sand, the ocean beach were strewn with gold dust, it would have no value whatever as a commodity; yet if that gold dust were taken up and coined into pieces of money, the number of such pieces being limited, they would have value precisely as gold pieces have value to-day. And, on the other hand, as Adam Smith says, if gold should reach a certain degree of scarcity, the slightest bit of it might become as valuable as a diamond.

Ricardo, leaving no form of the statement untouched, recurs to the subject by making the following remark:

"On these principles it will be seen that it is not necessary that paper money should be payable in specie to secure its value; it is only necessary that its quantity should be regulated according to the value of the metal which is declared to be the standard."

If it is not necessary for paper money, in order to be of equal value with gold money, to be payable or "redeemable" in gold, how can it be asserted that silver money, in order to maintain its value in relation to gold, should be redeemable in that metal ?

Prof. Fawcett, in his work on Political Economy, says:

"In discussing the laws of price, the principle was established that general prices depend upon the quantity of money in circulation compared with the wealth which is bought and sold with money, and also upon the frequency with which this wealth is bought and sold before it is consumed. If more wealth is produced and an increased quantity of wealth is bought and sold for money, general prices must decline unless a larger quantity of money is brought into circulation."

When Prof. Fawcett says that "general prices must decline unless a larger quantity of money is brought into circulation," he is but stating in another form of phrase that the value of money increases as its quantity diminishes. This is the quantitative theory. Prof. Fawcett further says:

"The amount of money required to be kept in circulation depends upon the amount of wealth which is exchanged for money. Hence, ceteris paribus, the amount of money ought to increase as the population and wealth of a country advance." --Political Economy, page 371.

If the amount should be increased, surely the increase must be an increase of the quantity. Mr. N.A. Nicholson, of Oxford, in his Science of Exchanges, says:

"Whatever substance may be used as currency, an excessive quantity of it (more than is required by the wants of the community) necessarily causes a diminution of its purchasing power."

To show that even gold is subject to the same law of quantity, Mr. Nicholson asks:

"Could a currency, then, consisting entirely of the best gold coin only, be depreciated ?"

To which he replies:

"Certainly, provided that the exportation of gold could be altogether prevented, the amount in use would soon become greater than what was required by the wants of the community, and its purchasing power would diminish in the same proportion."

What Mr. Nicholson means by the "wants of the community" is the amount of money necessary to sustain prices at the international level.

Earl Grey, writing to Mr. Grenfell, one of the governors of the Bank of England, and referring to Ricardo, says:

"I would remind you (though it is hardly necessary to do so) that in his admirable pamphlet on this subject, he (Ricardo) has shown the value of paper money issued by the authority of the state to depend upon its amount as compared to the wants of the state in which it circulates. No one, I believe, now doubts this to be true, and experience has proved that inconvertible paper money will circulate not only without depreciation, but even at a premium if the issues are sufficiently limited." [Letter from Earl Grey, dated May 31, 1881. Quoted in The Bimetallic Controversy, by Gibbs & Grenfell, page 160.]

Prof. Shield Nicholson, of Edinburgh, in an article in the Nineteenth Century for December, 1889, states that every economist of repute since Ricardo's time has been an advocate of the quantitative theory of money.

Even a so-called debased coinage --that is, a coinage, each piece of which contains a smaller quantity of metal than the law prescribes-- will maintain itself at par provided the total number of coins put in circulation be not too large. On this point, as I have shown, Ricardo says, that in circulation such coins will pass for the quantity of metal they ought to contain, provided they be "not in too great abundance."

With reference to this relation of quantity, and to the absolute necessity of an increase of money pari passu with the demands for it, Prof. Perry, of Williams College, says:

"When, however, enterprises are multiplying and exchanges are being permanently increased in number and variety, then there must be a larger volume of money." ---Principles of Political Economy, page 409.

With regard to the irredeemable paper notes of the Bank of England, issued on the suspension of specie payments in 1797, Prof. Perry says:

"Cautiously issued at first, bank paper continued at par for several years after the suspension, which proves that when Government possess the monopoly of issuing paper money, and carefully limits its quantity, and both receives and pays it out at par, it may keep an inconvertible paper at par, or even by sufficiently limiting its quantity carry it above par."

How do gold-standard Senators, who talk of a sixty-cent dollar, explain the fact of a one-cent paper pound-sterling being at par with gold, or even at a premium over gold, without a penny's worth of gold existing in the entire kingdom ? I suppose they will say the notes were sustained by the "credit of the government." Then, why did the credit of the government allow the notes later on, when they were issued in larger quantity, to depreciate in value ?

