---[

in 1887,

Albert Michelson and Edward Morley will carry out a simple experiment that will show there is æther and non-moving Earth

in 1888 George Eastman will release for sale the first consumer camera "Kodak"]

to enable national banking associations to extend their corporate existence

Be it enacted by the Senate and House of Representatives of the United States in Congress assembled: That any national banking association organized under the acts of February 25, 1883, June 4, 1884, and February 14, 1880, or under sections 5133, 5134, 5135, 5138 and 5154 of the Revised Statutes of the United States, may, at any time within the two years next previous to the date of the expiration of its corporate existence under present law, and with the approval of the Comptroller of the Currency, to be granted as hereinafter provided, extend its period of succession by amending its articles of association, for a term of not more than twenty years

Mr. Burrows, of Missouri [Joseph Henry Burrows (May 15, 1840 -- April 28, 1914) greenback national; ordained minister; until very recently, he was member of the Republican party and supporter of republican policies.]. Mr. Speaker, if Congress had one single mind and if its opinions could be uttered through the medium of one tongue, I would like to listen to the answer which this Congress would give to the questions which are suggested by the bill under consideration. This bill (H.R. No. 4167) is the result of a complex process of gestation in the Committee on Banking and Currency, and bears the title of "a bill to enable national banking associations to extend their corporate existence." As such it is a matter of serious import to the people I represent, as well as to the people of the United States at large; and I propose, Mr. Speaker, to discuss briefly, in a somewhat Socratic method, some of the salient features of this bill. The antithesis of the measure before us is the cornerstone of the National party, which I have the honor to represent in part on this floor.

The measure before us is the rock of offense of both the old parties of the country against the welfare and wishes of the people. Were I to include, as I very properly might, upward of sixty Democrats and nearly a score of Republicans, with the little group of Nationals on this floor who owe their selection as Representatives here to their antagonism to the purposes of this bill, I might claim that no one measure, not even the tariff, had so vital a hold upon public sentiment, had so much to do with the character of this House and has so much to do with the character of the next two Congresses that are to meet here, as the measure which is being driven through this body with unbecoming and inconsiderate haste at the bidding of the favored few, the privileged class, the potent plutocrats, the commercial cliques, and the corporate cabals who demand the passage of this bill in their interests, with as little discussion as possible, and with all the speed that the fear of an awakened and growing public sentiment can urge to the flying feet of the financial pirates who are getting to their castle with the plunder of twenty years upon their backs, and seeking to have Congress bar the door against their pursuers by slipping the bolt of this bill as a law to guard their treasure for twenty years to come.

What, Mr. Speaker, I ask, is the reason for this bill ? Speaking for the people generally who do not own banking franchises, and for the people of my own State and district in particular, I ask this Congress, What do you mean to do by passing this bill ? Who ask for its passage ? What interests are to be conserved ? What evils are to be averted ? What errors are to be corrected ? And what benefits are to result, and to whom are the benefits to accrue from the passage of this bill ? The bill proposes to extend the existence of a class of corporations that exist not for the purpose of producing anything, not for agricultural, manufacturing, educational, charitable, or even strictly commercial business purposes.

A class of corporations that add not a dime to the wealth or intelligence of the people; a class of corporations that in the present state of civilization do not contribute to society as much as a traveling circus that amuses the multitude, nor add to the security of our finances half as much as a modern iron safe that scarcely demands even the tithing of a patent royalty for a service that is actually greater than that of the associations known as incorporated banks throughout the whole Union; such a class of corporations are here demanding the sanction of Congress for a further lease of power for twenty years --to do what ? Why, they propose to furnish the people with a paper currency that is as much superior to the old State bank currency as that was superior to the cowry of the African coast, says the representative of these banks.

I admit it; but I ask what of it ? As the lawyers say, I demur to this statement. I wish to know why these corporations should be chartered to do that for the people which they can do so much better for themselves ?

I would like some of the many gentlemen on this floor who are either the officers, directors, or stockholders of some of these national banks, and who will vote on this measure in which they have a direct pecuniary interest, or I would ask even those more judicial members, who favor this bill without a direct pecuniary interest, if they can give me one reason, just one good and valid reason, why they ask for the existence of a chartered monopoly or class to be created or perpetuated between the people and their Government that shall have delegated to it the sovereign power of issuing that which passes current as money in this country when the Government itself issues a paper currency as much superior to the notes or current debts of these national banks as their notes, when indorsed by the Government, are superior to the old State-bank notes ?

Nobody wants, nobody argues for, no one dreams of a return to the old system of paper currency that existed prior to the rebellion. There has not been heard in this Congress, nor for years before it, the voice of a solitary member on this floor advocating a return to the old State-bank system of currency; and when I see, as I constantly do, that gentlemen in the advocacy of this bill are constantly throwing up the false cry of "State banks or national banks," and asking us if we who oppose the national banking system would be willing to return to the old State-bank currency, I am compelled to declare that these gentlemen not only misrepresent the national party, but are raising a false issue to divert attention from the real issue now before the people.

The issue is not between the old State banking system and the present national banking law, any more than there is an issue between the old wooden plow of a century ago and the steam gang-plow of steel to-day, or between the dug-out boat of the savage and the steel steamer of our day. Men are not so conservative as to forever cling to that which has been supplanted by a better thing.

We no longer insist on wampum and coon-skin currency, although we know that at a time in our history they were the best and most acceptable in general use. So, too, we have relegated to the lumber-room and museum of the past the old State-bank money of 1860, and we who oppose national-bank currency have no more intention of using it again than the cotton factories or fabric-makers of to-day have of abandoning the inventions of Arkwright and Jacquard for the old spinning-wheels of our grandmothers in the forgotten attics of our older homesteads.

Where, then, Mr. Speaker, is the issue ? Clearly not between the best and the worst, but between the better and the best; not between the effete and the useful, but between the useful and the improved or more useful. Steam no longer competes with horse-power, its supremacy being conceded; but electricity is beginning to dispute many fields with Steam. So, too, the Treasury note is competing with the national-bank note for recognition in law of the supremacy that is already conceded to it by popular estimation.

The issue is between the United States and the favorite class of bankers for whom the Government has been indorsing for twenty years. The people propose to go into the business for themselves, instead of indorsing for an ungrateful and greedy class, who demand and receive pay from the indorser, upon whose credit they thrive.

The constitutional prohibition against any of the States making anything but gold and silver a legal tender is accepted in good faith by the party most earnestly opposing national-bank currency, and with it we accept in the same spirit the fact that the Constitution has made the General or Federal Government the sole power to issue or coin lawful money of the United States, whether of metal or of paper. The power to coin or make money having been delegated by the States to the Federal Government is exclusively vested in the General Government; and as if to emphasize the perpetual or irrevocable nature of this grant of supreme power by which the States, for the common welfare and convenience of all, divested themselves of those parts of their sovereignty which they conferred upon the Federal authority to create the nation, the tenth amendment to the original Constitution declares that "all powers not herein granted are reserved to the States or to the people thereof."

Like the powers to levy taxes, duties, and imposts, the powers to declare war, to make treaties, to maintain an army and navy, to establish post-offices and post-roads, the power of making, coining, or issuing the money of a nation is one of its most important sovereign attributes. These are powers that every nation guards with zeal, and which none allow to be infringed upon with impunity. Why, therefore, should we create, countenance, or continue a favored class of citizens, or of artificial persons known as corporations, to whom we unlawfully and unconstitutionally delegate one of the sovereign attributes and functions of the Government ?

What excuse have we for giving to corporations the power to issue money or currency any more than to create another class of corporations, like the great manufacturing companies, to levy the tariff, or a part of it; or to still other corporations, like the railway and express companies, to establish post-offices and post-roads; or to give to combinations of merchants duly incorporated the power to make treaties; or to lawyers the power to declare war, or confer upon the Grange organizations the function of regulating taxation or the issue of patents ?

There is not a whit more reason or excuse for the one than for the other of these methods; and since the preposterous character of an entire government by corporation, worse than the old guilds of London, is apparent to every one, and since we have by indirection and maneuver already far too much of government by corporations, it becomes every man in this House and in this land to see to it that he take his stand on the solid ground of popular rights and of constitutional government in this issue as against class privileges and the incongruous government by corporations that the present anomalous financial laws of this country now exhibit.

That portion of our currency that consists of coin, even to the paltry copper and the almost intrinsically worthless three-cent nickel coin, is so jealously regarded as the sole issue of the rightful authority of the General Government that the severest penalties are visited upon all persons or corporations who issue tokens, coins, or currency in imitation of these issues. Why should not the Government guard with still greater jealousy its exclusive right to issue the paper money of the land ? Why not treat as counterfeiters all banks of issue that purport to issue any money other than "lawful money of the United States," or the standard coins of its mints ? Surely the plea of convenience cannot be raised, for the Government prints and furnishes all the national-bank notes as well as the Treasury notes, and can therefore furnish enough. Besides, the plea of convenience would not avail the counterfeiter, or even the miner or assayer of bullion, were they to issue coin of equal or greater fineness and value than that of the authorized mints of the Government; and the penalty of a violated law would be inflicted on those who had usurped this attribute and function of Federal sovereignty, even though no injury had actually resulted.

But the gentlemen who urge the passage of this bill tell us that banks are a necessity of our civilization and of our commerce. I admit it, but I most emphatically deny that it is a necessity of commerce or of civilization that the debts or notes of these banks should be authorized to circulate as currency, and to take the place of real money of the Government, especially under the conditions that now exist to favor these institutions. Banks of exchange, discount, and deposit we must have at present, but banks of issue should be suppressed as counterfeiters in the interest of commerce, justice, and labor's rights to uniform standards which shall not be made to fluctuate according to the caprice or greed of the capitalist classes who control banking corporations.

But, again say these gentlemen, if you admit the convenience and usefulness of banks of discount, exchange, and deposit, you must know that without the power to issue money or emit bills of credit or circulate their notes as current funds these banks could not or would not exist. This proposition I utterly deny, and it is so far from true that I have only to cite the fact that in the State of New York alone there is an increasing number of State banks that now reaches nearly one hundred and fifty that do a profitable banking business without issuing a dollar of currency or notes of their own to pass for money. In fact not one-third of the banks and banking institutions of this country are banks of issue. Comptroller Knox, the special advocate of these national banks, shows, on page 25 of his report for December, 1880, that there were then 6,532 banks and banking houses and institutions in the United States, of which but 2,076, or not one-third, were national banks; that while the banks that do a legitimate business and issue no currency had deposits to the extent of $1,319,009,000, the national banks held, through the partiality of Government deposits, &c., only about $430,000,000 less than the other banks.

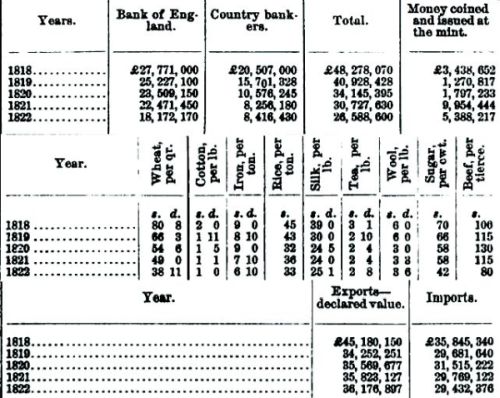

These figures at least offered us ample ground for denying the claim of the national-bank advocates on this floor and elsewhere, that the unconstitutional and dangerous function of issuing as currency the notes of these banks is essential to existence or prosperity of legitimate banking in this country, and for declaring that it is a claim that is as devoid of merit as it is false in fact and vicious in policy. Besides this, let me cite a few figures to show that our banking system does not need the royalty and profitable business of issuing money to sustain it in affluence and security such as the most conservative man, if a patriot, would take no alarm at. The annual report of the Secretary of the Treasury on the state of the finances for 1881, over the signature of Secretary Folger, shows that upon a capital of $463,821,985, and with an aggregate circulation of $300,344,250, the national banks then in existence, numbering 2,132, managed to have outstanding loans amounting to $1,169,022,303. That is to say, they managed to get more than $3 due to them for every dollar of circulation they had by loaning the currency over and over again, and thus making $1 do the work that $3.50 should have done in the commercial and business transactions of the country. This they did by "loans and discounts," the profits of which depend largely and mainly upon the scarcity of current funds. The scarcity of current funds, under existing law, depends or is made to depend so largely upon the caprice of the banker that the power to retire or to inflate the volume of currency, which is at all times in the hands of the non-producing class, represented by the Bankers' Association, that is forever seeking to get out of the producers the largest possible share of the fruits of labor, has become a daily danger to all classes of producers.

The present bill does not propose to remedy this evil in any manner or to any extent, and the people are to be left to the tender mercies of the cunning old spiders who spin the nets to entangle the honey-laden bees of labor through the devices of bank currency, bank discounts, and bank "shaves."

It is true that some of the gentlemen on this floor, having rather more of both intelligence and of conscience in this regard than their more thoughtless and more avaricious fellows, have been put to the blush of shame so often by having this power of shortening or lengthening the currency possessed by the banks constantly complained of, that they have been known to favor and to advocate some limitation or restriction upon the banks in this regard; but I warn gentlemen who may be appealed to for votes to pass this bill upon the ground that any such modification may be ingrafted upon it as an amendment, or that any such provision would accomplish one iota of gain for the people, that just so long as the banks have the power of issuing currency the danger inheres in them, notwithstanding you forbid them to increase or diminish their currency save upon a notice of three, six, or twelve months. Should Congress seek to insist on this restriction and still give the banks the power to issue money there would arise a new system of subsidiary and ephemeral banks, constantly organizing and going out of existence, merely to avoid the hampering of this proposed restriction and to play into the hands of the great banks the game of circumventing the popular will. Nor will it do for us to sugar-coat this dose of poison by any other amendments that do not cut off the head of the organized swindle of the whole national banking system by striking out the enacting clause of the bill before us.

The distinguished gentleman from New York, [Mr. Flower,] who seeks to throw a tub to the whale of popular indignation over the threatened passage of this bill by allowing the banks to be sued in the State courts and by compelling them to give three months' notice in retiring currency, must be fully aware of the worthlessness of rude palliatives in curing the evils of the national banking system. How, for instance, could he explain to the people of the Empire State in his projected gubernatorial campaign that the three months' notice amendment was of any real value, when the intelligent people of that State, as of the whole Union, are fully aware that the Bankers' Association, which meets at Saratoga every year, acts as one man, and can agree to give the required notice just in time to shorten up ready funds when the autumn crops need gathering or moving, or just in time to catch the spring opening of business and exact the big shaves on currency that are regulated by the morality and avarice of the bankers and all other monopolists, whose limit of extortion is avowed by them to be "all that the traffic will bear?"