All these great authorities agree, as I have shown, that the quantitative theory of money is correct, and that, instead of applying merely to gold, it applies to all money without discrimination or distinction of material.

Valuable Testimony of Delmar.

Alexander Delmar, whose very philosophical work on Money and Civilization I have examined and which is not so often quoted as this author deserves, says on pages 11, 12, and 13 of his introduction:

At long and adventitious intervals, like those great tidal waves which increase the disturbance or an always disturbed ocean, those openings of placer countries --Spain, Gaul, Africa, Spanish America, Brazil, California, Australia-- each of which caused a prodigious rise of prices and threw society into new forms.

Then, as if he would guard carefully against the frequent mistake of regarding the volume of coin and precious metals as being the only element to consider in the volume of money and regulation of value, he says:

Of all money now (1886) in circulation in Europe and America one half consists of paper notes. If these notes were suddenly demonetized or destroyed it is evident that in consequence of the increased work which each coin would have to perform, its value or purchasing power would be greatly enhanced and prices would fall. On the other hand, to the extent paper notes are added to the circulation prices will rise. * * * The purchasing power of the precious metals is susceptible of being depressed below the cost of producing them, by any circumstance that tends suddenly or greatly to augment the volume of money whenever the same is composed wholly or partly of such metals.

He has brought out here the essential point in determining value of coin to be the consideration of the total volume of both coin and paper money in circulation, and this should be understood better than it is by both mine owners and those engaged in other pursuits. Delmar claims that in his Science of Money he has---

Shown by numerous arguments and references to history that money did not and could not consist of any less number of coins or notes than the whole number, their nature being such that they could not be used, nor could their value be fixed without reference to one another; in other words, that the unit of money [for consideration of its value] was all money, and, therefore, that its value depended upon its volume; * * * that, therefore, money was related to equity or the maintenance of equitable relations between capitalists and laborers; that, like other measures, the most necessary and essential characteristic of money was specific limitation (of mass or volume): in other words, that to measure with precision and with justice the whole sum of money must be fixed at some more or less constant ratio to the volume of exchange.

But while quoting from Delmar I wish also to enforce the point I so strongly urge, that to protect property interests of the laboring world and the rights of mankind, and to simplify the whole subject of money as a standard of equity among the people, the State or Government must hold and use the power to regulate the volume of money, all kinds of money, in circulation, and to this end can not leave the coinage and issuance of either paper or metal money to the whims and interests of private corporations. If either should be let out to corporations it would be better to let out to them the coinage of the precious metals, for the very limitations on their production keep the banks within approximate bounds.

In speaking of the legislation of about two centuries ago by which the leading States of Europe gave over their control of volume to the exigencies of mining operations and coinage on private account and option Delmar says, pages 13 and 14:

Previous to the act of 1666 in England and 1679 in France, which gave free coinage to both gold and silver and allowed the volume of money to depend upon the exigencies individuals to add to or subtract from the volume of coin at their will, the State no longer keeping control of volume, as it should money was a comparatively simple subject, readily understood and as readily susceptible of regulation.

This helps us to understand that even the question of free coinage of either gold or silver must be considered in relation to the effect of such coinage on the total volume. We must never forget, if we would simplify and grasp the money question, that it is the volume or total number of units or dollars in circulation that controls and regulates the value of the units and the general range of prices on all exchangeable forms of wealth on which the welfare of mankind depends.

The Change of Volume of Money in its Ratio to Volume of Business.

To test our proposition we must start with already adjusted prices, and we will find that every great increase of volume in any country raises the prices in that country. Every great contraction lowers prices. All history and experience and reason teach this principle.

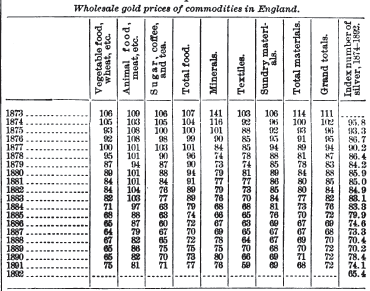

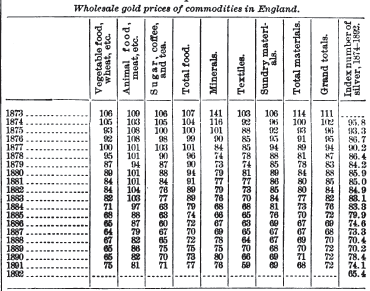

When nations are on a metallic basis of money, as on a silver basis, like India has been until within a year or so and like China has been, in part at least, silver being cheap and abundant for them to use as money and add to their volume, prices in silver are maintained. This has been precisely the effect in India and China. There has been no general decline of prices in either India or China in their silver money. Index number tables on leading commodities will show this --while in our country demonetizing silver and pushing by contraction toward the gold standard our prices on all leading products have, as a consequence, fallen about 50 per cent.

At the end of twenty years after the demonetization of silver in our country and Germany, under which influence silver has been rendered more abundant for China, India, and others of the Oriental countries, while gold, by the greatly increased demand for it, has almost doubled in value in the mad scramble for a gold standard in our Occidental countries, we find wheat 43 per cent higher in China than it was in 1873, rice 19 per cent higher, beans 13 per cent higher, in their silver money. (Appendix to Coinage Laws, page 463.) In India, wheat was 18 per cent higher in Bombay and 3 per cent higher in Calcutta, while rice, that comes in competition with one of our Southern products, was over 60 per cent higher in these places at the close of 1892 than they were in 1873, when we demonetized silver. (Coinage Laws, page 789.)

But are wheat and rice and other food products that we produce higher in this country than they were then ? In other words, while their prices have been well maintained in their silver currency, what has occurred to our prices in our foolish and criminal following of the Anglo-American gold and bond conspiracy ? Our prices, as every intelligent citizen in Nebraska and throughout the West knows, has gradually gone the other direction and is still going down, and the bottom for wheat prices resting on the ups and downs of money in circulation, may yet go to 20 cents per bushel in Nebraska if the money power can sufficiently control and contract the money volume.

Who gets the Benefits of this Gold Standard ?

Who gets the benefits among the nations we have mentioned in the attack upon and demonetization of our own silver ? Every nation except America. We get the losses, while England, using gold, and India and China, using silver, get the gains, and the mill still grinds and the bank and bond and gold advocates from Washington to Wall street tell us that we must hold on to the gold standard, issue bonds, and turn over the issuance of paper money to the tender mercies and financial erudition of the banks.

How does it work ? This way. An importer of wheat into England can say: "Here, I will give you Americans 65 cents per ounce for your demonetized silver." Before we demonetized our silver it cost him $1.29 per ounce. He takes it over to India, where silver has been the standard currency, and can get about as much wheat for the one ounce as he did twenty years before, although the silver to buy it with cost him only half as much. This keeps up prices in India and China in their currencies, but cheapens cost to Europe, and our wheat, sold not on silver but on gold prices, have fallen one-half, and our exports are retarded while Oriental exports have been greatly encouraged. Statistics will show that in wheat, cotton, an some other articles that come in competition with our productions the exports of India have increased during the last twenty years to a marvelous extent.

Europe, that produces no silver, and the Orient, which absorbs silver, both get the benefit, while our country loses by the same operation, by reason of the gold standard and appreciated dollars, about $300,000,000 per year on wheat alone and from one to two thousand millions of dollars per year on our entire production of goods and grains and metals. This is bank and gold-standard financiering. Do you not think it is time for the workers of this country to do a little financiering on the property side of this question, and raise prices on what they deal in by the restoration of silver to our people by free coinage ?

You say this will cheapen money.

Yes, to raise prices is to cheapen money in exchange for products, and to say the same thing in another way, to cheapen money by making it more abundant is to raise the general range of prices. This is the invariable and scientific law of money in every country and in all history. No competent student of the money question, here or elsewhere, will deny this. Other things being equal, an increase in volume of the money in any nation in proportion to the trade and work for money to perform will, in all cases, raise prices.

Then let us reduce the dishonestly high and scarce money of America by remonetizing silver or issuing legal-tender Government notes, or both, until we revive prices, profits, and industry, and secure more honest dollars in relation to the products, property, and debts of our own people.

Finally, I will say that prices of goods in China or England or France or elsewhere is only an indication of the ratio between the volume of money and the mass of exchangeable wealth in the one country, and can not therefore test the status of prices in other countries. There is no exact ground to test the effect of per capita circulation and prices in countries widely different in their habits of trade and quantity of business, but the test comes by noting change of prices in each country when the volume is changed in that country.