Certainly the gentleman from New York does not believe that the people, who generally have no money to waste in lawsuits against rich and unscrupulous corporations, would be pacified in their indignation against a perpetuity of the national-bank swindle by the convenience of the boon he would accord them of prosecuting in the State courts their cases against these banks. Nor will the proposition of the gentleman from North Carolina, [Mr. Scales] which would vouchsafe to the dear people the privilege (?) of pledging their lands to the national banks, so far neutralize the poison that lurks in this cup now held to the lips of Congress by the Bankers' Association, who demand that we swallow this bill, as to make it either a pleasing or a safe dose. Neither do I see safety or reason in the proposed amendment of my colleague, [Mr. Buckner,] which would require the national banks to keep their reserves in gold and silver. This proposition, coming from a distinguished Democrat, proves how heartily united the two old parties are in the interest of hard money, tightly locked up from circulation, and hard times tightly bound to the chariot-wheels of the capitalist class by the bond of oppressive class legislation.

The very thing for which many of our Democratic brethren, in common with the Nationals, denounced Senator Sherman when Secretary of the Treasury, the lock-up plan, which asked Congress to appropriate $100,000 to build a new vault to hold the overflow of coin from the glutted Treasury of a nation that owned over a thousand millions of dollars, is now proposed as a Democratic panacea for the rechartered banks. Verily, when this Shermanizing policy is added to the national-bank system, I hardly think the offensive carcass of this public cancer will smell one whit sweeter to the offended public nostrils. But the proposition of the gentleman that these banks shall issue no currency of a less denomination than $10 is merely good in so far as it cuts off the power to issue other smaller notes, but it is bad inasmuch as it does not altogether cut off the power of these banks from issuing currency.

My other colleague and fellow National [Mr. Haseltine] has offered an amendment, which, like that of the gentleman from Pennsylvania, [Mr. Brumm,] strikes at the root of the evil, and takes away at once the foundation and the necessity for these national banks.

The appropriation of the hundred or two hundred millions of dollars that lie in worse than idleness in the national Treasury from year to year toward the payment of the national debt is both in accord with honesty and a wise public policy; and the proposition of my distinguished colleague to issue non-interest-bearing Treasury notes to pay off the remainder of the bonded debt that may be due or optional is both just and statesmanlike, and would prove a greater blessing to our land than all the legislation of this Congress or the labors of those of the past twenty years have been able to achieve. No rational argument can be made against its lawful or its equitable character. If the credit of the nation be good in the bond it issues, surely it is better in the currency it would substitute for those bonds, as the substitute would be free from the burden of interest, and might be made taxable.

If the credit of the nation be good only because its Treasury holds coin, then the power of the Government over taxation, titles, property, life, and liberty, are but metaphysical myths to the minds of those who worship only at the glittering altars of mammon; and the government that pays out coin is committing financial suicide. Away with such rubbish ! Prate of wisdom to the brutes if the end of government be held to be the hoarding up of treasure ! While no man of you who favor this absurdity of a few grains of gold being the only standard of labor's reward, and of hoarded stores of gold in the national Treasury being necessary for any purpose beyond current expenses, dare carry out your financial logic to the absurd end to which it clearly leads, not one of you can successfully deny that the result of your policy is precisely that which I have indicated.

No, Mr. Speaker and gentlemen of this Congress, it will not do to attempt to gild this legal crime by trifling amendments. It will not turn away the growing wrath of the injured public for you to curb this financial monster by gentle stays or small fences in its onward path toward unbridled supremacy in national politics and legislation. You must kill it or it will kill you ! You must put the untaxed, privileged class of bondholders, who are already insisting that we are paying off the debt too fast and taking away their bonds and privileges, upon the level with other citizens. Already the banks are talking of their "vested rights," and as the gentleman from New York [Mr. Flower] assures us in his remarks, they do not need this bill to enable them to continue their existence, but merely to facilitate the continuation of their existence.

If they possess the power to recharter themselves, or if they have a quiet understanding with the Comptroller of the Currency that they can be renewed or rechartered by going out of business and commencing again for twenty years just before their charters expire, then why do these corporations deign to ask any action on the part of Congress at all ? Such is their position, in fact, and they gloss over their impudence by formally procuring the sanction of Congress to this bill --just to cover contingencies-- in order to avert an outburst of public wrath. I implore Congress and the people to wake up and throttle this monopoly, or the Government of the people will become the slave of the money-power.

The only safety is to cut off wholly the power to issue money which these banks possess; and upon that I stand, whether the present iniquitous special privileges of the national banks be retained or cut off. But, say these gentlemen, the banks need the currency privilege to sustain themselves. In denying it I have shown that they reap profits from each dollar equal to the ordinary profits by loans and discounts on $3.50; but this by no means exhibits the full amount of the profits of these banks. Out of 2,298 banks existing September 1, 1880, the profits of 2,072 of them above all losses for the six months previous to that date is shown, on page 48 of the annual report of the Comptroller of the Currency, dated December 8, 1880, to be $24,033,250, and for the year prior to that date, $45,186,034. On page 45 of the same report the losses of 1,360 of these banks is shown for the same periods as respectively $7,142,519.96, and $14,706,406, which very largely increases the percentage of profits on their business in order to leave as net gains over $45,000,000 as the result of a year's work.

The Comptroller of the Currency tells us that the national banks have lost in five years, from 1876 to 1880, inclusive, the sum of $100,551,475.45 in their business transactions, and yet he shows that in the same period they have declared dividends to the tune of $199,592,902, and in addition thereto have accumulated a surplus reserve fund of upward of $130,000,000, which they now hold as the "balance of power" in this gigantic struggle between these corporations and the people. Now, in speaking of this surplus fund we touch the most sensitive part of this vast cancer on the body-politic, and find the nucleus of the organized power of these favored classes by which they are here as a unit clamoring for the practically indefinite extension of their lucrative privileges, which this bill secures if passed.

Comptroller Knox, in his special plea for these banks, called his annual report, dated December 6, 1880, page 47, says that---

The law provides that a surplus fund shall be accumulated by setting aside before the usual semi-annual dividend is declared one tenth part of the semi-annual net profits of the bank.

And he adds:

In some cases this legal surplus now exceeds the capital of the bank.

To remember that this vast accumulated surplus of over $130,000,000 is but one-tenth of the net profits of the banks above the regular large semi-annual dividends, and that the banks held at the date of the Comptroller's report the additional item of $46,139,690 of "other undivided profits" and $3,452,504 of "unpaid dividends," we are confronted in the midst of this legislation by the visible power of an accumulation of $180,000,000 held by less than 2,200 corporations as a club over the heads of the people and Congress to beat down opposition to the scheme they have concocted for securing to themselves indefinitely the perpetuity of their still more valuable charters and privileges.

I do not speak carelessly when I say that this vast accumulation in a few hands is held as a club to drive or coax legislation, nor do I mean to be understood that such vast sums are used or are intended to be used to bribe or corrupt legislators; but I do mean that we have heard it distinctly stated by members of this House, by bankers, and by the subservient and subsidized press of the great cities that a failure to recharter these banks would precipitate a financial revolution through the compulsory distribution to the stockholders in these banks of the vast sums thus kept out of use in ordinary business, and that such a jolt or shock to the status quo of financial circles would demoralize capital, unsettle business, and divest the favored few of much of the mighty power they now possess over the many.

Fools and socialists, timid speculators, and conservatives destitute of foresight may, with the rich oppressors of labor and parasites of production, whose swollen coffers would, if justice were done, render up to the rightful owners this fund, befrightened at such an act of justice; but the unlocking of these vast sums would place in more numerous hands the funds to promote general business in other channels than the shaving of paper, the loaning of bank credits, and the "bearing" of the money market by vast lock-ups of the currency of the country.