There is according to estimates of a reliable authority which I have recently examined (speech of Senator John P. Jones on repeal bill, page 298, in pamphlet form) about $98,000,000,000 worth of production and commerce in the United States annually. This is an enormous amount and probably six to ten times as great as the production and trade of China. I have no means of knowing precisely as to this. Now, $2 per capita, mentioned as the circulation in China, would give us at least $800,000,000 of circulation for China, which is very close to one-half of our circulation, although the total of her trade may not even be one sixth or one-tenth as great as ours. So in proportion to her trade and need for money she may have far greater circulation than our country.

Now, having mentioned the question of export of gold in connection with currency and prices, I desire to take up this clamor about raids or withdrawals of gold from the gold reserve in our Treasury.

Who is Responsible for Continuance of the Raid.

I am convinced that the raids on the gold reserve are continued only by the option and consent of the Administration and these are my reasons:

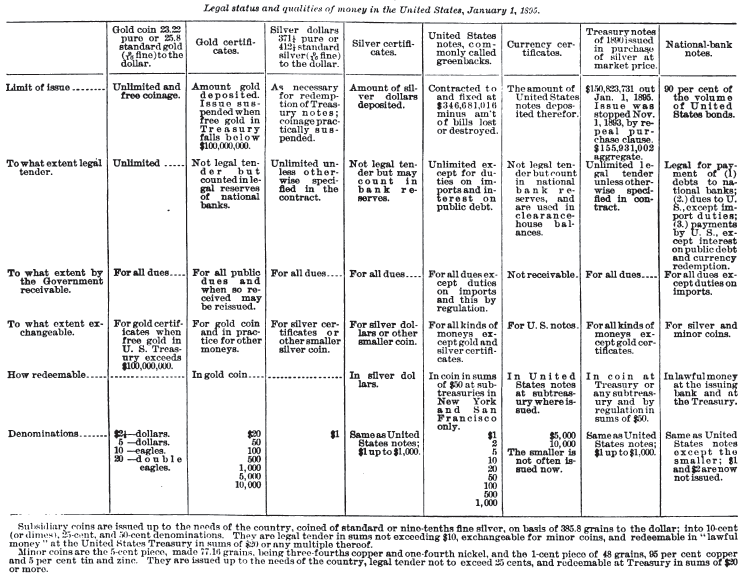

1. Greenbacks and Treasury notes, of which there are nearly $500,000,000 in existence, are used by the raiders to take the gold out of the Treasury.

2. These are all payable in silver as well as gold; are all payable in coin. All obligations of the Government are coin or bimetallic obligations, practically, except gold certificates.

3. There is abundance of silver in the Treasury that ought to be paid on these bimetallic or coin obligations, and if not a sufficiency coined to pay all coin obligations that may be presented, the Secretary of the Treasury can, under the laws existing, coin more at his discretion.

4. The announcement by the Secretary that he should from this hour forward use the right and option of the Government of paying all coin obligations in silver coin at any time when the amount of the gold reserve in the Treasury was below, say $100,000,000, would instantly stop the presentation of any excessive amount of such coin obligations and protect the gold reserve.

The honorable Secretary of the Treasury is not using the legal right and option of paying coin obligations favorably to the Government and in the interest of preserving the gold reserve in the Treasury when he fails or refuses to pay out silver while it is more abundant than gold in the Treasury.

The option of payment is always and wholly the right of the debtor --the one who pays-- and by no fair construction can become the option of the creditor.

France and other nations, with their more or less complete control of the central bank, exercise their option for the side of the Government, and not for the disadvantage of Government, when given by law or contract to the Government as debtor. Our own Treasury is the only place among the civilized nations of the earth where the legal right and option is not used favorably to the Government. But here the gold speculators of the world may raid freely for gold with bimetallic or coin obligations.

The last paragraph of section 2 of the Sherman silver-purchase law of 1890, in declaring for a policy to maintain silver and gold metals at a parity, does not destroy the right or option of the Government to pay the coin of either metal on all coin obligations.

The Stanley Matthews Resolution.

The Stanley Matthews resolution, carried by a strong majority in both Houses of Congress early in 1878, is still in force, as declaring the intent of Congress, and ought to be obeyed.