In the interests of business, and in the desire to protect popular rights, agricultural labor, and mechanical industries from the dangerous power of this gigantic banking octopus that holds, in addition to its vast and valuable chartered powers, Government favors, and associated advantages, this vast sum of nearly $200,000,000 of extra, reserve, unexpended, or undivided profits as the result of a few years of money monopoly, (during which they have paid right royal dividends besides,) I demand that the power of this unproductive system be trampled out of existence by the will of every patriot who hopes to leave to his children at least a chance to prosper in the race of life without becoming forever a slave in the treadmill of bank-credit and bank-currency combinations against labor and productive enterprise.

If gentlemen in this House are to-day afraid of the consequences of distributing to its individual owners the present surplus held by these national banks, with what abject slavish submission would they not contemplate the increasing accumulation of this fund through the years and decades that are to follow an extension of their bank charters ? If the vaunted statesmen and pseudo-statesmen of to-day stand aghast or tremble in awe before the threatened jolt or jar or disturbance in business which these banks threaten if their demands are not met by this Congress, how clearly must it appear to the man who sees the future or who comprehends the present that we are already bound in the chains of a banking oligarchy and moneyed aristocracy that simply regard the people, the toiling, producing masses, as their legalized prey, and who resent all efforts of a few brave men in Congress to rescue this fair land from the harpies who, under the guise of most benevolent bankers and capitalists, are enabled through the iniquitous laws which this bill would perpetuate to reap all the richest results of the labors of every class of citizens without even claiming to render an equivalent to society for these advantages.

It has not been my purpose, Mr. Speaker, in these remarks to reiterate the familiar evils and oft-cited absurdities of our present banking law, which allows these banks to issue as currency that which is not in law or in fact lawful money, which compels the Government of the United States to pay a few rich men, as soon as they apply for and receive a bank charter, interest on bonds that have been practically redeemed, and royalties to corporations whose notes they indorse, which enables the associated money-kings of the country to form a plutocracy that defies the popular desire to restore to the Government the power of controlling the volume and character of the currency.

I have not attempted to amuse, nor to recite bombastic platitudes to array rich against poor, or labor against its creature and natural servant, capital; but in entering my solemn protest against the continuance of this wicked financial system of our present national banks, that has grown so fat, impudent, and domineering as to threaten the people who would curb its power after the first twenty years of its existence, I have sought to show to the country and to the legal minds of this House that the present system should not be extended or perpetuated, because---

1. It is unconstitutional.Every man, Mr. Speaker, who sees, as all may see who will look, that with our ever-increasing aggregation of great wealth in our great cities there is an ever-increasing amount of want and crime, of scarcity and hardship among the workers, an increase of underpaid and discouraged farmers and a vast increase in the tendency of our young men to shirk work for the fields of the gamblers, money-changers, and other parasitic classes that are so influential in this country at present; all, I say, who see these things must feel that unless we do something to prevent this centripetal aggregation of wealth; something to restrain the present tendency to disinherit the many and to give all to the few; something to soften or mitigate the sharpness of the contrast that is forever rising higher and higher between the two chief products of the Democratic-Republican financial policy of to-day, namely, millionaires and paupers; unless we do some of these things there is and will be dangers to our institutions, to our families, and to our very lives, which will surely come in the same or worse forms, as it will come from the same causes in more modern form, as the terror of the French Revolution of 1789.

Industry will not be forever wronged, robbed, injured merely to gratify the greed of the moneyed class. Agriculture will not be forever the bond-maid of banking and railway rings. Manufacture and invention will not remain indefinitely and unquestioningly the serfs and beggars of the money lenders, who hold them under this financial system at the mercy of the ignorance, cupidity, or timidity of those who control capital.

Mr. Speaker, you know these things are true. The very gentlemen who ask us to pass this bill know these things are true. Gentlemen who profess to be anti-monopolists, who can see the evils of railway monopoly, of gas monopoly, of water monopoly, of shipping or manufacturing monopolies, shut their eyes at the command of the banker who exacts tribute from them under guise of doing them the favor to shave their notes or discount their paper credit, and obediently refuse to see the size or iniquitous character of the master monopoly of them all, the parent monopoly of all the rest, that of the money or currency monopoly of these national banks.

It is against this monster monopoly that the people are fighting. It is to resist its further encroachments that they have organized, stood by, and are extending the power of the National party which I have the honor in part to represent here. Knowing these things as you do, knowing that the substitution of Treasury notes for the present volume of national-bank notes would be hailed as a boon by all the farmers, workers, and producing classes of this land, both because it would give us a better currency of real money and because it would be a saving of many millions of dollars annually to the whole people; knowing that the votes you give here on this measure, the record you will make on this bill, cannot be obliterated by excuses to your outraged, awakened, and indignant constituents when they shall find themselves bound, gagged, and sold to the money-changers by your act in the passage of this bill --I ask you, in the name of justice, in the name of the American people, and of our country's best interests---

How dare you pass this bill ? When its indefensible provisions, its ridiculous subserviency to the power of the "reserve fund" and the "other undivided profits" are exposed before your constituents, as they surely will be; when the appeal is taken from your action here to the people whom you by this bill propose to keep enslaved to the money-kings; when the faithful Greenbackers go to the hustings to expose to the people the full extent of this crime against their rights and best interests, as we surely will do; when, finally, want, oppression, monopoly, and enlightened public opinion combine to bring to justice or to scourge with stripes the men who chose to obey the money-kings rather than the people, you who vote for this bill will be praying for the mountains to fall on you and the waves of a political oblivion to hide you forever. Upon no ground can the passage of this bill be defended with success. For no valid reason can a vote be asked for it.

It is one of the most wicked, defenseless, inexcusable, flagrant cases of a popular swindle that ever came before Congress, not excepting the land-grant, Credit Mobilier, granite contract, river and harbor, whisky bill, or other swindles that have disgraced the Congressional legislation of the past or threaten it at the present moment. Here and now gentlemen must make their record and choose their fate. They know whether they will serve the people who are opposed to this bill and to the national banking system, or whether they will obey the commands of the Shylock Radicals and Bourbon Democrats who conspire to pass this measure. The crisis has come, and the old dodge of Bourbons and Radicals talking against the national-bank swindle in their districts to get votes and voting with the political harlots who think they conceal their acts from their distant constituents can be played no longer with any hope of success.

In conclusion, I ask, in all candor and seriousness, why should we, how can we, and how dare we pass such a bill as this ? Let the bank charters expire. Banking will not cease. Over two-thirds of the banks and banking of the country is already done without these bank charters. Let the charters expire, and put all the banks on a level. Let the charters expire, and put the Government again in sole and exclusive possession of its rights. Let the charters expire, and put the vast revenue accumulations in the bank-vaults into trade, commerce, business, and productive enterprises. Let the charters expire, and behold "the best banking system the world ever saw" thereby superseded by the best currency and most equitable financial system that man has ever devised. Let the charters expire, and forbid with the spirit of Andrew Jackson the rechartering of banks by the Government or by any authority which shall claim the right to empower them to issue currency ! Let the charters expire, and the end of monopoly will be in full view ! Let the charters expire, and let the people live freed from the national-bank incubus that now assumes to be their master.

Could we have a financial Peter the Hermit to thunder over the land his anathemas, and to preach a new crusade against these banks, his cry at this moment would be: The national banks must go ! Let the charters expire !

Mr. Ermentrout.

I have agreed to give the remainder of my time to my friend from Texas, [Mr. Culbebson.] The butt-end of the argument appears to be on the side of the bill, and I therefore do not think it more than fair that those gentlemen who entertain views opposed to the measure should have a fair hearing, and I therefore yield to the gentleman from Texas.

The Speaker pro tempore. The gentleman from Pennsylvania [Mr. Ermentrout] yields the remainder of his time, which is fifteen minutes, to the gentleman from Texas, [Mr. Culberson] Does the gentleman from Texas desire to occupy also the time he is entitled to in his own right ?

Mr. Culberson. Yes, sir.

The Speaker pro tempore. The gentleman from Texas then is recognized for thirty-five minutes.

Mr. Culberson. [David Browning Culberson (September 29, 1830 -- May 7, 1900) D, Texas; Confederate soldier; studied law, admitted to the bar]

Mr. Speaker, I would not trespass upon the indulgence of the House by participating in this debate, but for the fact that I feel it incumbent upon me to support and defend the amendment which I have submitted to the bill now under consideration. The bill substantially reenacts the national bank act of 1864. The banks now in existence, numbering 2,148, are authorized to reorganize at the expiration of their charters for an additional period of twenty years, and full authority is given for the organization of new banks with like period of duration. By reference to a the amendment which I have submitted will be observed that it propose to put the present national banking system into a process of gradual destruction, as it provides that after the passage of the act no franchise or charter shall be granted or extended to any association for the purpose of banking and that no banking association now in existence shall be revived or reorganized.

The amendment further provides that, as each bank now chartered shall expire by limitation or by voluntary surrender of its circulation, the Secretary of the Treasury shall prepare Treasury notes, in the usual form, of like denominations and of like amounts of the notes of such bank, and shall pay them out to the creditors of the Government, who may elect to receive them at par in payment and satisfaction of their claims. The notes which are provided for are to be pure and simple "Treasury notes," receivable by the Government for all dues whatsoever. I do not propose, Mr. Speaker, to repeal the bank act, as since the adoption of the Revised Statutes it is doubtful whether Congress has authority to terminate the charter of a bank lawfully pursuing its avocation and business within the terms of its charter, therefore I propose to leave the law as it is, to cover the operations of all existing banks and control their conduct until they shall expire by limitation.

I do not think, Mr. Speaker, that a more just and proper method to close up and discontinue the present system of banking could be suggested. By it all individual or vested rights are recognized and protected and the business interests of the country sedulously guarded and shielded from any harm or disturbance whatever by reason of a reduction in the volume of currency. No stockholder in a bank can justly complain of any violence or injustice to any right acquired by his investment, as the measure which I advocate permits each association to pursue its business unmolested for the full period of time fixed by its charter. In respect to the public aspect of the subject I submit that no possible detriment or disturbance of the business of the country will follow the adoption of my amendment. Because every banknote which may be canceled under the operation of it will be substituted by a Treasury note having all the attributes and functions of money which appertain to bank-notes. There will be no reduction of the volume of the currency. As the bank notes will pass out of circulation Treasury notes will pass into circulation readily, and will perform all the offices of money which national-bank notes now perform.

Bank notes are equivalent in value to coin, not because of the intrinsic merit of the bank which puts them into circulation, but for the reason that their ultimate payment and redemption are guaranteed the Government. A Treasury note with like guarantee will not be less esteemed as a circulating medium. I do not intend by anything have said or may say in this debate to assent to the proposition that Congress has authority to create a bank and invest it with the power to issue notes designed to circulate as, and clothed with the functions of, money. The currency of this country is its life, and the framers of the Constitution wisely vested the law-making power with authority to coin money, prescribe its volume, and regulate its value. National banks exercise governmental functions in respect to the currency. Instead of the law-making power issuing the entire currency of the country it has relegated to banking associations the authority to issue it without limit. They are invested with full power to dwarf or inflate the volume of currency at their pleasure. There is now absolutely no restraint or limitation upon the power of the banks to decrease or increase the volume of currency.

I believe, Mr. Speaker, that the act in this respect is in conflict with the Constitution. But it was passed twenty years ago. Private rights and vast business interests, both public and private, have been acquired and grown up under this system of banking, and the practical question is, how best to discontinue the system without injustice to individuals, without wrong to vested rights, and without serious derangement of the interests of the public. I submit that my amendment is a full and complete answer to the question. I believe, Mr. Speaker, that a large majority of the people of the United States are in favor of the discontinuance of the national banking system. They are prepared to see it pass away as speedily as practicable; not because the continuance of the system implies a perpetuation of the national debt, as is alleged by some, for such result would not necessarily follow. There are bonds enough already issued and which do not mature until 1907 to support the system upon a far more extensive scale than now exists. There are to my mind graver and stronger reasons why the system should be abolished.

It has outlive the object and purpose of its establishment, and there is no necessity of a public character for its longer continuance. If, Mr. Speaker, the advantages and benefits of the system out-weighed its injustice and disadvantages to the public, or if they were equal, we might be pardoned for giving new life to the banks and extending their succession for twenty years, as proposed by the bill. But if, on the other hand, there are no benefits or advantages derived by the people from this system, and if it can be shown, as I believe it can, that it is a vast monopoly and opposed to the best interests of the people, how are we to escape the just indignation of those whom we represent if we fail now and here to put an end to its existence ?

What was the object and purpose of the act which authorized national banking ? It was passed in 1863. The Government of the United States at that time was engaged in war. It was struggling to maintain its credit and to provide means necessary to prosecute the war. It became necessary for the Government to utilize all its resources and exercise all its powers, doubtful and unquestioned, to maintain its credit and provide the means to support its armies in the field.

It was believed by those who conducted the affairs of the Government at that time that the system of banking authorized by the act of 1863 would aid the Government to sell its bonds, and also aid in maintaining the credit of the currency. The history of that eventful period and the debates in Congress show that the national banking system would never have been instituted or authorized but for such prevailing sentiment and belief. Therefore, to state the case as strongly as it should be stated, this banking system was adopted, first, to induce the purchase of the bonds of the Government, and thereby enhance the credit of the Government, and second, to maintain and enhance the value of the legal-tender greenbacks, in which bank notes were made redeemable. I am not here, Mr. Speaker, to question either the motives or the soundness of the judgment of those who inaugurated this system and fastened it, I fear for all time, upon the country.

I believe that the motives which inspired the President and his Secretary of the Treasury, Mr. Chase, to approve the plan were pure and laudable but subsequent events have demonstrated that patriotism has exerted but little influence over the management of these institutions. The Government was vastly deceived when it set up these fiscal agencies, so called, to enhance the value of its bonds and the credit and solvency of its currency. Corporations consult their own interests. Unlike individuals, sentiment does not temper their dealings. Their interests pointed toward cheap bonds and depreciated legal tenders. They needed the bonds to bank upon, and when they were called upon to redeem their notes, the cheaper the greenbacks the less gold it would take of the interest on their bonds to supply them. Accordingly, we find that the bonds decreased in value more rapidly after the bank act was passed than before. Such would seem to have been the natural and sure result. The banks supplied themselves with all the bonds they needed to bank upon at from fifty to sixty cents on the dollar, and, notwithstanding banknotes were redeemable in legal-tender greenbacks, legal tenders depreciated over 70 per cent.