Let the Secretary do his plain duty and exercise for us our legal and reserved right and option to pay in silver, and the raid on the gold reserve is ended. I will quote the resolution from the speech of Senator Jones, together with the comments that he made thereon during the debate on the repeal bill:

Whereas by an act entitled "An act to strengthen the public credit," approved March 18, 1869, it was provided and declared that the faith of the United States was thereby solemnly pledged to the payment in coin or its equivalent of all the interest-bearing obligations of the United States, except in cases where the law authorizes the issue of such obligations had previously provided that the same might be paid in lawful money or other currency than gold or silver; and

Whereas all the bonds of the United States authorized to be issued by the act entitled "An act to authorize the refunding of the national debt," approved July 14, 1870, by the terms of said act were declared to be redeemable in coin of the then present standard value, bearing interest payable semi-annually in such coin; and

Whereas all bonds of the United States authorized to be issued under an act entitled "An act to provide for the resumption of specie payments," approved January 14, 1875, are required to be of the description of bonds of the United States described in the said act of Congress approved July 14, 1870, entitled "An act to authorize the refunding of the national debt;" and

Whereas at the date of the passage of the said act of Congress last aforesaid, to wit, the 14th day of July, 1870, the coin of the United States of standard value of that date included silver dollars of the weight of 412½ grains each, declared by the act approved January 18, 1837, entitled "An act supplementary to the act entitled 'An act establishing a mint and regulating the coins of the United States,' to be a legal tender of payment, according to their nominal value for any sums whatever: Therefore,

Be it resolved by the Senate (the House of Representatives concurring therein), That all the bonds of the United States issued or authorized to be issued under the said acts of Congress hereinbefore recited are payable, principal and interest, at the option of the Government of the United States, in silver dollars of the coinage of the United States, containing 412½ grains each of standard silver; and that to restore to its coinage such silver coins as a legal tender in payment of said bonds, principal and interest, is not in violation of the public faith nor in derogation of the rights of the public creditor.

A motion to refer that resolution to the Committee on Finance of the Senate was voted down. A very influential member of the Senate, the then Senator from Vermont, Mr. Edmunds, moved to strike out such phraseology of the resolution as declared silver to be legal tender in payment of the bonds and to insert instead phraseology which would make the bonds "payable in gold or its equivalent." But, not satisfied with these words, the distinguished Senator from Vermont in addition moved to incorporate in the resolution the following declaration:

And that any other payment [that is to say, any other than gold or its equivalent] without the consent of the creditor would be in violation of the public faith and in derogation of his rights.

This proposed amendment brought sharply before the attention of the Senate the very point in issue. What was the decision of the Senate upon that point ?

The amendment of the Senator from Vermont was voted down; the vote standing-- yeas 18; nays 48. This means that nine years after the passage of the act to strengthen the public credit which guaranteed to the creditors payment of the principal and interest of their bonds in coin and seven and one-half years after the standard of the coin was named, 48 out of 66 Senators of the United States repelled the assertion or implication that the bonds were payable in gold alone.

This resolution passed the Senate on January 16, 1878, by a vote of 43 yeas to 22 nays, and passed the House on the 29th of same month by 189 yeas to only 79 nays, and this ought to be a sufficient guide as to the intent of Congress regarding the payment of the public debt, including even the refunded bonds, and it repels the assumptions of the money power that coin obligations must be paid in gold alone.

It is strange how pure and refined some men on this floor have become when they, in the face of such strong declarations and in the face of the plain provisions for coin payment recited in the acts of Congress on which the bonds have all been issued, even these last ones of doubtful authorization, for which the specie-resumption law of 1875 is quoted as sufficient warrant, and knowing how closely bond-holders scrutinize the terms of payment --I say it is strange that men here or anywhere claim that the Treasury gold must be kept open to the raid for it on all kinds of coin obligations, while the reserved right and option of our people to pay in silver coin as their interests may require is so completely retained although ignored by our administrations.

Did Silver Coinage under the Bland Act drive out Gold ?

On February 28, 1878, the so-called Bland Act, providing for the coinage of not less than $2,000,000 per month of silver dollars, also restored their full legal tender without limit. The Wall street press raised a howl, as usual, and started to scatter throughout the country their usual false prophecies of panics and danger which failed to materialize for the occasion.

About three weeks after the passage of the Bland law of 1878, a conference regarding silver and the resumption of specie payments with the now Senator John Sherman, of demonetization fame, who was then Secretary of the Treasury under President Hayes, was held by the Senate Finance Committee. The Secretary, Mr. Sherman, for the time, gave evidence bearing on silver that will prove how surely silver was held to be the proper payment on all coin obligations of the Government. The chairman of the committee asked Mr. Sherman, "What effect has the silver bill had, or is likely to have, upon the resumption of specie payments?" Remember that the Bland law was now in operation. After saying "I shall have to confess that I have been mistaken myself," and after stating some adverse effects that he believed the new law would have, he goes on to state the advantages.