If, however, Mr. Speaker, I am mistaken in all this, there can be no question about the present. United States bonds are selling at a high premium; legal-tender greenbacks are at par with gold and silver. We do not need these fiscal agencies to enhance the value of our bonds or greenbacks, and therefore we cannot re-enact the bank law and extend this system for twenty years or longer for the reasons and purposes which influenced Congress twenty years ago to pass the original act. We must look up some other excuse, some other reason and purpose to justify a practical re-enactment of the bank act as is proposed by this bill. In consideration of the aid which it was supposed these fiscal agencies would give the Government in maintaining its credit the Government conferred upon them privileges, immunities, and favors of immense value. In a Government like that of the United States, where every citizen is supposed to be equal before the law, and each alike entitled to its protection, such a system of class legislation, of governmental favoritism as the national banking system discloses is an enormity of the most frightful magnitude. All other monopolies in this country are dwarfed into insignificance when compared with it.

I propose, Mr. Speaker, to show what some of these privileges, immunities, and favors are, and how they have been used and enjoyed by the banks. Every association of five or more persons who may own and deposit in the Treasury of the United States $100,000 in bonds of the Government are entitled to receive $90,000 in unsigned bank notes. The bonds remain in the Treasury and the interest thereon is paid quarterly by the Government to the bank. The notes are signed by the officers of the bank and are used as capital for banking. Each bank is authorized to operate for twenty ears. Practically the capital of every five men thus associated together in a banking association is nearly doubled, almost free of cost to them. One-half of it remains at the Treasury and earns interest; the other half is loaned to the customers of the banks at from 6 to 24 per cent. per annum. In order that these pets of the Government should have an open field in which to ply their vocation, all State banks were taxed out of existence. Besides, they are permitted to bring all their suits in the United States courts without regard to the amount in controversy and without respect to the cost or inconvenience of unfortunate debtors.

Again, no tax can be laid upon their bonds, and all the legal-tender greenbacks held in reserve or placed to the credit of the surplus fund are likewise non-taxable. While these are valuable privileges and favors, there are others far more valuable. The national banks constitute a huge monopoly. My friend from Pennsylvania, [Mr. Mutchler,] who has just delivered a very able speech in favor of the bill, affirms that the national banking system is not a monopoly, because every man in the United States who has the means to invest in bonds may become a national banker, and that, banking being free to all, can in no just sense be deemed a monopoly. Now, I submit that the gentleman does not state the proposition quite accurately. I affirm that the system is a monopoly the reason that banks alone can issue and put into circulation bank notes. They enjoy monopoly in that respect.

If a farmer owns United States bonds, why may he not deposit them at Washington and have the privilege of taking home with him 90 or cent. of the amount in notes guaranteed by the Government to loan to his neighbor at the rate of interest allowed by the laws of the State in which he resides ? Simply because under the law such a privilege is restricted solely to national banks. I repeat that the currency of this country is its life-blood, and Congress has put it in the keeping of soulless corporations, who may increase or lessen its flow as their interest dictates or their caprice may suggest. They can make money cheap to-day and to-morrow dear. The property of the country and its entire business are at the mercy of the system. We have now seven hundred and sixteen millions of paper currency, consisting of three hundred and forty-six millions legal-tender greenbacks and three hundred and seventy millions of national-bank notes.

The amount of greenbacks is fixed by law and cannot be decreased or increased except by law. The representatives of the people in Congress must be consulted before the volume of greenback currency can be changed, but the banks alone control the volume of banknotes. They are not responsible to the people. The exercise of their power over the currency of the country is nowise regulated or limited by law. Who can doubt or who will assume to say that such associations, with no legal restraints or limitations in this respect, united by common interests, inspired, as all business corporations are, by the greed of gain, do not constitute a dangerous and powerful enemy to every opposing interest in the land ? The Comptroller's report for last year shows that in the last twelve years the national banks have distributed among their stockholders $517,825,392 of net profits, and have on hand besides $130,000,000 surplus funds, all earned upon an average capital of less than $500,000,000. And we are to-day importuned on all sides to give a new lease of power to such an overshadowing monopoly.

The toiling millions of the country are again called upon, not as before in a time of war and wide-spread alarm; not in a season of a general depression, when Government securities and credit were at a fearful discount; not in a moment of extreme peril, when patriots seized every plausible expedient to restore the credit of the Government; but in the silence of a profound peace, in the midst of comparative prosperity, with Government securities and credit far above par, to support this vast, unfeeling, grasping monopoly for another period of twenty years. Such is the proposition, sir; no more, no less. Judging the future by the past, these institutions will gather into their coffers over a billion of dollars' profit and three hundred millions of surplus capital upon an investment of $500,000,000 in the next twenty years, the period proposed by this bill. The brains and muscle of the country are proposed to be mortgaged for twenty years to earn such princely fortunes for the banks, and all for what ? Absolutely for no consideration whatever. The people do not need their currency, because the Government can furnish them currency direct, without cost; and if, as as supposed, they aided at any time the Government in maintaining its credit, such aid no longer is needed nor desired.

We are under no obligation to the national banks, Mr. Speaker. If their friends will continue to claim that they have rendered the Government in times past valuable services, I answer that long since all such services have been full paid for and the obligations discharged. If they are to retire now, and forego for the future the exclusive rights and favors which they have enjoyed for twenty years under the legislation of Congress, they will have the satisfaction of knowing that they have gathered princely fortunes from the toil and labor of those whose interests they assume and pretend to have promoted. We are told, sir, that the national banking system is friendly to the best interests of the people. I deny that proposition, and I affirm that from the very day of its organization to the present time it has warred incessantly upon the rights and upon the best interests of the people; that it has been ungrateful and selfish, and has used its power and exclusive privileges to increase the burden of taxation and embarrass the Government in every laudable effort it has made to lighten the weight of the public debt.

In other words, sir, this creature of Congress early became its master, and for twenty years has dictated, in the main, the financial laws and operations of the Government to its own advantage. The proof is abundant to establish this proposition, but in the limits of my time only the most prominent facts can be presented. I pass the period of the war for obvious reasons, nor will I weary the House to recapitulate the efforts of the banks between the close of the war and the first administration after its close to contract and destroy the greenback currency. Among the first, if not the very first, act of Congress approved by President Grant was the act of 1869 entitled "An act to strengthen the public credit." It will be remembered that about one billion and a half of the bonds were payable in lawful money. It was so stipulated in the contract. Greenbacks were lawful money, made so by law, and the Supreme Court affirmed the validity of the statute. But unfortunately they were at a serious discount and far below par value in coin.

By the act referred to, all the securities, outstanding bonds, and currency of the Government were declared payable in coin, and the faith of the Government was pledged to discharge them in gold and silver. This was in plain violation of the contract. The terms of the contract did not admit of any dispute. The history of that period records the fact that when the measure was before Congress the corridors around this Hall, the committee-rooms, above an below us, and the city itself, swarmed with the agents and attorneys of the banks who were here to influence the judgment of Congress and aid in the passage of that infamous act. The work was accomplished. It required great labor, for the work was infamous. The public debt was increased $600,000,000 by the legal effect of the act, and the bonds held by the national banks alone were enhanced $25,000,000. The banks owned about 356,000,000 of bonds. They had purchased them at discount ranging from forty to sixty cents in dollar. They were payable in lawful money, and might have been discharged in legal-tender greenbacks, which were then at a serious discount.