John Sherman's Testimony as Secretary of the Treasury.

On the other hand I will give the favorable effects. In the first place, the silver bill satisfied a strong public demand for bimetallic money and that demand is, no doubt, largely sectional. No doubt there is a difference of opinion between the West and South and the East on this subject, but the desire for remonetization of silver was almost universal. In a government like ours it is always good to obey the popular current, and that has been done. I think, by the passage the silver bill. Resumption can be maintained more easily upon a double standard than upon a single standard. The bulky character of silver would prevent payments in it, while gold, being more portable, would be more freely demanded, and I think resumption can be maintained with a less amount of silver than of gold alone.

Senator Bayard. You are speaking of resumption upon the basis of silver, or silver and gold ?

Secretary Sherman. Yes, sir; I think it can be maintained better upon a bimetallic, or alternative standard, than upon a single one, and with less accumulation of gold. In this way remonetization of silver would rather aid resumption. The bonds that have been returned from Europe have been readily absorbed -- remarkably so. The recent returns in New York show the amount of bonds absorbed in this country is at least a million and a quarter a day. We have sold scarcely any from the Treasury since that time. This shows the confidence of the people in our securities, and their rapid absorption will tend to check the European scare.

Senator Voorhees. That shows, Mr. Secretary, that this cry of alarm in New York was unfounded. Then this capital seeks our bonds when this bimetallic basis is declared !

Secretary Sherman. Yes; many circumstances favor this. The demand for bonds extends to the West and to the banks.

Senator Jones. Then, in its effect upon the return of the vast amount of bonds you refer to, would there not be an element of strength added in favor of resumption, in that the interest on these bonds returned would not be a constant drain upon the country ?

Secretary Sherman. Undoubtedly.

Senator Jones. Would the fact that they come back enable us to maintain resumption much easier ?

Secretary Sherman. Undoubtedly.

Senator Bayard. You speak of resumption upon a bimetallic basis being easier. Do you make that proposition irrespective of the readjustment of the relative values of the two metals as we have declared them ?

Secretary Sherman. I think so. Our mere right to pay in silver would deter a great many people from presenting notes for redemption who would readily do so if they could get the lighter and more portable coin in exchange. Besides, gold coin can be exported, while silver coin could not be exported, because its market value is less than its coin value.

Senator Bayard. I understand that it works practically very well. So long as the silver is less in value than the paper you will have no trouble in redeeming your paper. When a paper dollar is worth 98 cents nobody is going to take it to the Treasury and get 92 cents in silver; but what are you to do as your silver coin is minted ? By the 1st of July next or the 1st of January next you have eighteen or twenty millions of silver dollars which are in circulation and payable for duties, and how long do you suppose this short supply of silver and your control of it by our coinage will keep it equivalent to gold when one is worth 10 cents less than the other ?

Secretary Sherman. Just so long as it can be used for any thing that gold is used for. It will be worth in this country the par of gold until it becomes so abundant and bulky that people will become tired of carrying it about; but in our country that can be avoided by depositing it for coin certificates.

But possibly one may say that the recent Treasury notes of 1890 were issued under a law pledging parity. Yes, possibly, but not such a parity as keeping silver in subordination to gold. That is not parity, but imparity, as we may say, or inequality.

Besides, as we have at another time stated, this incidental injection or stump-speech clause about parity that has become the scapegoat on whose head were laid the crimes of Wall street and her allies --laid by the high priesthood of the Aaronical golden calf worshipers can not blot out or override the express statement of the act in the mandatory part of the same law that these Treasury notes should be redeemed "in coin."

Section 2 of the law of July 14, 1890, is plain enough on this point, but section 3 provides that there shall be coined of silver, "under the provisions of this act, as much as may be necessary to provide for the redemption of the Treasury notes herein provided for."

Where is the stump-speech, double-construction, parity-policy clause against such positive specific provisions to redeem in silver coin as well as gold ?

Notwithstanding the intent and plain provisions of the law, from tables I shall give you a little later in my remarks you will find that while the scheme of the money power was on hand to drive Congress to repeal the silver part of that law, Secretary Foster, and the present secretary following in the same line, made heavy payments in gold, instead of silver, as the interest of the Government demanded, in redemption of these same silver-purchase Treasury notes --ranging from one to eight million dollars in gold per month for the raiders.

Referring to this parity scapegoat clause, as I have termed it, I will call attention to the reply of Senator Jones of Nevada to Senator Vilas in his speech on the repeal bill:

Mr. Vilas. I do not suppose that the Senator can make the answer he is making now without knowing that the reason why the silver dollars have been held at par is because the Government has done it by force of its pledge of parity, and by the practice of the Treasury in maintaining it.

Mr. Jones of Nevada. I can say to the Senator that I was on the conference committee which made what he calls a "pledge of parity," and there was no "pledge of parity" given. There is not, in my judgment, a lawyer in this body who will tell me that under any rule for the interpretation of statutes a stray expression, such as the Senator calls a "pledge of parity," without any provision for its enforcement, is more binding than a provision distinctly and expressly mandatory, specifying with precision what, under certain circumstances, the executive officers should do.

There was never any promise made that the silver dollars should be exchanged for gold. And as every man knows, during the very period in which the gold standard press was stating that the people of this country feared the silver dollars would go to a discount, those very dollars were going to a premium over gold. There was never a more impertinent declaration put before a people than that the recent panic was occasioned by any fear on the part of the people of this country that their silver money might not retain all its value. What better proof can be cited of this than that silver dollars went to a premium of 3 per cent over gold ?

During all the period of the panic I never heard of a man taking any portion of the money of the United States, whether a silver dollar, a greenback dollar, a Treasury note, or note of any other kind, to the Treasury to be exchanged for gold. In all the "runs" that were made upon the banks and all the money that was taken out of the Treasury no effort was made by our people to get gold. The fear entertained by the people was not of the kind of money in which they would be paid. What they feared --and subsequent events proved their fears to be well-founded-- was that the banks did not have any form of money in which to pay.

Retiring Greenbacks to Secure the Issue of Bonds.

Just at present the money powers are trying to secure the destruction of the United States notes or greenbacks and secure the issuance of bonds instead, and the advocates of the pending bill are seeking to turn over the issuance of all paper currency to both State and Federal banks.

So now the raid is by use of greenbacks instead of Treasury notes, and this will answer for them the double purpose of discrediting the greenback and preparing an excuse for the Secretary to sell more bonds to the raiders to get the looted gold back again.

It has been shown many times that the teaching and prophecy of our Wall street financiers are nearly always wrong whenever they put forward their efforts to influence financial legislation. Under the plea, of standing for "honest money" they have stood for an appreciating money by contraction and demonetization until they have broken down prices, mined the investors in property and productive enterprises, and have given us the most dishonest money the world has ever seen. Under the plea of desiring to maintain silver at parity with gold they have done everything in their power to prevent the possibility of parity, closing the mints and keeping silver out of use as far as possible, and then pretending they do not know why price of silver bullion has gone down.

They talk against the greenbacks and legal-tender notes of the Government as being "founded on nothing," meaning on Government credit, and yet make their own notes redeemable in greenbacks and founded on Government bonds, both of which rest purely on Government credit.

They assured us of "relief from the financial stringency" and the raiders on the gold reserves if the purchasing clause of the Sherman law of 1890 was repealed. By these assurances and various other means the law was repealed November 1, 1893. Instead of relief and prosperity following, the lowest prices ever known have overtaken all products, and as to the raiding of the gold reserve by presentation of greenbacks, it has suffered greater depletion during this last year, 1894, than in all the fifteen

years preceding.

Did Repeal of the Purchase Clause of the Sherman Law Stop Gold Raid ?

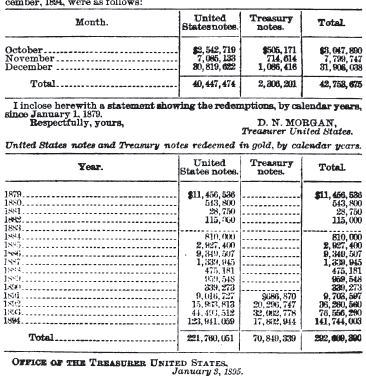

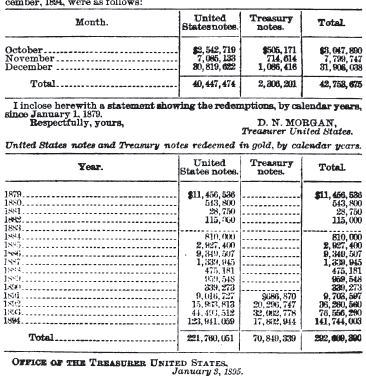

That none may question the statistics I have given on the gold redemption of the United States notes since 1879 in comparison with the raids of the last year, I will insert the following tables and a brief letter from the honorable Treasurer of the United States, bringing the computations by months down to the beginning of this month, and from current reports the raid on our gold this month still continues:

Treasury Department, Office of the Treasurer,

Washington, D.C., January 10, 1895.