But these patriotic fiscal agencies, the banks, united by a common interest and influenced by a common greed, deliberately combined their power, which far exceeded all other influences, and secured the passage of this law, which created an additional burden of $600,000,000 upon the people for which there was absolutely no consideration and which was an unmixed fraud upon the taxpayers. In 1870 Congress undertook to refund the public debt at a less rate of interest. The bill originated in the Senate, and I beg to call attention to the eighth section of that measure as it passed the Senate. It is as follows:

Sec. 8. And be it further enacted, That on and after the 1st day of October, 1870, registered bonds of any denomination not less than $1,000, issued under the provisions of this act, and no other, shall be deposited with the Treasurer of the United States as security for notes issued to national banking associations for circulation under an act entitled "An act to provide national currency secured by a pledge of United States bonds, and to provide for the circulation and redemption thereof," approved June 3, 1864; and all national banking associations organized under said act,or any amendment thereof, are hereby required to deposit bonds issued by this act, as security for their circulating notes, within one year from the passage of this act, in default of which their right to issue notes for circulation shall be forfeited, and the Treasurer and the Comptroller of the Currency shall be authorized and required to take such measures as may be necessary to call in and destroy their outstanding circulation, and to return the bonds held as security therefor to the association by which they were deposited in sums of not less than $1.000: Provided, That any such association now in existence may, upon giving thirty days' notice to the Comptroller of the Currency, by resolution of its board of directors, deposit legal-tender notes with the Treasurer of the United States to the amount of its outstanding circulation and take up the bonds pledged for its redemption.

When the bill came to the House the combined power of the national banks again appeared around this Hall and was everywhere visible. The section was stricken out and the Senate was forced to accept the bill as amended, and thus amended it became the law. I do not propose, Mr. Speaker, to animadvert upon this action of the banks. Language which I control is too sterile to characterize it properly. I content myself with reproducing an extract from the speech of Senator Sherman, who had charge of the bill, and who I believe was then, as he is now, the ablest financier of this country. He said:

Mr. President, the three remaining sections of this bill apply to the national banks. That is much too great a theme for me to enter upon at this stage of the debate; I will explain in a very few words the theory of those sections. The national banks are mere creatures of law. They hold their existence at the pleasure of Congress. We may tomorrow, if it promotes the public interests, withdraw their authority. The franchise has been valuable to them.

We think it right they should aid us in funding the public debt. They hold of our securities $346,000,000. Nearly all of these bear 6 per cent. interest in coin. We will not deprive them of any them; we will not take from them the property they enjoy; we will not deny them even the payment of 6 per cent. as long as they are the owners of these bonds. But they hold the franchise of issuing paper money guaranteed by the United States, and which constitutes the circulation of our country; and we say that enjoying this franchise we now stipulate with them for the reduction of interest on the bonds they hold. The provisions of this bill are not arbitrary.

We are about to retire and cancel our notes by the provisions of this act. We are about to give them the monopoly of the circulation of this country, the sole and exclusive privilege of issuing paper money. We have destroyed the State banks. And now what do we require in return ? That they shall join us in reducing the burdens of the public debt; that they shall bear some little of their share of the loss of income which every holder of the public securities must suffer.

Sir, national banks would be very unwise indeed to make issue on this question. If any man here is a friend of the national-bank system, I can claim to be. I was here at its cradle, introduced the original banking bill and advocated it, and also introduced the amendment to it, conducted it, and saw it passed. But if I believed now that the banks of the United States were unwilling to aid us in reducing the rate of interest on the public debt to the extent of the limited sacrifices they are called upon by this bill to make, I should certainly change very much my opinion of them and of the whole system.

I wish now to record my deliberate judgment that in this conclusion to which we have been compelled to arrive by the action of the House we are doing the national banks a great injury, which will impair their influence and power among the people, and that the opposition of the national banks to this provision which we have required them to aid in the funding of the public debt will tend more to weaken and destroy them than any thing that has transpired since their organization. I do not see how we can go before the people of the United States and ask them to lend us gold at par for our bonds, when we refuse to require agencies of our own creation to take them; when we even refuse to require new banks not yet organized to take those new bonds, and when we refuse to require old banks, which have made on the average from 15 to 20 per cent. annually upon the franchise. But, sir, the vote of the House shows the power of the national banks.

It will be observed from what I have read that Mr. Sherman, if not the author of the plan of national banking, was the author of the original bank act of 1863 and the supplemental act of 1864. Those acts, as passed, contained a reservation of the right to Congress to alter, amend, or repeal them. This reservation was dropped out by the adoption of the Revised Statutes. I call attention to this fact to show that, notwithstanding the banks were in the power of Congress and subject at any time to be destroyed by a repeal of the law, yet they boldly defied the power of Congress and defeated the laudable efforts of the Government to avail itself of their influence in lessening the interest on the public debt. In this connection, Mr. Speaker, I desire to call attention to the conduct of the banks at the close of the last session of Congress. In the opinion of a large majority of that Congress it was practicable to refund a portion of the public debt in 3 per cent. bonds, and a bill for that purpose passed both Houses. That measure contained the following provision:

Section. 5. From and after the 1st day of July, 1881, the 3 per cent. bonds authorized by this act shall be the only bonds receivable as security for national-bank circulation, or as security for the safe-keeping and prompt payment of the public money deposited with such banks: Provided, That the Secretary of the Treasury shall not have issued all the bonds herein authorized, or so many thereof as to make it impossible for him to issue the amount of bond so required: And provided further. That no bond upon which interest has ceased shall be accepted or shall be continued on deposit as security for circulation or for the safe-keeping of the public money; and in case of bonds so deposited shall not be withdrawn, as provided by law, within thirty days after the interest has ceased thereon, the banking association depositing the same shall be subject to the liabilities and proceedings on the part of the Comptroller provided for in section 5234 of the Revised Statutes of the United States: And provided further, That section 4 of the act of June 20, 1874, entitled "An act fixing the amount of United States notes, providing for a redistribution of the national-bank currency, and for other purposes," be, and the same is hereby, repealed; and sections 5159 and 5160 of the Revised Statutes of the United States be, and the same are hereby, re-enacted.

---[R.B. Hayes vetoed it on March 3, 1881.]

These fiscal agents of the Government were again called upon to aid in the reduction of the interest upon the public debt in part, and what was the result ? Their agents and attorneys were on all sides plying their influence to defeat the bill. They threatened to produce a panic. They affirmed, and truthfully so, that the business of this country, vast as it is, was at their mercy, and rather than aid the Government to reduce the interest upon the bonds they would deposit lawful money in the Treasury and surrender their circulation, and thus contract the currency to the disturbance of business and the panic of capital. Congress for one time boldly opposed the unreasonable exactions and demands of the banks, and disregarded their threats. The bill was passed, eighteen millions of dollars were deposited by the banks in fifteen days pending the controversy, and the volume of currency to that extent was reduced. Business felt the blow, and but for the resources of the Government, applied on the instant, a panic would have occurred. As soon as the bill reached the President all the combined power and influence of the banks were concentrated and brought to bear upon the executive branch of the Government to secure a veto. They triumphed and the bill fell. In the muscular language of my friend from Missouri, [Mr. Bland] "they bulldozed the President."

We are now paying, Mr. Speaker, 3½ per cent. upon what are known as the Windom bonds, because of the defeat of the 3 per cent. funding act, which was brought about by the influence of national banks. The act was in all respects reasonable, and the experience of the country since that time will attest the fact that our bonds drawing 3 per cent. interest could have been sold at par.