Hon. H.A. Coffeen, House of Representatives:

Sir: In compliance with the request made in your memorandum of this date, I have the honor to say that the redemptions of United States notes and Treasury notes in gold during the months of October, November, and December, 1894, were as follows:

Remember that the gross exports of gold give no indication of the net exports. Much of the gold that was drawn on Treasury notes and others while the scare was being worked up against Treasury notes, and to secure the repeal of the silver-purchase clause was shipped back again from Europe in the same kegs that contained the gold when exported.

Now, having stopped the issue of legal-tender Treasury notes, the scare and clamor is worked up against the United States notes, or greenbacks; so they are being used, as you see from the tables, instead of the Treasury notes of 1890. Will the people be caught again by the tricks of the bank and bond and gold conspiracy and allow the complete destruction of their legal-tender greenbacks and the issuance of interest-bearing gold bonds --not coin but gold bonds-- instead ?

Not by my vote shall the conspiracy win as long as I shall represent the interests of Wyoming on this floor. Let us stand by the greenbacks and silver as a permanent part of our currency.

How the Banks Save the Country.

The redemption of greenbacks in gold began January 1, 1879, under the law known as the specie resumption act, and from that time to January 1, 1894, a period of fifteen years, the amount of gold paid out on United States notes, or greenbacks as commonly called, was less than $98,000,000 for the entire period, being an average of less than $7,000,000 ($6,521,266) per year. This brings us to the year 1894, just closed, the first calendar year since the repeal of the silver-purchase clause, pushed through Congress by the gold and bank power to "save the country and stop the raids on the Treasury gold." Did this stop it ? Did it even reduce the payment of gold on greenbacks below the average of $6,521,266 per year ?

Oh, no; here, as in nearly all other claims and prophecies, they have again failed.

The payment of gold to the raiders in 1894 under this repeal measure, entirely cutting off the coinage of silver, has been over $123,000,000 --a sum far greater than all paid out during the fifteen years preceding, including silver coinage under the Bland Act for over eleven years and the purchase of silver for the remainder of the period up to the time of the "great unconditional."

It would at the preceding average rate take over nineteen years to deplete the Treasury of as much gold as has been looted from the Treasury by the gold and bank combine within the last twelve months on greenbacks alone, leaving out of the account the manipulation of Treasury notes also. And during this last month of December nearly one-third as much gold has been taken out by these vicious processes of the false prophets as in fifteen years before.

Why are the People not Protected at the Treasury ?

Who can rely upon such sources of teaching ? Why should Congress longer listen to them ? On what important financial proposition have they ever taken position since the gold conspiracy began but what has been directly or indirectly dangerous and detrimental to the people, who ought to have a circulation of currency independent of bank manipulation and who ought to have a Government and a Congress that would give the people such a currency ?

Why is it not done ? Why are the people not protected ?

Because the people have too long been following the false teaching and the false prophecy of the money power. And because, too, I fear, that we have not had an Administration and Secretary of the Treasury since the days of Lincoln and Johnson but what has allowed the money power the benefit of every possible construction, and sometimes bold misconstruction, of the laws, and as far as possible cut off the people from their highest and best legal rights and options to pay all coin obligations in silver as well as other lawful money for payment.

To-day, in one hour of bold, patriotic action, the raid on gold would be stopped forever if our Administration and the Secretary would pay out silver in all coin redemptions properly. I know not what others may think of the actions of some of our highest officials during this twenty-five years' struggle with the money power, but as for me, "I would rather be a dog and bay the moon than such a Roman."

Let Congress Resist Executive Interference on Legislative Matters.

I can not attack motives. I must, however, be allowed to attack ignorance and error in method. I must be permitted to appeal to this House --a parliament than which none should be found on the face of the earth more honorable and intelligent and true to the people --so if possible to arouse them to break loose and throw off the hypnotic spell that the glare of wealth and power has thrown over this legislative body.

In our sphere as Representatives in the legislative branch of this Government there is no power greater than ours. Our commissions are from the highest sources --the sovereign people themselves. We do not derive our authority on legislative questions from the Chief Executive, and we ought to withstand encroachments upon our prerogatives from that source as we would those of the most insidious enemy that could undertake the subversion or subjugation of our country.

We must prove ourselves men and patriots and true to the trust the people have placed in our hands. Is this a hard thing to do ?