---["Immediately after the adjournment of Congress, the Secretary of the Treasury, Mr. Windom, adopted the idea of compromising with the bondholders and continuing the 5 and 6 per cent. bonds then falling due at 3½ per cent., payable at the option of the government.Mr. Randall. Will the gentleman from Texas allow me to interrupt him a moment ? Before the 1st of May, 1881, two months after the adjournment of the last Congress, the bonds of the United States had reached such a premium that they returned to those who purchased them at the market prices less than 3 per cent., showing clearly that those who had voted for the funding bill as passed at the close of the last Congress were right in the belief that a Government loan could be negotiated at 3 per cent. I will hand to my friend from Texas, [Mr. Culberson,] to be incorporated in his remarks, a statement showing what income is yielded by 4 and 4½ per cent. Government bonds, at the market prices, on the 1st, 2d, 3d, 4th, and 5th days of the present month; the 4½ per cent. bonds yielding an average of about 2.70 per cent. to purchasers at market prices, and the 4 per cent. bonds yielding about 2.86 per cent. This is an official statement from the Treasury Department, the calculations having been made by Mr. Elliott, a recognized authority on subjects of this kind.

Mr. Culberson. Mr. Speaker, by permission of the House I will insert the table in my remarks, which is as follows:

Statement of the prices (flat and net) of the 4 per cent. securities of the United States, redeemable after July 1, 1907, and the 4½ per cent. securities of the United States, redeemable after September 1, 1891; together with the corresponding rates of interest realized to investors therein, for the 1st, 2d, 3d, 4th,and 5th days of May, 1882, respectively.

E.B. Elliot, Government Actuary. Treasury Department, May 6, 1882.

But, Mr. Speaker, the crowning act of all the outrages upon the interests of this country committed by the national banks was the part they took in the perpetration of that great financial crime, the demonetization of silver in 1873. Of all the conspirators who aided in that dark and secret deed they are the most guilty, and if there are any degrees in the atrocity of that act they deserve the highest. They owned about $370 000,000 of our bonds. Originally the were purchased at a great discount. Originally they were payable in lawful money, but as we have seen they had been converted without consideration into coin bonds, at the instance of the banks, payable in coin at its then standard value, and by which the banks reaped an immense harvest of profit. Not satisfied with the immense powers, immunities, and exclusive privileges bestowed upon them by law, to some of which I have adverted, the banks deliberately conspired to break the financial peace of the count by demonetizing silver.

Silver was cheaper than gold, and their bonds being payable in coin, might lawfully be discharged in silver, the cheaper metal. The silver currency was the currency of the people and occupied the field of circulation too completely for the interests of the bank notes. It had to be destroyed. It was destroyed and the national banks gathered again a rich harvest of profits by the enhancement of the value of their bonds and the appreciation of their notes. But at what terrible costs, privation, and sacrifices to the people and business of the country ! Who, even now, Mr. Speaker, can look back over the period from 1873 to 1878, during which one-half of the metal currency of the world lay dormant and demonetized, and contemplate the frightful waste of values, the broken fortunes, the poverty and universal depression which marked that period without a feeling of indignation and shame ?

The history of our country, eventful as it has been, furnishes no parallel to the financial distress produced by the demonetization and withdrawal of silver from circulation. The fires in the furnaces of our vast manufactories burned to ashes, vast enterprises of internal improvements were abandoned, labor ceased to command living wages and thousands upon thousands of able-bodied men trumped the country, vainly begging for work and living upon scant charity of those whom the crush had not entirely despoiled. Properties of all kinds except national banking stock shrank in value with fearful rapidity, until State and municipal governments had no competition in bidders at tax sales, and all the financial gloom and depression was precipitated at a time when the country, torn to pieces by war, was struggling under a load of debt and taxation never before borne by any people with such heroic fortitude.

During this period the national banks made money with a rapidity which astonished the honest men connected with them, while the people grew poorer day by day. Who of us does not remember the angry opposition of the banks to the remonetization of silver and its limited coinage as established by the "Bland bill" ? Congress dared not falter in that work. The will of the people had been heard. It was the language of command. We passed the bill in spite of the combined influences of the banks. Again they concentrated all their power and influence upon the Executive, and the sad spectacle of the President of the United States cowering before this august monopoly was repeated. He [Hayes, February 28, 1878.] vetoed the bill, but Congress made it the law notwithstanding his veto.

Mr. Hooker. [by not voting, he voted for it] My friend from Texas will allow me to say right here, that the distinguished gentleman from Georgia, [Mr. Stephens] chairman of the Committee on Coinage, Weights, and Measures, stated to the House on the day that silver was demonetized, it constituted one-half of the metallic money of the world. In addition that $346,000,000 of greenbacks were kept alive only by the action of a Democratic House.

The Speaker pro tempore. The time of the gentleman from Texas has expired.

Mr. Bland. [voted against it] I hope by unanimous consent he will be permitted to conclude his remarks.

Mr. Reagan. [voted against it] I believe I am entitled to the floor, and I will yield to my colleague as much time as he desires.

The Speaker pro tempore. The gentleman from Texas is entitled to the floor.

Mr. Reagan. I yield to my colleague.

Mr. Culberson. I will not trespass much longer on the indulgence of the House. In 1874 the Republican party was defeated in the House of Representatives. The triumph of the Democracy was an earnest protest filed by the people against the domination of banks over the legislation of Congress. Yet this influence was in no wise daunted by the rebuke. In the closing days of the last session of the Forty-third Congress it put in an appearance on the resumption bill, and fastened upon that measure a clause providing for the redemption and cancellation of the legal-tender greenbacks. The work of destruction was going on when the Democrats, for the first time in twenty years, on the 4th day of December, 1875, presented a majority in the House of Representatives. The whole financial policy of the Government since the war had been in the interests of national banks. The Democratic party remonetized silver and partially restored its coinage. All efforts to repeal the resumption law were defeated, except the proposition to rescue $346,000,000 of legal-tender greenbacks from destruction. We saved that much of them to the people.

---[the hard-money Democrats saved the greenbacks; not the heroes of paper-money conspiracy books...... like Pig-iron Kelley, who at the end of the day voted for this bank-renewal bill]And thus we see, Mr. Speaker, that the policy of the banks was to convert the bonds which could be discharged in greenbacks into coin bonds, and when changed to make war on silver, the cheaper and most universal circulation, in order to have the bonds payable in gold only, to destroy the legal-tender currency as redeemed under the resumption act, so that the only currency should be gold and national bank notes. When the Forty-fourth Congress assembled that policy had been ingrafted in the law. We found it sanctioned by law. In part the policy had been executed and was beyond the reach of repeal or modification. The struggle to remonetize silver and the fight to sustain the remnant of the legal-tender currency show that if these banks could have triumphed we would to-day have no currency but old and national-bank notes. My friend from Arkansas [Mr. Jones] in his able speech the other day presented the situation exactly. He said there was an irrepressible conflict going on between banks on one side and silver and silver certificates on the other.

Such, Mr. Speaker, is the fact; and because of that conflict we have propositions now pending to destroy silver and silver certificates. Are these banks, therefore, not the enemies of the best interests of the people ? Show me, if you can, where sentiment or patriotism or respect for the interests of the people, when opposed to their interests, ever tempered their grasping and cruel policy. They are the open enemies of that grand principle which underlies our theory of government: "All men are equal before the law and each alike is entitled to its protection." Whenever the Government with one hand takes the money of a citizen and with the other bestows it upon a corporation it is no less a robbery because the transfer is made under the form and color of law. Why should Congress, in the face of all these facts, give to the banks a new life, a new lease of power over the people ? Does any one suppose that, if this bill should become a law, this system can ever hereafter be changed ? Surely not. The system is stronger to-day than at any time in the past. It grows in strength year by year; it has been powerful enough in the past to dictate laws to Congress and vetoes to Presidents. Will it be less powerful or less grasping in the future ? Has it not grown by the favors of Government until its strength is sufficient to defy the people and their representatives in Congress ?